- Crypto Intel

- Posts

- Bitcoin Sinks, States Buy the Dip, and Banks Go Full Stablecoin Mode

Bitcoin Sinks, States Buy the Dip, and Banks Go Full Stablecoin Mode

Crypto's holiday week is coming in hotter than the turkey, with Bitcoin breaking its usual Q4 rhythm, Texas planting the first real flag for state-level BTC reserves, and US Bancorp pulling stablecoins straight into the banking mainstream.

If you want a clear snapshot of where the next wave of money, momentum, and influence is heading, this rundown gives you the edge before the market decides the next move.

The Vault Just Opened on a $2T Market Opportunity

Elf Labs owns 100+ priceless trademarks for icons like Cinderella & Snow White. They’ve already earned $15M+ in royalties, and are now using AI to turn these legends into living, interactive worlds for the next generation. With patented tech & a $2T market opportunity ahead, the next chapter of entertainment is being written in real time.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Momentum just snapped in three directions at once—seasonality cracked for Bitcoin, state governments stepped into accumulation mode, and big banks finally started stress-testing on-chain dollars.

These shifts might look unrelated at first glance, but together they're reshaping the tone of the market—and giving you a fresh map for how to position through the rest of Q4.

Markets

Bitcoin's Thanksgiving Chill: Holiday Price Slips as Seasonal Trends Break

Bitcoin is heading into Thanksgiving with one of its weakest seasonal setups in years, coming in roughly 6% below last year's holiday price.

The market usually treats Q4 as Bitcoin's victory lap, but 2025 brought a 35% correction and five straight red weeks instead.

Holiday Season Breaks Tradition

The day before Thanksgiving has historically been a soft spot for Bitcoin, and this year kept the streak alive with lower liquidity and cautious hedging.

Traders have watched six of the last seven pre-Thanksgiving sessions close red, including the brutal 8% drops in 2020 and 2021.

Thanksgiving Day itself usually behaves better, with an average 1.5% gain and only four negative prints since 2013.

The day after tends to outperform even that, averaging more than 2.3% returns.

Weak Liquidity and Heavy Liquidations

Week 47 has historically delivered almost 3% gains, but Bitcoin is still stuck in a seven-week drawdown from its $126,000 all-time high.

With November down more than 20%, this has already become the worst month since mid-2022.

Institutional flows have reshaped the entire market structure, pushing retail traders to the sidelines and leaving exchanges thin on liquidity.

That shift is why October's liquidation cascade topped $19 billion in a single day, marking the largest wipeout in crypto history.

Take: This isn't the kind of festive mood Bitcoin holders wanted, but it's also the type of slow, illiquid period where smart money quietly accumulates.

If you're navigating this stretch, don't chase moves—just track liquidity, watch for volatility spikes around options expiry, and stay patient as the market resets into December.

Policy

🇺🇸 Texas Makes First Move Toward a Bitcoin Treasury With $5M ETF Buy

Texas just grabbed a $5 million slice of BlackRock's Bitcoin ETF, marking the closest any US state has come to building an official Bitcoin reserve.

It's not a pure on-chain Treasury yet, but it's a very clear step toward one.

A Strategic Placeholder While the Reserve Gets Built

The state appropriated $10 million earlier this year to create the Texas Strategic Bitcoin Reserve, and this ETF buy is their placeholder while custodial contracts are finalized.

Officials said they've already collected industry guidance on best practices for running a state-level crypto reserve.

Other states have dipped pension funds into Bitcoin ETFs, but Texas is trying to build a direct, sovereign-style position.

Michigan and Wisconsin have moved retirement allocations around, but neither has committed its own Treasury funds like this.

A Wave of State-Level Efforts Is Forming

New Hampshire and Arizona are also preparing their own reserve plans, though their programs are still in early stages.

Private-sector initiatives like New Hampshire's $100 million Bitcoin bond are also helping build paths toward broader state involvement.

Advocates say state interest won't slow down just because the market corrected sharply.

Most lawmakers don't consider the current drawdown severe enough to derail long-term planning.

Take: Texas planting a flag—however small—matters because governments move slowly until they suddenly don't.

If more states follow, you could see a new class of long-duration buyers entering Bitcoin, so keep an eye on which legislatures return in early 2026 with bills in hand, because that's when momentum can snowball.

