- Crypto Intel

- Posts

- Bitcoin's Test, Capital's Mood, and a Corporate War Chest

Bitcoin's Test, Capital's Mood, and a Corporate War Chest

Bitcoin is back above $90,000, but what happens next depends on leverage, regulation, and who still has dry powder.

This week shows you where conviction is holding, where capital is quietly pulling back, and who's positioning to stay in control if volatility snaps back.

If you want to understand whether this market is building strength—or just stretching risk—this is where to focus.

Colorado’s Most-Awarded Brewery Did Something Totally Unique

Some companies make lofty promises to investors and never deliver. Others use those dollars to unlock new levels of scale.

That’s Westbound & Down’s story. Already Colorado’s most-awarded craft brewery, they opened their doors to investors for the first time to help open a flagship Denver-metro-area location.

With 2,800% distribution growth since 2019 and a retail partnership with Whole Foods, it’s no shock investors maxed out that campaign in less than 60 days.

But it’s what comes next that’s even more exciting. Fresh off Brewery of the Year honors at the 2025 Great American Beer Festival, W&D is scaling toward 4X distribution growth by 2028.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Price action is telling one story, but flows, positioning, and balance sheets are telling another.

From Bitcoin's fragile reclaim of $90,000, to nearly $1 billion leaving US crypto funds, to Strategy padding its cash reserves, these moves reveal how traders and institutions are managing risk before the next decisive swing.

Markets

Bitcoin Reclaims $90,000—but the US Session Is the Real Test

Bitcoin climbed from roughly $88,000 to above $90,000 during Asian and European trading hours, extending a familiar December pattern.

The move looked constructive on the surface, but traders remained cautious ahead of the US market open.

Recent rallies have consistently found early support outside US hours, only to fade once American traders step in.

That behavior has turned the US session into the key stress test for whether upside momentum can actually hold.

Leverage Is Building Quietly

As price pushed higher, Bitcoin futures open interest climbed steadily toward $60 billion across major venues.

Binance, CME, and Bybit all saw increases, pointing to fresh leverage rather than simple short covering.

Rising open interest alongside price doesn't automatically spell trouble, but it raises the stakes. If spot demand doesn't follow through, leveraged positioning can unwind quickly.

A Familiar December Pattern

Earlier pushes above major levels—including $90,000—have often reversed during New York hours.

Those pullbacks have triggered fast liquidations as hedges are added and profits are taken.

The concern now isn't whether Bitcoin can touch $90,000, but whether it can stay there once US trading ramps up.

Failure would reinforce the month's pattern of lower highs and sharp retracements.

Take: This rally is less about the breakout and more about what happens next.

If $90,000 holds during US hours, it breaks December's rhythm—but if leverage leads and spot demand lags, volatility could return fast.

ETFs

Regulatory Delays Trigger $952M Exodus From US Crypto Funds

Digital asset investment products saw $952 million in outflows last week, snapping a month-long streak of inflows.

Nearly all of that capital—about $990 million—came from US-based products.

CoinShares linked the move to delays around the US Clarity Act and renewed regulatory uncertainty. Concerns over continued whale selling added to the defensive tone.

Ethereum Takes the Biggest Hit

Ethereum-based products led the retreat with $555 million in outflows.

Analysts noted Ethereum has the most at stake from clarity legislation, making it more sensitive to policy delays.

Bitcoin products weren't spared either, with $460 million in redemptions. This reversal followed one of the largest ETF inflow days since October, just a week earlier.

Selective Demand Still Exists

Not all assets were sold.

Solana and XRP products recorded inflows of $48.5 million and $62.9 million, respectively, pointing to selective conviction rather than blanket risk-off behavior.

Outside the US, modest inflows into Canada and Germany partially offset losses. Still, global crypto ETP assets slipped to $46.7 billion, down from $48.7 billion at the end of 2024.

Take: This looks less like a loss of faith and more like regulatory fatigue.

Capital isn't leaving crypto—it's rotating toward assets with clearer narratives while investors wait for US rules to stop slipping.

