- Crypto Intel

- Posts

- Crypto’s Split Personality Is Back, So Make Sure You're on the Correct Side

Crypto’s Split Personality Is Back, So Make Sure You're on the Correct Side

Bitcoin just reminded you it still trades like a global macro asset, not a bubble in isolation.

Institutions quietly stepped back in through ETFs, while Ethereum kept processing record activity without breaking a sweat.

This week is about where risk shows up, where capital is actually moving, and what still works when headlines get loud.

Must-Own Picks (Sponsored)

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

See His Breakdown of the Seven Stocks You Should Own Here.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Three forces are shaping crypto right now.

Bitcoin reacted first to trade war fears, ETFs absorbed billions from institutional buyers, and Ethereum proved it can scale real usage without choking fees.

Together, they show how the market is maturing beneath the volatility—and where positioning matters more than panic.

Markets

Bitcoin Slips on Trade War Fears, Triggers $865M in Liquidations

Bitcoin slid sharply during the early Asian session, falling from $95,385 to around $92,415 and wiping out over $865 million in leveraged positions.

Nearly 90% of those liquidations came from bullish traders who expected last week's momentum to continue.

The timing mattered. US stock and bond markets were closed for a public holiday, leaving crypto to absorb global risk jitters without its usual macro anchors.

Macro, Not Crypto, Drove the Move

Analysts say the drop had little to do with crypto-specific fundamentals. Instead, markets reacted to renewed US–EU trade tensions and tariff threats surfacing ahead of the World Economic Forum in Davos.

President Donald Trump's comments on punitive tariffs against EU allies injected uncertainty across global markets. Bitcoin simply moved first because it trades nonstop.

Leverage Gets Flushed

The sell-off quickly cleared excess leverage that had built up during last week's rally. That kind of reset often looks violent but can reduce fragility in the short term.

Altcoins followed Bitcoin lower, dragging the total crypto market value down nearly 3%. More than $110 billion in market cap evaporated in a few days.

Take: This move looks like a macro-driven shakeout, not a breakdown in Bitcoin's structure.

For you, it's a reminder that leverage amplifies headlines, but pullbacks driven by global risk shifts often reset the market rather than end the cycle.

ETFs

Bitcoin and Ether ETFs Log Their Best Week Since October

US-listed spot Bitcoin and Ether ETFs just posted their strongest inflows in three months. Together, they pulled in several billion dollars as institutional demand quietly returned.

Bitcoin ETFs led with $1.42 billion in net inflows, while Ether ETFs attracted $479 million. BlackRock's IBIT and ETHA dominated both flows.

Sticky Capital Is Back

Analysts say these inflows reflect longer-term positioning, not short-term arbitrage. The popular cash-and-carry trade has faded as yields compressed.

That shift matters because it changes market behavior. Institutions buying to hold affect the structure differently than traders chasing basis spreads.

Price Action Follows Flows

Bitcoin is up roughly 6% this month, while Ether has gained close to 8%. The correlation suggests ETFs are now actively shaping price rather than reacting to it.

That contrasts with late 2025, when ETF demand failed to lift prices meaningfully. The tone feels different this time.

Positioning Ahead of Q1

Market analysts say institutions are positioning ahead of potential regulatory clarity and macro shifts expected early this year. That forward-looking behavior tends to be steadier and less emotional.

Sustained inflows will matter more than one strong week. Momentum needs reinforcement.

Take: This ETF surge signals institutions stepping back in with intention, not urgency.

For you, steady inflows like these usually support gradual upside and lower volatility, even if they don't deliver explosive moves overnight.

Trivia: What does “gas” measure on Ethereum? |

Slow Erosion (Sponsored)

They mocked your values and expected everyday Americans to stay financially exposed.

Now the dollar faces pressure, global conflicts threaten stability, and inflation quietly eats away at savings.

Doing nothing is exactly what powerful interests are counting on as uncertainty grows.

This Patriot’s Tax Shield explains how real, physical gold can help defend wealth during political and economic disruption.

A free Wealth Protection Guide reveals how Trump’s agenda could impact gold and why timing matters now.

Click here to get the FREE Wealth Protection Guide now.

Blockchain Activity

Ethereum Transactions Hit Record as Exit Queue Drops to Zero

Ethereum just processed more transactions than at any point in its history, pushing daily activity near 2.9 million. The surge caps a sharp rebound in on-chain usage heading into early 2026.