Trivia: What does the term “hash rate” measure? |

Finally Revealed Free (Sponsored)

He’s spent three decades mastering the market. But what he’s sharing today isn’t just for pros.

It’s the same trading indicator he’s used to time major moves for over 30 years — and he’s making it simple enough for anyone to follow.

You don’t need a trading degree or a fancy setup. This indicator shows clear “buy” and “sell” moments — no guesswork, no confusion.

It helped him spot major rallies before they took off… and it just flashed again.

He’s giving you free access to it today — along with a short guide explaining how it works.

[Get the free indicator now]

Stablecoins

US Bancorp Tests On-Chain Dollars With a New Stellar-Based Pilot

US Bancorp is officially running a stablecoin pilot on the Stellar blockchain, signaling that mainstream banks are now moving past research and into real deployment.

The bank is partnering with PwC and the Stellar Development Foundation to test programmable money in a regulated environment.

A Practical Test, Not a Thought Experiment

PwC's blockchain lead said the goal isn't to brainstorm anymore, but to prove stablecoin infrastructure works at bank scale.

The pilot is built to test real transaction workflows, settlement speed, and customer protections.

Stellar was chosen because it includes native tooling to freeze assets and unwind transactions at the protocol level.

US Bank said this type of built-in control is essential for meeting regulatory requirements and consumer safety standards.

Tokenized Assets Are Next on the List

Beyond stablecoins, US Bank is exploring how 24/7 on-chain settlement can be applied to tokenized assets.

The bank believes the same speed and efficiency benefits could expand to other financial products over time.

This pilot lands as banks across the US restart digital-asset initiatives under a more permissive regulatory environment.

Institutions that spent years watching from the sidelines are now stepping in with real testing and real budgets.

Take: US Bancorp entering stablecoin territory is another sign that traditional finance isn't waiting for crypto-native builders to define the future—they're building their own version of it.

If you're tracking stablecoins or tokenization, watch Stellar's institutional traction, because banks rarely choose a network lightly, and this pilot could set the tone for others.

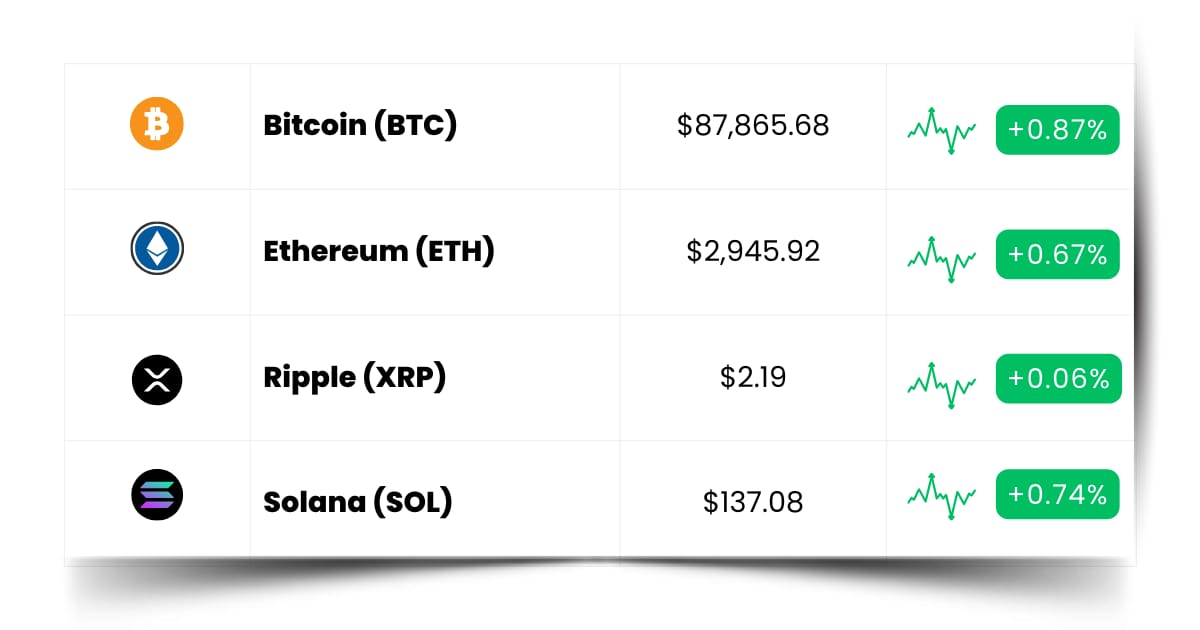

Coin Leaderboard

Crypto Pulse

Big-money players might be tiptoeing through Thanksgiving, but the small-cap scene clearly didn't get the memo.

