- Crypto Intel

- Posts

- Bitcoin Shakes Out Leverage as Institutions Keep Building

Bitcoin Shakes Out Leverage as Institutions Keep Building

Leverage flushed, rails built.

Hello and welcome to Crypto Intel, the twice-weekly newsletter covering the latest updates, breaking news, and exciting opportunities in the crypto world.

Today, we’ll look into…

Ignored Opportunity (Sponsored)

There's a hidden market where crypto trades at 80-95%cheaper than mainstream exchanges.

It's called the "Native" Markets, and it's how every crypto millionaire has made their fortune.

Don't buy at the top - get in before retail even knows:

Click here for the FREE guide on how it's done.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Three forces are colliding at once. Bitcoin is digesting a leverage shakeout, institutions are broadening exposure beyond Bitcoin, and regulation is moving from noise toward structure.

Together, these shifts tell you whether to tighten risk, stay positioned, or prepare for the next rotation.

Markets

Bitcoin Dips to $92K as Liquidations Reset the Rally

Bitcoin slipped back toward $92,000 after failing to hold gains near $94,000, triggering a sharp but contained wave of selling. Roughly $440 million in leveraged positions were liquidated, exposing how thin participation still is under the surface.

Liquidity Improved, Leverage Stayed Fragile

The early-2026 rally was fueled by easing year-end liquidity stress and growing expectations for Federal Reserve rate cuts. That backdrop lifted the broader crypto market by roughly $250 billion in market cap before momentum stalled.

Despite the upside, leverage was never fully rebuilt. Futures positioning stayed conservative, leaving the rally vulnerable once sellers pressed the market.

A Controlled Shakeout, Not a Breakdown

The pullback unfolded quickly, with Bitcoin dropping about 3% from its local high before stabilizing near $92,600. Most of the damage landed on overextended longs rather than long-term holders.

Open interest resets instead of collapsing. That kind of unwind usually signals digestion, not a structural trend reversal.

Institutional Pressure Eases at the Margins

MSCI's decision not to exclude crypto treasury stocks from its indexes removed a potential source of forced selling. That spared passive funds from having to exit positions tied to companies holding Bitcoin on balance sheets.

The move didn't spark a rally, but it reduced downside risk. Sometimes stability comes from what does not happen.

Take: This looked like leverage getting rinsed, not conviction leaving the market. For investors, the message is simple—Bitcoin can move higher, but only when participation catches up to price.

Institutional Adoption

Morgan Stanley Files for Ethereum Trust After ETF Push

Morgan Stanley filed a registration statement for an Ethereum Trust, extending its crypto product lineup. The move followed recent filings for spot Bitcoin and Solana ETFs.

TradFi Keeps Expanding Its Crypto Toolkit

The filing signals that large banks are no longer treating crypto as a one-asset story. Ethereum is increasingly viewed as infrastructure exposure rather than a speculative add-on.

Morgan Stanley already opened crypto access to clients through its wealth management arm in October. This filing builds on that foundation rather than starting from scratch.

Regulated Wrappers Are the Real Story

Trusts and ETFs give institutions familiar ways to gain exposure without touching wallets or private keys. That structure lowers friction for advisors and compliance teams.

Each new product widens the funnel. Adoption often happens quietly before it shows up in price.

ETH Gets Pulled Further Into the Institutional Core

Ethereum's role as a settlement and application layer makes it a natural next step after Bitcoin. This filing reinforces that institutions are thinking in portfolios, not single-asset bets.

It also reflects confidence that demand exists. Banks rarely build products without clients already asking for them.

Take: This isn't about a short-term Ethereum trade. It's about crypto becoming a standard menu item inside traditional finance, one regulated wrapper at a time.

Trivia: What is the primary function of a hash function in blockchain? |

Don’t Miss Out (Sponsored)

Most investors have never been shown this before.

Just before the Great Depression, a little-known market signal quietly began identifying historic winners—long before headlines caught on.

That same signal flagged several legendary stocks at prices that now seem impossible.

Now, with volatility rising again, it’s flashing green on three under-the-radar opportunities positioned to outperform into 2026.

Click here NOW — before it's too late.