Poll: When Bitcoin drops 20% in a day, your reaction is… |

Future Growth Insight (Sponsored)

A powerful shift in America’s AI landscape is underway, and a new group of companies is positioned to benefit.

A free report reveals 9 AI-driven operations showing strong revenue trends and real domestic expansion.

These picks come from sectors seeing faster adoption, lighter regulatory pressure and growing infrastructure demand.

Investors watching early indicators may find the timing advantageous.

Get the Free Report

Institutional Adoption

Strategy Boosts Cash Reserves by $748M Through Stock Sales

Strategy raised $747.8 million last week by selling common stock, significantly bolstering its cash position.

The company's USD reserve now sits above $2.2 billion, according to a recent SEC filing.

That reserve is designed to fund dividends on Strategy's preferred shares. At current levels, it can cover roughly 32 months of preferred dividend payments.

Balance Sheet First, Bitcoin Second

The raise did not involve selling Bitcoin. Strategy still holds 671,268 Bitcoin, acquired for just over $50 billion and now worth around $60.4 billion at current prices.

Shares of MSTR rose about 3% premarket alongside Bitcoin's weekend bounce above $90,000. Despite the uptick, the stock remains down more than 40% year-to-date.

A Different Kind of Flexibility

By increasing cash rather than leverage, Strategy adds breathing room to its capital structure. That flexibility matters if volatility returns or financing conditions tighten.

The move also reinforces Strategy's long-term posture. Bitcoin remains the core asset, but liquidity is being prioritized.

Take: This isn't a Bitcoin bet—it's a risk-management one.

Strategy is shoring up optionality, which could help it stay aggressive long-term without being forced into reactive decisions during drawdowns.

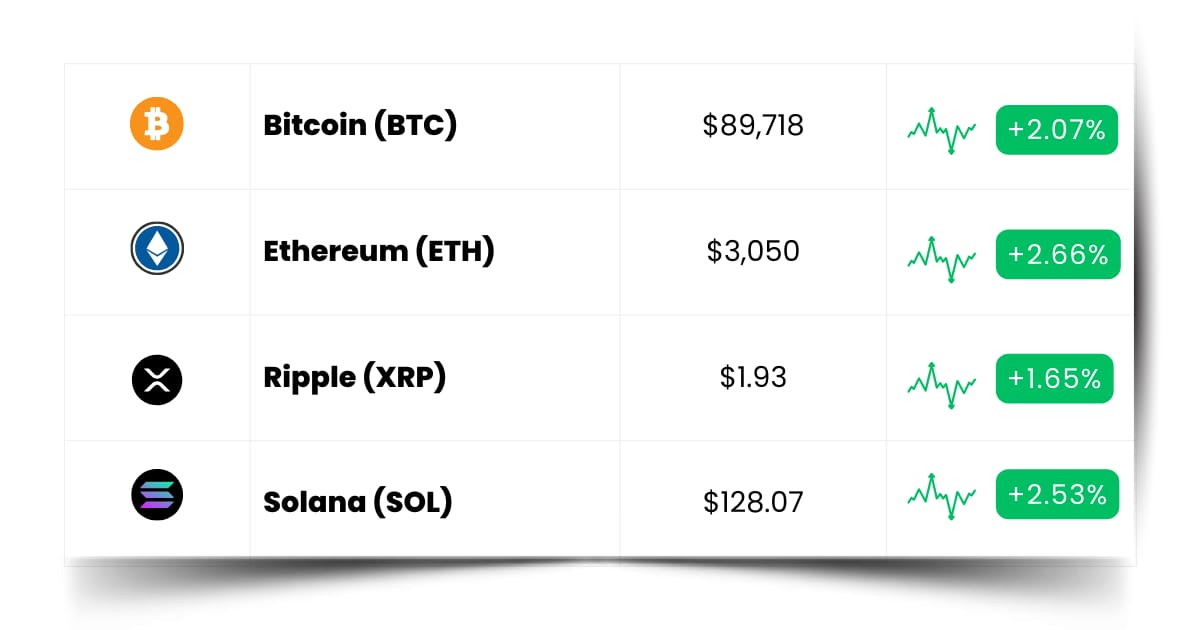

Coin Leaderboard

Crypto Pulse

Bitcoin is fighting to hold $90,000, funds are pulling back, and institutions are tightening their balance sheets—but speculation didn't get the memo.

