- Crypto Intel

- Posts

- Bitcoin Slips as Policy Fights Heat Up

Bitcoin Slips as Policy Fights Heat Up

Bitcoin is wobbling under macro pressure, banks are pushing back on stablecoins, and ETF investors are quietly heading for the exits.

If you're holding risk right now, this is about knowing what's noise, what's signal, and where the real pressure points are forming.

This week isn't about chasing upside—it's about protecting position and spotting where the market may be setting a trap or a floor.

New Seven (Sponsored)

If you own ZERO of the Next Magnificent Seven stocks.

Original Mag Seven turned $7,000 into $1.18 million.

But these seven AI stocks could do it in 6 years (not 20).

Now, the man who called Nvidia in 2005 is revealing details on all seven for FREE.

Find Out More Now Before It's Too Late.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Three forces are steering crypto right now.

Bitcoin sentiment is turning cautious, US banks are lobbying hard to shape stablecoin rules, and ETF outflows are testing whether institutions are done selling—or nearly finished.

Together, they matter because they shape how capital moves next. If you understand these shifts, you're not reacting—you're positioning.

Markets

Bitcoin Bearish Sentiment Builds as BTC Slips Below $89,000

Bitcoin slid under $89,000 as bearish sentiment accelerated, with prediction markets rapidly repricing downside risk.

Odds of a drop to $69,000 have climbed to 30%, up from just 11.6% a week ago.

The price weakness followed a sharp rejection near $90,000, reinforcing the sense that upside momentum has stalled.

Bitcoin is down 6.7% on the week after failing to hold January's $97,000 high.

Macro Volatility Is Doing the Damage

The sell-off was triggered by renewed macro stress after President Donald Trump floated tariffs on Europe and territorial claims over Greenland.

That shock liquidated roughly $865 million in leveraged positions in just 24 hours.

A brief pause in those plans sparked a fast bounce back toward $90,000, but it failed to stick.

In total, nearly $2 billion in positions were wiped out during the whipsaw, highlighting how macro-sensitive Bitcoin has become in 2026.

Defensive Capital, Thin Conviction

Derivatives data shows open interest stuck between 240,000 and 265,000 BTC for over ten days, signaling a lack of fresh capital.

Large players appear hesitant to deploy risk at current levels, keeping price action choppy.

Gold has absorbed much of the safe-haven demand, pulling attention away from Bitcoin. Even strong altcoins have struggled, reinforcing how unforgiving this tape has become.

Take: This looks like risk repricing, not panic.

For you, it means Bitcoin is sidelined until macro pressure eases or large players step back in—sentiment can flip fast, but conviction is clearly thin right now.

Stablecoins & Policy

US Bank Lobby Targets Stablecoin Yields as Top 2026 Priority

The American Bankers Association has made blocking stablecoin yields its top priority for 2026.

The group argues that interest-paying stablecoins could drain deposits from traditional banks and weaken lending.

The ABA wants lawmakers to ensure that payment stablecoins cannot offer yield, rewards, or indirect incentives.

Stablecoin oversight now tops the lobby's policy agenda as Congress debates crypto market structure.

Banks Fear a Deposit Drain

Bank executives warn that trillions could move out of the banking system if stablecoin yields are allowed. Bank of America's CEO previously estimated that as much as $6 trillion could be at risk.

Although the GENIUS Act already bans stablecoin issuers from paying yield, banks say loopholes remain. They are pushing for tighter rules to block third-party yield structures entirely.

Crypto Pushback Is Growing

Crypto leaders strongly disagree with the banking lobby's stance.

Circle CEO Jeremy Allaire called fears of bank runs "totally absurd," arguing that yields improve adoption and user stickiness.

Anthony Scaramucci added that banning yield could put the US dollar at a disadvantage against China's digital yuan.

The debate is now shaping up as a direct fight between legacy finance and crypto-native infrastructure.

Take: This fight isn't about safety—it's about control.

For you, stablecoin rules are becoming a major policy risk and opportunity, because whatever Congress decides will shape how dollars actually move on-chain.

Trivia: Which crypto-related item sold for millions despite being digital? |

Early Window (Sponsored)

Every market cycle produces a select group of companies that drastically outperform the rest.

