- Crypto Intel

- Posts

- Banks Move In, Bitcoin Waits, and Speculation Runs

Banks Move In, Bitcoin Waits, and Speculation Runs

Investors must balance between safety and speed in today's crypto market.

Bitcoin is getting ignored, gold and copper are getting paid, banks are stepping into crypto, and US states are quietly rewriting the rules. This week isn't about price—it's about where capital feels safe, where it feels useful, and where it's still on the sidelines.

If you want to stay ahead, this is about understanding why money is moving before it shows up on the chart.

When Empires Break (Sponsored)

History shows every dominant empire follows the same path: debt, debasement, and decline.

The warning signs are no longer subtle—runaway deficits, weakening currency power, and global institutions quietly repositioning.

Markets are already responding, with hard assets outperforming traditional benchmarks and central banks accelerating their moves.

This is not a forecast. It is a pattern repeating in real time.

There is still a narrow window to reposition retirement assets into stores of value that have survived every monetary collapse in history.

Miss the shift, and the cost is paid later.

See How the Shift Works

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Markets aren't confused—they're being selective. From Bitcoin lagging fear and AI trades, to banks positioning themselves between you and the order book, to US states shaping crypto-friendly ground rules, these moves show how risk is being repriced in real time.

Markets

Bitcoin Trails Gold and Copper as Capital Chases Tangible Assets

Bitcoin has lagged major assets in 2025, while gold and copper have surged to the top of the performance table. Gold is up roughly 70% year-to-date, copper is up about 35%, and Bitcoin is down around 6%.

That split matters because gold and copper represent opposite macro bets. One prices in fear and currency debasement, the other prices in AI-driven growth and industrial demand.

Fear and AI Are Winning—Without Bitcoin

Gold's rally reflects rising concern over fiscal debt, tariffs, and political risk across developed markets. Copper's strength tracks electrification, data centers, and AI infrastructure spending.

Bitcoin was expected to benefit from both narratives. Instead, capital has flowed toward assets investors can touch, store, or plug into the real economy.

Why Bitcoin Missed Both Trades

Bitcoin's "digital gold" pitch hasn't convinced new institutional buyers. Many investors see it as a passive hedge rather than a growth asset tied to real-world use.

Without a sovereign bid, Bitcoin remains dominated by higher-risk capital like hedge funds and retail. Central banks still choose gold when they want protection.

A Market Pricing Two Futures at Once

The copper-to-gold ratio has dropped nearly 20% to multi-decade lows. That signals late-cycle conditions where growth optimism coexists with deep systemic anxiety.

Stocks and Treasuries lagging alongside a weaker dollar reinforce the message. Markets are hedging promises and paper risk.

Take: This isn't Bitcoin failing—it's Bitcoin waiting. If fiscal stress deepens, Bitcoin could still react with more torque, but for now, investors are paying for certainty, not optionality.

Institutions

Banks Move Into Crypto Trading as Pressure Builds on Exchanges

US banks are preparing to enter spot crypto trading after new guidance from the Office of the Comptroller of the Currency.

The OCC confirmed banks can facilitate "riskless principal" crypto trades without holding inventory.

That green light arrived as JPMorgan Chase explores offering crypto trading to institutional clients. Wall Street is no longer watching from the sidelines.

What 'Riskless' Really Means

Banks can now broker crypto trades and earn fees without taking market risk. That lowers regulatory friction and gives them a structural edge.

For many users, buying Bitcoin from a bank feels safer than using a crypto-native exchange. Trust and distribution matter more than technology here.

Why Exchanges Feel the Heat

Retail-focused exchanges rely heavily on spot trading and custody fees. Banks can compete directly in that low-risk, high-volume segment.

That doesn't kill exchanges, but it squeezes margins. Expect more focus on derivatives, global markets, and infrastructure services.

Banks Will Still Move Carefully

Most banks will limit offerings to Bitcoin, Ethereum, and regulated stablecoins. Full exchange-style menus aren't coming anytime soon.

Many will still rely on crypto-native firms for liquidity and plumbing. Competition and partnership will coexist.

Take: This is a credibility shift, not a takeover. Banks entering crypto validates the market, but it forces exchanges to evolve beyond basic spot trading to stay relevant.

