- Crypto Intel

- Posts

- Bitcoin Breaks $111K as UK Opens the Door and Japan Eyes Reform

Bitcoin Breaks $111K as UK Opens the Door and Japan Eyes Reform

This week marked a shift in tone—and geography—for crypto's next move.

Bitcoin bounced back above $111K, the UK opened retail access to Bitcoin ETPs for the first time since 2021, and Japan hinted it might soon let banks trade digital assets directly.

If last week was about fear, this one's about follow-through. Momentum, regulation, and reform are finally moving in the same direction—and it's starting to show on the charts.

This Technology Makes Every City a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing. Their patented tech creates 2,000 ocean-quality rides per hour, anywhere in the world, across all skill levels.

Surf tourism is a $65B global industry, yet fewer than 1% of people live near real waves. Licenses sold across the U.S. and Australia, with plans for a first commercial park in the works.

3x world champ Tom Curren and surf icon Mark Occhilupo have joined as ambassadors and shareholders. Even actor Chris Hemsworth has praised Surf Lakes.

You have until October 30th at 11:59 PM PT to invest in Surf Lakes.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News — What This Means for You

From Tokyo to London, big economies are turning pro-crypto again. The bullish data and regulatory shifts are giving investors something rare in 2025—clarity.

Each move points toward a world where traditional finance and blockchain aren't at odds but in sync. And that's where the next wave of conviction—and capital—could come from.

Markets

Bitcoin Jumps Past $111K as Risk Appetite Returns

Bitcoin surged 3.7% to $111,099 as Asia's equity markets hit fresh highs, helped by Japan's Nikkei crossing 49,000 for the first time ever.

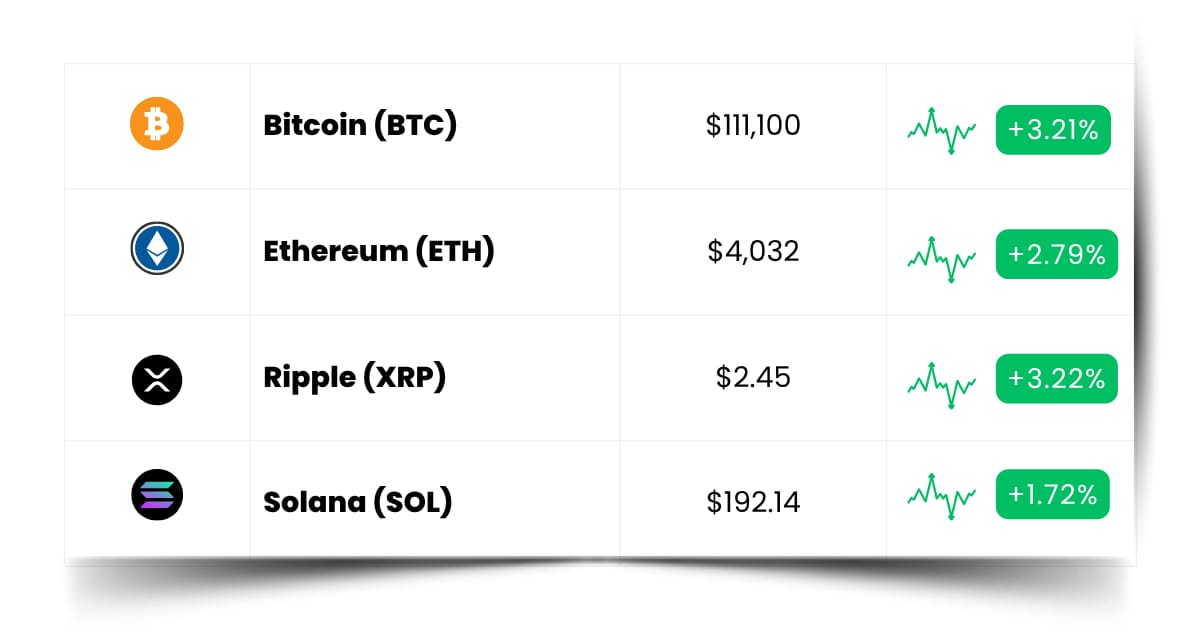

Ethereum, XRP, Solana, and BNB each climbed between 3% and 5%, lifting the CoinDesk 20 Index by 3.6%.

Macro Momentum Meets On-Chain Optimism

On-chain data confirmed the mood shift. Bitcoin's RVT ratio—comparing network value to transaction volume—fell sharply, a signal that usage and accumulation are rising.