ARTX, ZKP, and BEAT all surged, showing that when conviction wobbles at the top, attention dives down the curve.

This is the release valve of the market. Liquidity looks for speed, narratives compress into days, and the sharpest moves show up where risk is still cheap, and rules feel far away.

ULTILAND (ARTX) $0.4562 (+58.83%)

ARTX ripped 58.83% as traders reacted to its newly announced partnership with SentismAI, reigniting short-term momentum.

zkPass (ZKP) $0.1811 (+53.02%)

ZKP jumped 53.02% after the team addressed launch-related turbulence, helping restore confidence following a volatile debut.

Audiera (BEAT) $4.40 (+48.65%)

BEAT added another 48.65% in the past 24 hours, extending a staggering two-month run that's now up more than 5,000%.

Signals Activating Now (Sponsored)

What if you could see where the pros are focusing now?

A newly released 5-stock report uncovers the companies that analysts believe could deliver the strongest upside in 2025.

These names show strong growth, earnings acceleration, and major market catalysts that point toward potential triple-digit returns.

The opportunity window is narrow and access is free only until midnight tonight.

[Get the 5 Stocks Report Before Access Closes]

Future Forward

If you want a head start in crypto, stop staring at candles and start watching behavior.

Conferences, airdrops, and token launches show you where attention is gathering before the price ever reacts.

Airdrops aren't random giveaways. They're how teams quietly reward early users and stress-test real demand without marketing noise.

Token launches are public auditions. You see who's confident enough to ship, price risk in real time, and let the market judge the story immediately.

Conferences tie it all together. When builders, capital, and regulators show up in the same rooms, the next narrative usually forms there first—not on social feeds.

Crypto Conferences:

💎 BUIDL Europe 2026 (Jan 7, 2026)

💎 TOKYO DIGICONX 2026 (Jan 8, 2026)

💎 PEER Summit 2026 (Jan 9, 2026)

Upcoming Airdrops:

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

Upcoming Token Launches:

🚀 SUBBD (SUBBD) Presale (Dec 31, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

🚀 EarnPark (PARK) Token Sale Tier 4 (Jan 8, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Aave?

Aave is a decentralized lending platform that lets you lend and borrow crypto without using a bank.

You interact directly with smart contracts, which automatically manage loans, interest rates, and collateral.

When you lend assets on Aave, you earn interest paid by borrowers. When you borrow, you lock up collateral and can access liquidity without selling your crypto.

Aave is governed by its community through the AAVE token. Token holders vote on changes like risk parameters, upgrades, and how the protocol evolves over time.

For you, Aave matters because it shows what DeFi does best.

It replaces traditional financial plumbing with open, programmable systems that anyone can use—no permission required.

Everything Else

Ghana has officially legalized crypto trading and handed regulatory authority to its central bank, turning one of Sub-Saharan Africa's most active crypto markets into a regulated on-chain economy instead of a legal gray zone.

BitMine added nearly $300 million worth of Ethereum during last week's market pullback, pushing its treasury past 4 million ETH and signaling long-term conviction despite sitting on sizable unrealized losses.

Coinbase agreed to acquire The Clearing Company as it accelerates its push into prediction markets, reinforcing its strategy to become an "Everything Exchange" spanning crypto, equities, and real-world outcome contracts.

JPMorgan is weighing spot and derivatives crypto trading for institutional clients, reflecting rising demand from hedge funds and pensions as US regulatory clarity slowly improves.

Aave's token slid after an internal governance dispute over who controls the protocol's brand assets escalated into a public vote, exposing how off-chain control can still shake confidence in on-chain systems.

Crypto doesn't reward the loudest takes—it rewards the people who notice patterns early and stay curious when others get complacent.

If you keep tracking where money moves, products launch, and trust gets built, you'll spend less time chasing moves and more time understanding why they happen.

Best Regards,

— Benjamin Vitaris

Crypto Intel