The latest screening has pinpointed the 5 Stocks Set to Double, each showing rare traits linked to early stage momentum.

These names carry the same type of indicators that have historically appeared ahead of strong rallies.

Earlier reports featured stocks that delivered +175%, +498%, and +673%.

Get the Free 5 Stocks Set to Double Report.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

ETFs

US Bitcoin ETF Outflows Hit Highest Level Since November

US spot Bitcoin ETFs recorded $1.22 billion in weekly outflows, the largest since November. The withdrawals came as Bitcoin slipped roughly 5% over the same period.

Tuesday and Wednesday alone accounted for nearly $1.2 billion in redemptions. Despite the selling, Bitcoin remains roughly flat year-to-date.

A Pattern That Rhymes

Historically, heavy ETF outflows have coincided with local price bottoms. Similar spikes in November, March 2025, and August 2024 all preceded meaningful rebounds.

In November, Bitcoin bottomed near $80,000 before recovering above $90,000. Earlier cycles show the same pattern during macro-driven stress events.

Cost Basis Matters Here

The average cost basis for ETF investors currently sits at $84,099. Glassnode data shows this level has repeatedly acted as strong support during previous pullbacks.

As long as the price holds above that zone, forced selling pressure may remain limited. That creates a clear line in the sand for institutional positioning.

Take: ETF outflows don't automatically mean more downside.

For you, this kind of selling has often marked exhaustion rather than capitulation—especially when price stays above institutional cost bases.

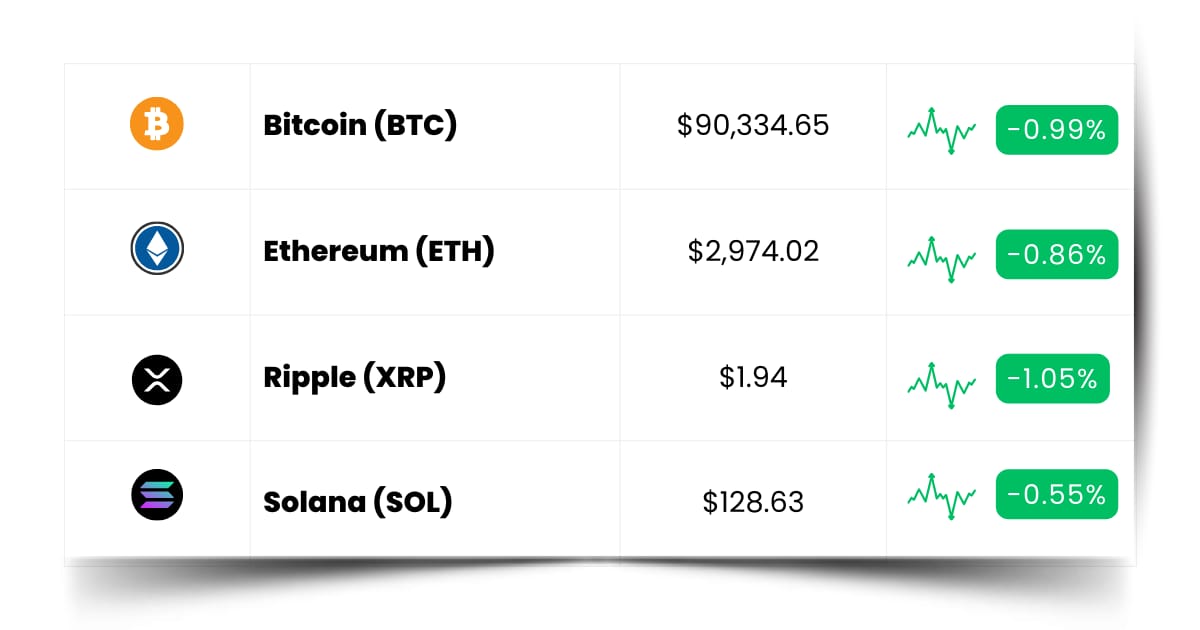

Coin Leaderboard

Crypto Pulse

Bitcoin is stuck digesting macro shocks, ETF flows are draining patience, and policy fights are tightening the edges—but fast money didn't stop moving.

It just ducked the headlines and chased velocity.

