- Crypto Intel

- Posts

- Bitcoin Tests Nerves, Corporates Go All-In, NFTs Get Reality-Checked

Bitcoin Tests Nerves, Corporates Go All-In, NFTs Get Reality-Checked

Crypto is at one of those hinge points—where price tests conviction, institutions quietly take bigger swings, and speculative froth gets flushed out hard.

If you're trying to decide whether to get defensive or get ready, this week's moves are your early signal on where strength is forming and where it's fading.

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Markets are holding their breath as Bitcoin sits on a major support line and macro winds tilt risk-on again, thanks to easing US-China tensions.

At the same time, Bitcoin-heavy corporates are showing they're not scared of volatility, while NFTs just reminded everyone what happens when hype outruns conviction.

If you want to stay positioned instead of reactionary, these shifts point to where smart money is quietly planting seeds—because in crypto, bottoms and breakouts don't send calendar invites.

Markets

🇨🇳 Bitcoin Tests Key Support as China Suspends Tariffs on US Goods

Bitcoin is sitting right on its 50-week simple moving average, a level that has repeatedly acted as the springboard for every major leg higher since 2023.

At the same time, the US and China just dialed down trade tensions, removing a major global risk overhang.

Risk Sentiment Improves as Trade Tensions Cool

China suspended its additional 24% tariffs on US agricultural products for a year, following high-level talks between President Trump and President Xi.

That move helps clear uncertainty hanging over global markets and encourages risk-taking across assets like Bitcoin.

Beijing also halted retaliatory tariffs on US soybeans, corn, wheat, sorghum, and chicken.

Combine that with Washington easing fentanyl-related levies, and you get a rare diplomatic tailwind for markets.

Bitcoin Faces Technical and Narrative Test

Bitcoin's long-term trendline support sits around $102,900, and traders are watching whether bulls can defend it for the fourth time.

The chart says "bounce zone," but the mood is cautious after repeated rejections above $113,000.

A curveball hit sentiment when Sequans Communications sold Bitcoin to retire debt, breaking the recent trend of corporate accumulation.

That move challenges the idea that every public company holding Bitcoin is in pure "buy and never sell" mode.

Take: Bitcoin is hovering at the edge of a cliff that has historically turned into a launchpad.

If you're long-term, this kind of macro relief mixed with technical support is usually where you lean in—not panic out—but stay patient until price confirms the bounce because markets love to test conviction before rewarding it.

Institutional Demand

Metaplanet Taps $100M Bitcoin-Backed Loan to Buy More BTC and Buy Back Shares

Metaplanet just pulled a page from Michael Saylor's playbook—borrowing against Bitcoin to buy more Bitcoin and its own stock.

The Tokyo-listed treasury giant secured a $100M BTC-backed loan to keep accumulating and support its share price.

Major BTC Collateral and Flexible Terms

The company holds 30,823 BTC—about $3.5B—giving it a deep collateral cushion even if Bitcoin dips.

The loan can be repaid anytime and carries a standard US benchmark rate plus a spread, meaning it's structured for safety, not max leverage.

Proceeds may fund fresh Bitcoin buys, share repurchases, and options-based yield strategies.

This flexibility lets Metaplanet defend its stock during volatility while continuing to stack BTC.

Aggressive Expansion Despite Market Swings

Metaplanet recently announced a $500M BTC-backed buyback plan after its market-based NAV briefly fell below 1.0.

Management paused accumulation during the drawdown, but the target remains bold—210,000 BTC by 2027.

Meanwhile, S&P slapped Michael Saylor's Strategy with a "B-" rating, citing concentration risk and liquidity constraints.

Analysts warn that some public BTC holding firms saw their NAVs collapse, ending the first wave of corporate BTC hype cycles.

Take: Metaplanet is betting that volatility is noise and Bitcoin is destiny, and it's acting with conviction that most traders only tweet about.

If you're bullish long-term, companies doubling down like this are your signal—but remember that leverage works both ways, so size your own bets with discipline, not hero energy.

Poll: How do you store most of your crypto? |

Limited-Time Offer (Sponsored)

Some price patterns only appear before major moves — and analysts say five companies are flashing them right now.

These stocks have rising revenue, strong balance sheets, and technical setups that could send them soaring.

Past reports featuring similar indicators uncovered triple-digit winners within months.

This new list highlights the next potential wave of high-momentum stocks — and it’s free to access for a limited time.

[Access the 5 Stocks Report – Free for a Short Time]

NFTs

NFT Market Value Drops 46% in 30 Days as Liquidity Turns Fragile

NFTs just suffered one of their sharpest resets yet, with market cap nearly halved in a month.