Regulation

CLARITY Act Heads to Senate Markup as Debate Continues

The Digital Asset Market Clarity Act is set for Senate markup next week, according to Senator Tim Scott. The bill aims to establish a comprehensive crypto market structure framework in the US.

Momentum Builds, But Friction Remains

The House passed the legislation in July 2025, clearing one major hurdle. If the Senate passes it without changes, it could move directly to the president's desk.

That said, negotiations are still active. Key issues around DeFi, sanctions compliance, and enforcement authority remain unresolved.

Industry Split Reflects Growing Pains

Some legal experts believe a deal is likely, even if compromises are required. Others warn that bipartisan alignment is still fragile.

Delays have already mattered. CoinShares previously linked nearly $1 billion in product outflows to prolonged regulatory uncertainty.

Clarity Matters More Than Speed

Market participants are less focused on perfection than predictability. Clear rules tend to unlock capital, even if those rules are strict.

This bill is foundational, not cosmetic. It has shaped how crypto operates in the US for years, not months.

Take: Volatility around regulation is the cost of maturation. For investors, progress—even messy progress—matters more than short-term delays because clarity is what ultimately brings durable capital back in.

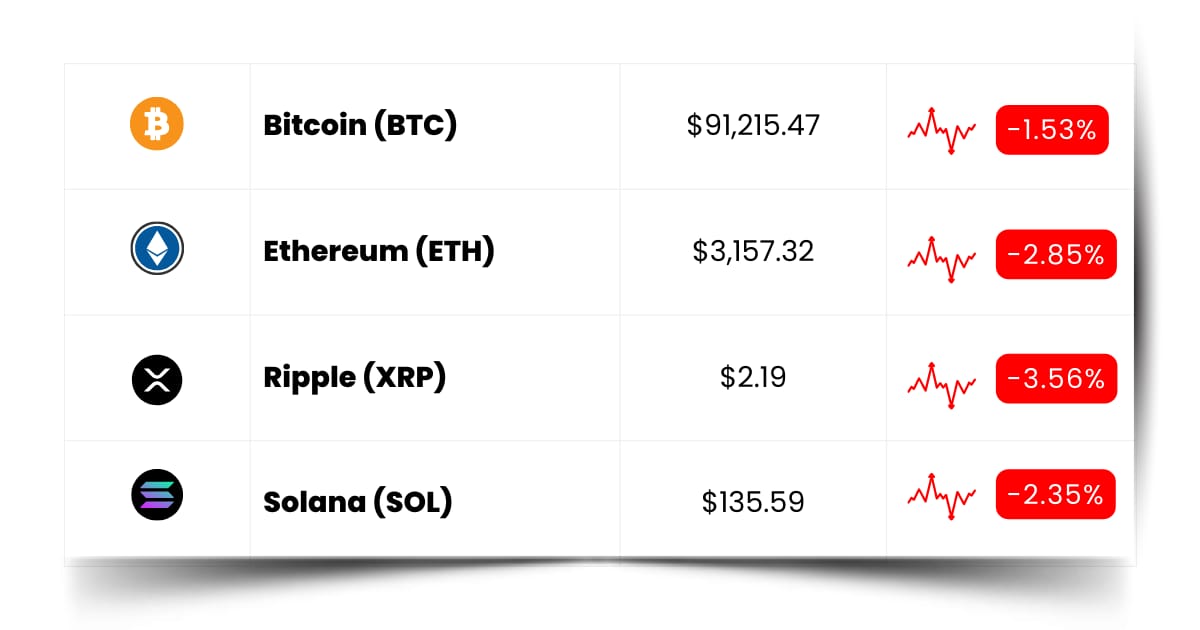

Coin Leaderboard

Crypto Pulse

Bitcoin just shook out leverage, institutions are still building behind the scenes, and the loudest moves are happening far away from the headlines.

EURt, WOD, and BOUNTY are flying because fast money isn't waiting for confirmation—it's reacting to gaps, inefficiencies, and short-lived attention.

This is a market where patience holds the base, and speed hunts the edges.