KO, ACU, and RIF are ripping because momentum doesn't need certainty right now, only a clean path and a reason to move.

This is a tape where hesitation weighs down the majors and speed gets rewarded elsewhere.

Kyuzo's Friends (KO) $0.1199 (+94.33%)

KO was already trending higher over the past month, but momentum went vertical in the last 24 hours with a 94.33% surge as short-term traders piled in.

Acurast (ACU) $0.2561 (+125.98%)

ACU returns to the Crypto Pulse leaderboard for a second straight appearance, posting a fresh 125.98% gain as momentum stayed firmly in control.

Rifampicin (RIF) $0.01168 (+68.57%)

RIF jumped 68.57% in the past 24 hours, cutting through heavy volatility as fast money chased the move.

Who Controls (Sponsored)

The world is rapidly shifting to cashless systems, with countries like China leading the way.

As the U.S. rolls out FEDNOW, it’s clear that convenience could come at a steep price—your freedom.

With digital currencies, those who control the ledger control your ability to speak, transact, and live freely.

Stay informed and safeguard your future.

Download our guide on CBDCs and protect your wealth.

CLICK HERE TO GET YOUR GUIDE NOW

Future Forward

The real edge in crypto usually shows up off the charts.

It forms where builders demo unfinished products, early users stress-test ideas, and momentum starts before anyone is arguing about price targets.

Airdrops reward curiosity more than capital.

Clicking around early, using products, and paying attention before the hype cycle spins up often matters more than trying to time a perfect entry later.

Token launches are reality checks in motion.

Some ideas catch instantly, others stall out fast—but both reveal what the market is actually willing to back with attention and liquidity.

Conferences are where narratives get road-tested before they trend. If you want to understand what might matter next, this is where the signals usually surface first.

Crypto Conferences:

💎 Fintech Retreat 2026 (Jan 25, 2026)

💎 DeFi Retreat North America 2026 (Jan 25, 2026)

💎 GDX Summit 2026 (Jan 26, 2026)

Upcoming Airdrops:

🎁 Rainbow (RNBW) Airdrop (Jan 26, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

🎁 SoSoValue (SOSO) Airdrop (Apr 2026)

Upcoming Token Launches:

🚀 Somate (SOMT) IDO on Spores (Jan 26, 2026)

🚀 AntDrop (ANT) IDO on KingdomStarter (Feb 2, 2026)

🚀 Magicblock (BLOCK) Presale (Feb 5, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Ledger?

Ledger is a company that makes hardware wallets, which are physical devices used to store crypto securely offline.

Instead of keeping your private keys on a phone or computer, Ledger keeps them separated from the internet.

That matters because most hacks don't break blockchains—they compromise devices.

A hardware wallet reduces that risk by making it much harder for attackers to access your keys remotely.

Ledger devices let you send, receive, and manage crypto while keeping control in your hands. Even if your computer is compromised, transactions still need physical approval on the device.

For you, Ledger is about ownership, not convenience.

It's a reminder that in crypto, security improves when you rely less on platforms and more on tools designed to protect you directly.

Everything Else

Ledger is reportedly preparing a New York IPO that could value the hardware wallet maker at over $4 billion, signaling renewed Wall Street appetite for crypto infrastructure as security risks—and revenues—keep rising.

Ethereum mainnet activity has surged past several Layer-2s after lower fees revived usage, but analysts warn that a large share of the spike is driven by address poisoning attacks rather than real user growth.

Kansas lawmakers have proposed a state-run Bitcoin and digital assets reserve fund that would hold abandoned crypto and route staking rewards into public coffers, raising new questions around custody, transparency, and governance.

PwC says crypto adoption is accelerating unevenly across regions, with institutions now embedding digital assets into core systems even as usage and impact vary widely by local economic conditions.

Binance has applied for a MiCA license in Greece as part of its push to rebuild credibility in regulated markets, marking another step in its post-settlement strategy to reestablish a strong European presence.

Crypto isn't asking you to predict the future—it's asking you to notice what's quietly changing.

When you track where builders are shipping, regulators are tightening, and capital is hesitating or committing, you stop reacting late and start moving with intent.

Best Regards,

— Benjamin Vitaris

Crypto Intel