Even strong October trading volume couldn't stop valuations from cratering across both blue-chip and new-generation collections.

Volumes Rise While Prices Sink

Global NFT market cap fell from $6.6B to $3.5B despite a 13% jump in sales volume.

Bitcoin and Base NFTs bucked the trend with 9% and 24% gains, but Ethereum, Solana, and Immutable saw deep corrections.

Polygon and BNB Chain suffered the worst, with market values collapsing over 80%.

When liquidity tightens in crypto, NFTs usually get hit first—and hardest.

Blue-Chips Aren't Immune

CryptoPunks floor prices dropped from $214K to $117K, a 45% haircut in a month.

BAYC and Pudgy Penguins saw rising trading volume but still tanked in price, a sign that traders are flipping instead of accumulating.

Moonbirds volumes sank 63% alongside a floor collapse from $14.7K to $6.5K.

Buyers are showing up—but they're hunting exits, not diamond-hands bragging rights.

NFT Platforms Evolve Past JPEG Meta

OpenSea is pivoting toward a universal on-chain trading hub.

Meanwhile, Animoca is heading toward Nasdaq, positioning itself as a Web3 gaming and metaverse gatekeeper even while NFT markets bleed.

Take: This is the kind of capitulation that usually separates hype traders from true builders, and historically, bottoms form when people stop calling bottoms.

If you're long-term, don't chase the dip blindly—focus on ecosystems with real users and creators, not just vibes and Discord nostalgia.

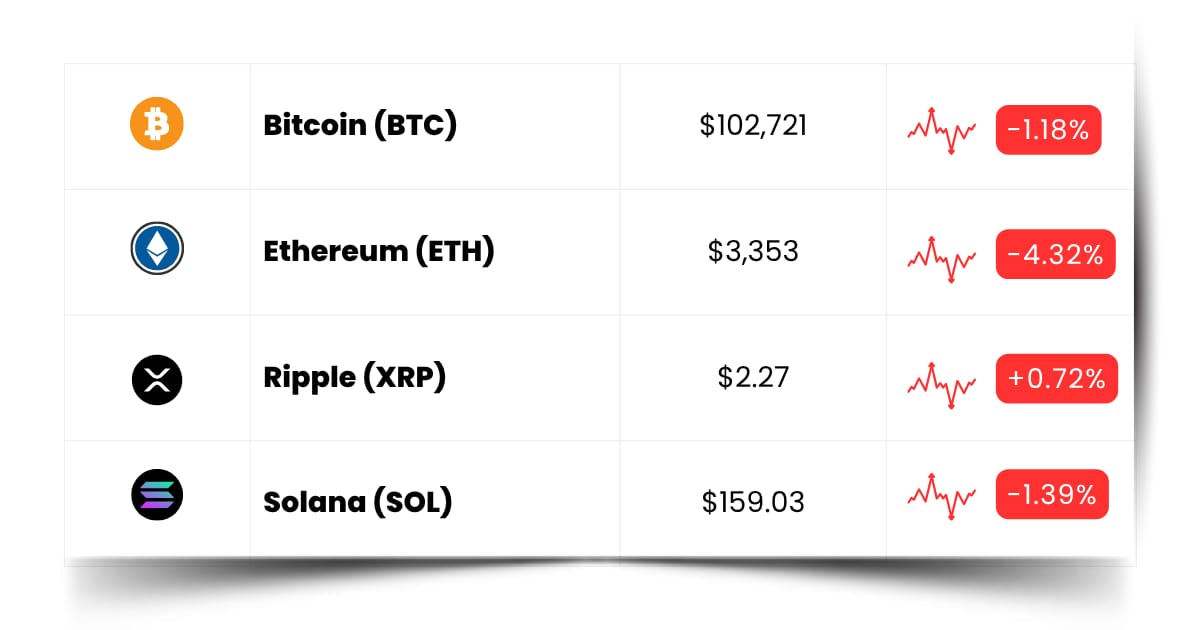

Coin Leaderboard

Crypto Pulse

Macro headlines are all about Bitcoin fighting to hold a key support, corporates borrowing against BTC to stack even more, and NFTs getting a harsh reality check—basically, conviction is getting tested across every corner of the market.

But while the big caps breathe, the tiny tickers are doing backflips again, because early-stage crypto never sleeps just because Bitcoin takes a breather.