Analysts at Alphractal noted that similar drops historically preceded bull runs as coins moved from cold storage into circulation.

Even Michael Saylor hinted that Strategy may be buying again.

Asia's Rally Lifts Global Sentiment

Japan's markets were fueled by optimism around incoming Prime Minister Sanae Takaichi, who supports Abenomics' mix of low rates and fiscal expansion.

China's 4.8% GDP growth and a weaker dollar added more fuel to risk assets.

The combination of fiscal looseness in Japan and potential Fed rate cuts later this year created a perfect setup for risk-on trades.

Even gold's pause around $4,250 helped push money back into Bitcoin.

Take: Macro and on-chain signals are finally speaking the same language—and it's bullish.

If risk appetite holds, Bitcoin's move past $111K could be the start of a broader recovery wave led by Asia and backed by renewed institutional inflows.

Institutional Investment

BlackRock, 21Shares, and Bitwise Launch Bitcoin ETPs in the UK

For the first time since 2021, retail investors in the UK can now buy Bitcoin exchange-traded products. BlackRock, 21Shares, WisdomTree, and Bitwise all listed new offerings on the London Stock Exchange on Monday.

The FCA's U-Turn Opens the Floodgates

The Financial Conduct Authority officially lifted its retail ban, bringing the UK closer to Europe's crypto-access model. It's a major policy reversal after years of regulatory caution.

BlackRock's iShares Bitcoin ETP (IB1T) joined others already trading on Xetra, Euronext Amsterdam, and Paris.

Meanwhile, 21Shares launched four ETNs, including low-fee "Core" Bitcoin and Ether options charging just 0.10%.

Institutional Credibility, Retail Access

WisdomTree's Bitcoin and Ethereum ETPs—once restricted to high-net-worth investors—are now available on mainstream UK platforms.

Bitwise joined in with four new listings and slashed fees on its Core Bitcoin ETP from 20 to 5 basis points.

BlackRock's growing dominance continues, with $85.5 billion already in its iShares Bitcoin Trust. Together, these listings signal that crypto is no longer confined to hedge funds—it's coming to your brokerage screen.

Take: The UK's move is more than symbolic—it's structural. Opening ETPs to retail means everyday investors now have a regulated bridge into Bitcoin exposure, and that liquidity could help stabilize demand across Europe's crypto markets.

Poll: When a friend brags about a 10x crypto trade, your reaction? |

Top 5 Alert (Sponsored)

How would it feel to double your money by this time next year?

From thousands of stocks, only 5 have emerged with the best chance to gain +100% or more in the months ahead.

You can see all five of these tickers — absolutely free.

Just download the newly released 5 Stocks Set to Double special report.

While we can’t guarantee future performance, previous editions of this report have delivered gains of +175%, +498%, and even +673¹.

The newest picks could be just as profitable.

Act fast — this opportunity ends at MIDNIGHT TONIGHT.

Download the report now, absolutely free

Policy

Japan Weighs Letting Banks Trade and Hold Crypto

Japan's Financial Services Agency (FSA) is preparing reforms that would let banks hold and trade digital assets like Bitcoin under the same framework as bonds or equities.

The move would overturn a 2020 rule that barred banks from owning crypto for investment.

A Shift From Caution to Inclusion

The FSA is also considering registering major banking groups as "crypto exchange operators," allowing them to offer direct trading services.

The proposal will be reviewed by the Financial Services Council, which advises the Prime Minister.

If approved, it would place Japan among the first developed nations to integrate digital assets into mainstream banking.

That's a huge credibility boost for crypto markets long excluded from traditional balance sheets.

Policy Meets Pressure

Japan's openness comes as it faces a debt-to-GDP ratio near 240%, forcing policymakers to seek new growth avenues.

Crypto innovation could act as both an economic spark and a hedge against local financial stagnation.

Allowing banks to trade crypto also aligns with global adoption trends in the US and Europe.

It signals that digital assets are maturing into a legitimate asset class worthy of central regulation.

Take: Japan's potential policy shift could redefine how banks worldwide approach crypto exposure.

If the reform passes, it may accelerate institutional adoption across Asia and create a new liquidity hub that strengthens Bitcoin's global base layer.

Coin Leaderboard

Crypto Pulse

Momentum didn't just return—it exploded. As Bitcoin reclaimed $111K and Asia’s markets hit record highs, smaller tokens lit up the charts with pure speculative energy.