Poll: If you had to explain crypto in one word, it would be… |

Hidden Setup Zone (Sponsored)

After reviewing thousands of companies, analysts isolated the 5 Stocks Set to Double based on accelerating performance, improving fundamentals, and strong technical signals.

This newly released report breaks down why these five picks may be positioned for significant moves in the coming year.

While results cannot be guaranteed, past reports uncovered gains reaching +175%, +498%, and +673%.

Access is free until midnight.

See the Free 5 Stocks Set to Double Access Today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

US Policy

Arizona Pushes to Block Crypto Taxes and Protect Node Operators

Arizona lawmakers introduced new bills aiming to exempt crypto from certain taxes and protect blockchain node operators. Some measures would require voter approval in 2026.

The proposals include banning property taxes on crypto and stopping cities from taxing or fining node operators. It's one of the most aggressive state-level crypto policy pushes yet.

What the Bills Actually Do

One bill would exempt virtual currency from state property taxes. Another would prevent local governments from charging fees to node operators.

A constitutional amendment would lock those protections in place if voters approve. That makes reversal far harder.

Arizona's Bigger Crypto Ambition

Arizona already has a digital asset reserve law on the books. Lawmakers have also floated giving the state authority to invest in assets like Bitcoin.

Not all efforts have succeeded, but the direction is clear. Arizona wants to be structurally crypto-friendly.

A Patchwork Across the US

Other states are moving in different directions. Some want small tax exemptions, others propose transaction taxes.

At the federal level, limited exemptions are still under debate. State-level experimentation is filling the gap.

Take: This won't change markets overnight, but it shapes the map. States that reduce friction attract builders, capital, and infrastructure long before prices react.

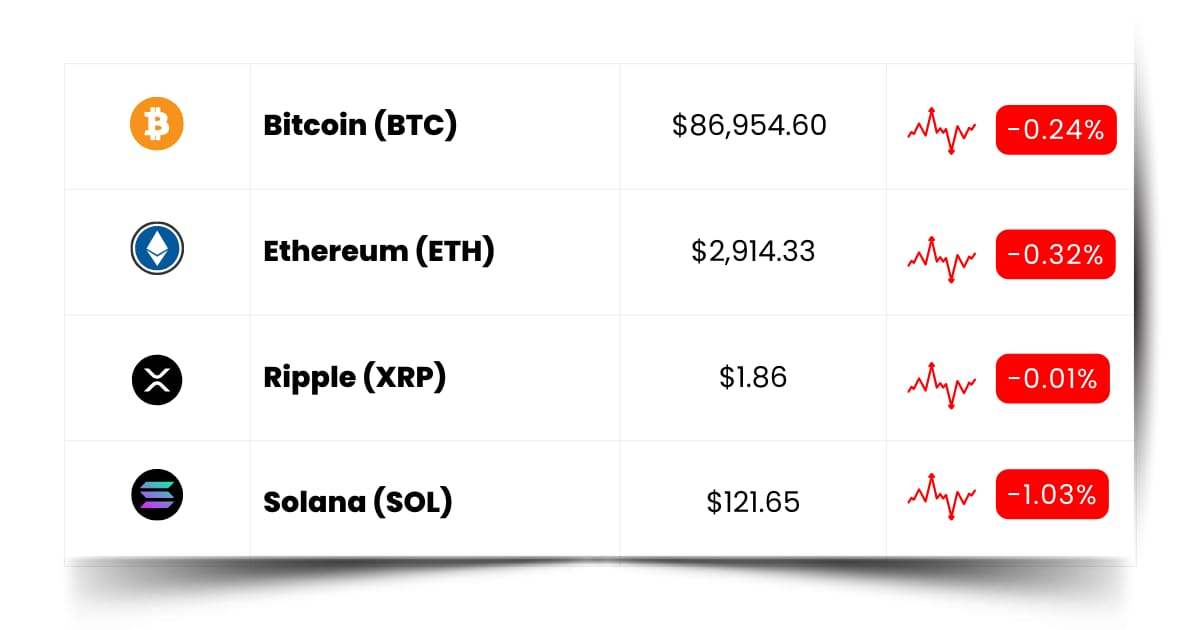

Coin Leaderboard

Crypto Pulse

Bitcoin is getting passed over by fear trades and AI money, banks are moving closer to the order book, and states are lowering friction—but speculation is still sprinting ahead. CXT, RIF, and ICNT ripped higher, proving that when capital hesitates at the macro level, it looks for speed further down the curve.