Today's movers—GIGGLE flying after a Binance nod, CUDIS ripping through volatility, and ZK pumping on revenue-share tokenomics—prove something simple: even in a "wait-and-see" market, momentum never fully disappears, it just hides in the weirdest places.

If you're paying attention only to Bitcoin's moving averages, you're going to miss the plays sneaking in through the side door.

Giggle Fund (GIGGLE) $164.82 (+112.64%)

GIGGLE ripped 112.64% after Binance said it would support transaction-fee donations for the token, sparking a burst of community hype and fresh volume.

CUDIS (CUDIS) $0.05224 (+46.41%)

CUDIS climbed 46.41% in a volatile session, showing traders are still willing to chase sharp rotations when momentum catches fire.

ZKsync (ZK) $0.07467 (+44.35%)

ZK popped 44.35% after the Layer-2 network floated a revamped tokenomics plan tying value capture directly to network revenue.

Limited-Time Access (Sponsored)

Markets move fast — and these 7 stocks could be next in line for significant short-term momentum.

They’ve been identified by a performance-based ranking system with a proven record of finding early movers.

But once attention hits, the best entry points are often gone.

Take a moment to check which stocks made this month’s elite list before the next round of moves begins.

Access the 7 Best Stocks Report — Free for a Limited Time

Future Forward

The biggest wins right now aren't coming from chasing candles—they're brewing in Discord threads, buried GitHub commits, closed beta forms, and those "we're testing with a few users" tweets most people ignore.

By the time the hype hits TikTok and Twitter starts calling it "obvious," the door will already be halfway closed.

Private testnets, sneaky airdrop earners, and early-whitelist hunters are quietly stacking runway while everyone else argues macro on social media.

If you're waiting for a YouTuber thumbnail before taking action, you're playing the game on beginner mode while others speedrun the hidden levels.

Crypto Conferences:

💎 22nd NextGen Payments and RegTech Forum (Nov 6, 2025)

💎 Fintech Revolution Abu Dhabi 2025 (Nov 6, 2025)

💎 Bluechip25 Summit (Nov 6, 2025)

Upcoming Airdrops:

🎁 No upcoming airdrops are announced for the next few weeks.

Upcoming Token Launches:

🚀 Friendly Giant AI (GIANTAI) IDO on Spores (Nov 10, 2025)

🚀 Finsteco (FNST) IDO on BinStarter (Nov 11, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is RLUSD?

RLUSD is Ripple's US dollar-backed stablecoin, designed to make moving money on-chain feel as safe and seamless as using a bank wire—but without the waiting or the fees.

Every RLUSD token is backed by dollars and short-term US Treasuries, which helps keep it stable at $1.

Unlike many stablecoins that start from scratch, RLUSD launched into Ripple's global payments network, which means banks, fintechs, and businesses already plugged into Ripple can use it for fast settlement.

That gives RLUSD real utility beyond trading—it's built to move money across borders and between institutions.

Right now, you can find RLUSD on Ethereum and the XRP Ledger, and Ripple says demand is coming from both institutional players and everyday users.

For you, that means RLUSD may become another reliable option for holding stable value, sending payments, or interacting with DeFi apps.

In simple terms, think of RLUSD as a "business-grade" stablecoin with real banking-style backing and a global payments engine behind it.

It's still early, but if crypto payments are going mainstream, you'll probably hear a lot more about this one.

Everything Else

Hong Kong charged 16 people over the $205.8M JPEX scandal and sought three more via Interpol, signaling tougher enforcement that should make you extra cautious about unlicensed platforms and influencer-driven pitches.

France advanced a 1% annual "unproductive wealth" tax on large crypto holdings, a move critics say punishes builders and could push talent abroad—if you're France-based or raising there, factor this into your tax and domicile plans.

Canada's 2025 budget will introduce stablecoin laws requiring full reserves, redemptions, and risk controls, which could make on-chain payments safer for you as banks, fintechs, and remitters plug into clearer rules.

Ripple's RLUSD surpassed a $1B market cap less than a year post-launch as M&A expands its payments stack, hinting that you'll see more institutional settlement rails across Ethereum and the XRP Ledger.

Monero rallied while the market sold off as the 2026 privacy-regulation narrative strengthened, reminding you that niche "pockets of strength" can outperform when macro gets choppy.

Crypto rarely hands out invitations—it rewards people who poke around, explore, and follow curiosity even when the charts look sleepy.

The next breakout wave usually starts in silence, not in headlines, so stay curious, stay building your edge, and treat every quiet moment as a setup, not a slowdown.

Best Regards,

— Benjamin Vitaris

Crypto Intel