XION blasted 159.82%, ARTX followed with a 190% launch, and GLEEC punched through a 106% rebound—reminding everyone that even in a slow, choppy market, momentum has zero interest in waiting for the macro picture to settle.

XION (XION) $0.8594 (+159.82%)

XION exploded 159.82% after confirming its new listing on South Korea's Bithumb exchange, sending fresh momentum through the token's markets.

ULTILAND (ARTX) $0.2538 (+190.69%)

ARTX ripped 190.69% higher as excitement surged around its newly announced listing on Binance Alpha.

Gleec Coin (GLEEC) $0.1237 (+106.22%)

GLEEC snapped back with a 106.22% jump following several weeks of sharp volatility, reclaiming ground in a single fast-moving session.

Free Investor Access (Sponsored)

The biggest gains often start where few are looking.

Analysts just released a free report on 5 overlooked stocks showing strong earnings momentum and insider confidence.

These could be the next leaders of the coming market cycle.

The report is free to download, but only for a limited time.

[Access the Free 5 Stocks Report Now]

Future Forward

Airdrops, crypto conferences, and fresh token launches aren't just calendar events—they're where the energy of the next market rotation starts taking shape.

If you stay plugged into these early signals, you'll spot the trends long before they go mainstream.

Crypto Conferences:

💎 Fintech Ireland Summit 2025 (Nov 27, 2025)

💎 Abia Web3 and Digital Economy Conference 2025 (Nov 27, 2025)

💎 Digital Asset Conference III (Nov 27, 2025)

Upcoming Airdrops:

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

Upcoming Token Launches:

🚀 Blink Galaxy (BG) TGE and Distribution (Dec 1, 2025)

🚀 EarnPark (PARK) Token Sale Tier 4 (Dec 3, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Stellar (XLM)?

Stellar is a blockchain built for moving money—fast, cheap, and across borders—without all the friction that normally comes with sending value around the world.

You can think of it as a global payments rail where transactions settle in seconds for a fraction of a cent.

What makes Stellar stand out is its focus on asset-backed tokens, which lets users move digital dollars, euros, or even stablecoins like they're sending a text message.

Banks and fintechs like it because the network has built-in tools for freezing assets and undoing transactions when something goes wrong, giving it a "bank-grade" safety layer most blockchains don't have.

Developers also use Stellar to issue tokenized assets or build payment apps, thanks to its simple smart-contract approach and predictable fee structure.

It's not trying to compete with heavy DeFi chains—it's trying to make real-world money movement feel less like paperwork and more like modern tech.

If you're exploring stablecoins, cross-border transfers, or enterprise-style on-chain finance, Stellar is one of the easiest places to start.

It's fast, it's efficient, and institutions are increasingly choosing it for pilots and real-world tests—including the kind of bank trials that can shape the next era of digital payments.

Everything Else

The Department of Homeland Security is probing whether Bitmain's mining machines pose a national-security risk, though experts say secretly controlling them would be nearly impossible without being noticed.

Tether's massive 116-ton gold stash now rivals the reserves of entire countries, and analysts say its aggressive buying may be helping push the gold market higher.

Spain's Sumar party wants to hike crypto taxes to 47% and label digital assets as seizable property, sparking criticism from experts who say the plan misunderstands how decentralized assets actually work.

South Africa's central bank flagged crypto and stablecoins as rising financial-stability risks as the country's user base approaches eight million and trading shifts heavily toward USD-pegged assets.

The UK's FCA is testing new crypto transparency templates with top exchanges, signaling that real-world experiments—not theory—will shape the country's 2026 crypto rulebook.

Crypto moves fast, but the real advantage goes to the people who slow down just enough to notice where the next spark is forming. Follow the signals, explore the corners most people skip, and stay curious—because the biggest opportunities almost always show up before anyone is looking for them.

Best Regards,

— Benjamin Vitaris

Crypto Intel