This is the market's pressure release. While big money debates safety and structure, fast money hunts momentum where narratives are loose, and price discovery moves first.

Covalent X Token (CXT) $0.01624 (-24.92%)

After drifting lower for most of the month, CXT exploded 274.98% in the past 24 hours, easily topping today's Crypto Pulse leaderboard.

Rifampicin (RIF) $0.01338 (+0.51%)

RIF ripped 66.40% as volatility picked up, pushing the token sharply higher after a quiet stretch.

Impossible Cloud Network (ICNT) $0.4653 (+11.91%)

ICNT climbed 42.55% in a single day, wiping out losses from earlier in the week and snapping its short-term downtrend.

Edge Before Crowd (Sponsored)

I'd like to give you a free copy of our brand-new report: 7 Best Stocks for the Next 30 Days.

Our objective, mathematical stock prediction system has consistently outperformed the market — delivering strong returns over decades.

This just-released Special Report reveals the 7 most explosive stocks from our top-ranked selections.

Fewer than 5% of stocks qualify to be one of our “7 Best.” These could be the most exciting short-term trades in your portfolio.

Don’t wait — see these picks before your next trade. Download it now, absolutely free.

[Click Here for the Free Report]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Future Forward

If you want to get ahead in crypto, stop watching the price and start watching where people show up.

Conferences, airdrops, and token launches tell you where builders are building, where capital is listening, and where attention is quietly forming.

Airdrops aren't freebies—they're early signals. Teams use them to reward real users, test demand, and surface communities before hype kicks in.

Token launches are live stress tests. You see who's ready to ship, who understands risk, and who can survive the market's first honest reaction.

Conferences pull it all together. When builders, funds, and regulators share the same rooms, tomorrow's narratives usually start there—not on your timeline.

Crypto Conferences:

💎 BUIDL Europe 2026 (Jan 7, 2026)

💎 TOKYO DIGICONX 2026 (Jan 8, 2026)

💎 PEER Summit 2026 (Jan 9, 2026)

Upcoming Airdrops:

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

Upcoming Token Launches:

🚀 SUBBD (SUBBD) Presale (Dec 31, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

🚀 EarnPark (PARK) Token Sale Tier 4 (Jan 8, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Bitmine?

Bitmine is a public company that's building a massive Ethereum treasury instead of treating ETH like a short-term trade. Think of it as a corporate bet that Ethereum will matter more over time—not just next month.

The company buys and holds Ether on its balance sheet, similar to how some firms hold Bitcoin as a reserve asset. As ETH's role in finance, staking, and infrastructure grows, Bitmine aims to benefit from that long-term exposure.

Bitmine also plans to stake part of its ETH holdings, which means earning yield by helping secure the Ethereum network. That turns idle assets into productive ones, creating income instead of just price exposure.

For you, Bitmine matters because it shows how crypto is moving into corporate strategy. Ethereum isn't just a token anymore—it's becoming something companies build around.

Everything Else

Ethereum quietly became Wall Street's default blockchain in 2025, as banks, asset managers, and even tech giants chose its layer-2 ecosystem for tokenization, helped by regulatory clarity and a more outward-facing Ethereum Foundation.

Aave's token fell 18% in a week as a governance fight over brand and control spooked investors, showing how off-chain uncertainty can hit harder than macro volatility even in a stable market.

Ether ETFs finally snapped a week-long outflow streak while XRP ETFs continued steady inflows, signaling that investors are differentiating between large-cap narratives instead of rotating in and out blindly.

Crypto hacks became fewer but more dangerous in 2025, with attackers shifting from simple code exploits to high-impact supply chain and phishing scams that target infrastructure and human trust.

Bitmine crossed 4 million ETH in holdings after another $40 million buy, reinforcing a growing trend of corporate crypto treasuries treating Ethereum as a long-term strategic asset rather than a trade.

Crypto rarely gives you clear signals—but it leaves clues everywhere. If you pay attention to who's building, who's allocating, and where conviction is forming early, you don't need to chase moves—you'll see them coming.

Best Regards,

— Benjamin Vitaris

Crypto Intel