Tether EURt (EURt) $0.5808 (-16.96%)

In an unexpected move, Tether's EURt stablecoin topped today's Crypto Pulse leaderboard, surging 138.42% even though the asset was officially shut down just a month ago.

World of Dypians (WOD) $0.04852 (+101.92%)

After sliding for nearly a month, WOD staged a sharp comeback, erasing its recent losses and pushing to fresh 30-day highs with a 96.60% jump.

Chainbounty (BOUNTY) $0.03396 (+59.89%)

BOUNTY extended its momentum with another strong session, climbing 75.93% over the past 24 hours as buyers stayed firmly in control.

Power Is Shifting (Sponsored)

They mocked your values and expected everyday Americans to stay financially exposed.

Now the dollar faces pressure, global conflicts threaten stability, and inflation quietly eats away at savings.

Doing nothing is exactly what powerful interests are counting on as uncertainty grows.

This Patriot’s Tax Shield explains how real, physical gold can help defend wealth during political and economic disruption.

A free Wealth Protection Guide reveals how Trump’s agenda could impact gold and why timing matters now.

Click here to get the FREE Wealth Protection Guide now.

Future Forward

In crypto, the real edge isn't predicting price—it's being early to where attention hasn't arrived yet. Conferences, airdrops, and token launches are where ideas start circulating quietly, before timelines and charts catch on.

Airdrops tend to reward participation, not portfolio size. When you actually test products, poke around new platforms, and show up early, you put yourself where teams look first when value gets distributed.

Token launches are stress tests in real time. They show you which projects can handle liquidity, users, and pressure—and which ones fold the moment the lights turn on.

Conferences compress months of online noise into a few days of signal. When builders and investors talk face to face, trends often surface there long before they trend everywhere else.

Crypto Conferences:

💎 Max and Stacy Bitcoin Golf Invitational 2026 (Jan 8, 2026)

💎 TOKYO DIGICONX 2026 (Jan 8, 2026)

💎 PEER Summit 2026 (Jan 9, 2026)

Upcoming Airdrops:

🎁 Recall (RECALL) Airdrop (Jan 13, 2026)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

Upcoming Token Launches:

🚀 EarnPark (PARK) Token Sale Tier 4 (Jan 8, 2026)

🚀 Fogo (FOGO) TGE and Distribution (Jan 13, 2026)

🚀 Warp Chain (WRP) IDO on Eesee (Jan 13, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is the CLARITY Act?

The CLARITY Act is a proposed US law designed to spell out how crypto markets are regulated and who oversees what.

Its main goal is to reduce confusion by clearly defining rules for trading, custody, and market structure.

Right now, crypto companies often operate in gray areas, unsure which rules apply or which agency is in charge.

The CLARITY Act aims to replace that uncertainty with a clear framework that businesses and investors can actually plan around.

For you, this matters because clearer rules tend to attract long-term capital. Institutions are far more likely to participate when expectations are written down instead of implied.

The bill is still being debated, which means details may change.

But even moving toward clarity—rather than staying stuck in limbo—signals that crypto is becoming a regulated part of the financial system, not a temporary experiment.

Everything Else

Metaplanet shares jumped and now trade at a premium to their Bitcoin holdings after MSCI removed near-term index exclusion risk, easing a key overhang for crypto treasury stocks without fully clearing future uncertainty.

US community banks warned lawmakers that yield-style stablecoin rewards could pull deposits out of local banks, arguing that loopholes in the GENIUS Act risk shifting trillions away from traditional lending.

Barclays made its first stablecoin-related investment by backing Ubyx, signaling that major banks are moving from talking about digital money to quietly building the rails behind it.

Moody's said stablecoins are becoming core financial infrastructure, with trillions in on-chain settlement and hundreds of billions likely flowing into tokenized finance systems by 2030.

RAKBank received in-principle approval to issue a dirham-backed stablecoin, showing how the UAE is pushing stablecoins beyond crypto-native use and into regulated, domestic payment rails.

Crypto moves the fastest at the edges, not the headlines. If you stay close to where things are being built instead of waiting for consensus, you give yourself more options—and better timing—when it finally shows up on everyone else's screen.

Best Regards,

— Benjamin Vitaris

Crypto Intel