修仙 kept its post-launch heat alive, AUCTION erased its crash losses overnight, and CTX rode SmartCon buzz straight into a breakout.

Capital isn’t hesitating anymore—it’s rotating fast, chasing narrative, exposure, and timing.

The message this week is simple: confidence is back, and traders are testing their edge again. In markets like this, speed isn’t everything—but conviction is.

修仙 (修仙) $0.01762 (+64.50%)

修仙 extended its post-launch momentum, climbing another 64.50% since its debut on October 10.

Bounce Token (AUCTION) $10.24 (+63.34%)

AUCTION bounced back hard, erasing all losses from the October 10 market crash with a 63.34% rally in 24 hours.

Cryptex Finance (CTX) $1.61 (+54.69%)

CTX surged 54.69% in a single day, fueled by excitement over its upcoming appearance at SmartCon.

Crypto Law Shockwave (Sponsored)

For years, crypto faced unclear rules and nonstop skepticism.

That ended in July.

Congress passed landmark legislation, and within days the market blasted to a record $4 trillion.

Why? Because institutions finally have clarity. Banks and Wall Street are free to move in—something retail investors rarely get a chance to front-run.

Our free book, Crypto Revolution, explains what this shift means and how to prepare before adoption accelerates.

It also comes with $788 in free bonus resources.

This isn’t hype—it’s history in the making.

[Download Your Free Copy Now]

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Future Forward

The next wave of gains won’t come from watching the charts—it'll come from knowing when the action starts.

Momentum hides in plain sight, buried in launch calendars and conference schedules, waiting for traders who plan ahead.

Airdrops, TGEs, and token events don’t just move prices—they shift liquidity. Mark the dates, prep your strategy, and let timing be your edge while everyone else is still scrolling for signals.

Crypto Conferences:

💎 Fintech Without Borders Forum 2025 (Oct 21, 2025)

💎 Innovate Finance FinTech as a Force for Good Forum (Oct 21, 2025)

💎 Zebu Live 2025 (Oct 21, 2025)

Upcoming Airdrops:

🎁 DFDV Staked SOL (DFDVSOL) Airdrop (Oct 23, 2025)

Upcoming Token Launches:

🚀 Momentum (MMT) IDO on Buidlpad (Oct 22, 2025)

🚀 MWX (MWXT) IDO on Spores (Oct 23, 2025)

🚀 Meteora (MET) TGE and Distribution (Oct 23, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Bitwise?

Bitwise is one of the biggest names in crypto asset management, known for building simple, regulated products that make digital assets easier to invest in.

Instead of buying Bitcoin or Ethereum directly, investors can use Bitwise’s exchange-traded products (ETPs) to get exposure through traditional markets.

The company's most popular fund—the Bitwise 10 Crypto Index Fund—tracks the ten largest cryptocurrencies by market cap.

It automatically rebalances to follow the market’s leaders, giving investors broad exposure without having to manage wallets or exchanges.

Bitwise also runs specialized products focused on Bitcoin, Ethereum, and DeFi, designed for both retail and institutional investors.

These funds trade on regulated exchanges and follow strict custody and reporting standards.

In short, Bitwise bridges the gap between crypto and traditional finance. It lets investors play the digital asset game with Wall Street tools—no private keys required.

Everything Else

New York lawmakers introduced twin bills targeting proof-of-work mining, proposing energy-based taxes of up to 5 cents per kilowatt-hour to fund household energy programs, though renewable-powered miners would be exempt.

Coinbase reported that 67% of institutional investors are bullish on Bitcoin for the next six months, citing strong liquidity, potential Fed rate cuts, and renewed treasury accumulation from firms like Strategy and BitMine.

Citi said stablecoins are powering crypto's next growth phase, lifting Ethereum activity while setting the stage for $1.9 trillion in market cap by 2030 as dollar-backed coins dominate global adoption.

Chainlink jumped 14% after whales accumulated $116 million in LINK, and the project revealed major partnerships with Swift, DTCC, Euroclear, and the US Department of Commerce to bring real-world assets on-chain.

Michael Saylor said Strategy can convert $100 million into Bitcoin within an hour, highlighting the company's aggressive buying capacity and reinforcing corporate Bitcoin adoption as a core treasury strategy.

Crypto isn't about who shouts loudest—it's about who sees the move before it happens. Keep your radar sharp, your curiosity alive, and your conviction steady.

Because in markets like these, the real winners aren’t lucky—they’re ready.

Best Regards,

— Benjamin Vitaris

Crypto Intel