What stands out is what did not happen. Fees stayed near recent lows despite the jump in demand.

Scaling Is Doing Its Job

Recent upgrades and growing layer-2 usage helped Ethereum absorb higher activity smoothly. The network handled the load without congestion or fee spikes.

That marks a shift from past cycles, where rising usage often meant rising costs. Efficiency is improving.

Staking Stays Balanced

Ethereum's validator exit queue has dropped to zero, while entry queues remain long. That suggests stakers are neither rushing in nor heading for the exits.

Staking looks stable rather than speculative. The network is humming, not overheating.

Narratives Are Changing

The old idea that higher fees automatically make ETH scarcer is losing weight. Smooth performance is becoming a stronger signal.

Usage, not stress, is telling the story.

Take: Ethereum's record activity with low fees shows a network maturing under real demand.

For you, that supports ETH's long-term utility case, even if it cools some of the reflexive scarcity narratives traders once relied on.

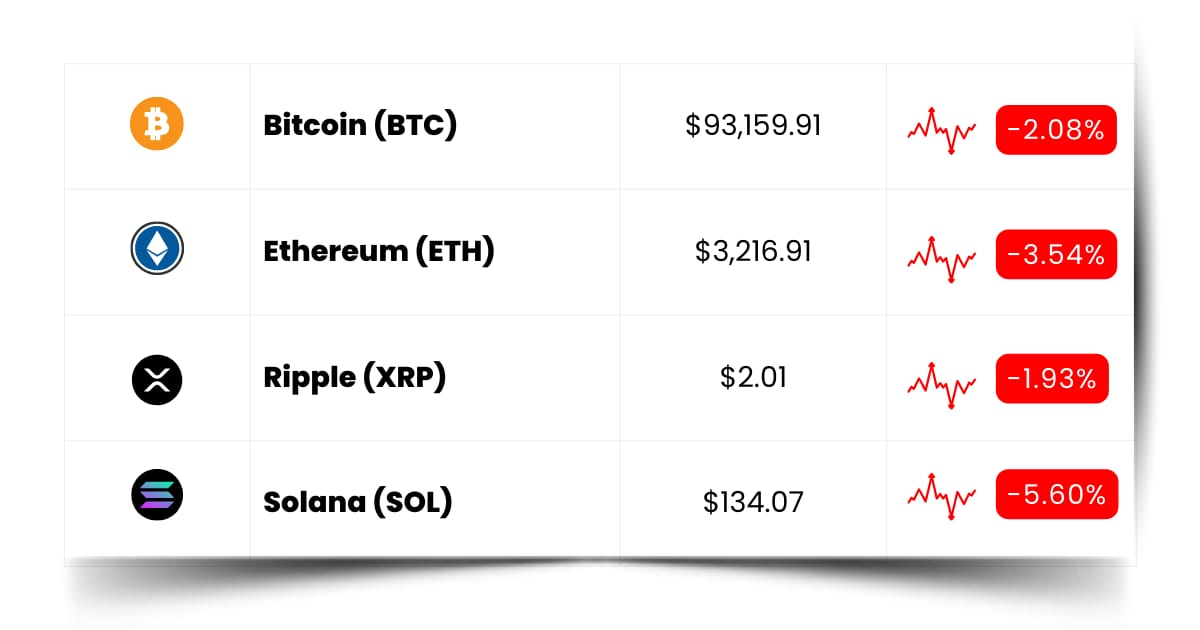

Coin Leaderboard

Crypto Pulse

Bitcoin just flushed leverage on macro headlines, institutions are quietly putting capital back to work through ETFs, and Ethereum is processing record activity without blinking.

That backdrop is pushing fast money into a very different corner of the market.

DOGE, DUSK, and ARPA are ripping because traders are hunting speed, rotation, and narrative edges while the bigger forces reset positioning underneath.

This is a tape where the long game is being rebuilt—and the short game is moving fast.

Department of Government Efficiency (DOGE) $0.01382 (+78.08%)

DOGE topped today's Crypto Pulse leaderboard, ripping 78.08% in the last 24 hours as momentum traders piled into the move.

Dusk (DUSK) $0.2435 (+41.67%)

DUSK jumped 41.67%, riding the broader strength in privacy-focused tokens even as the wider market stayed under pressure.

ARPA (ARPA) $0.02090 (+59.12%)

After weeks of tight, sideways trading, ARPA broke out with a 59.12% surge, catching traders' attention as volatility returned.

Backdrop Shifting (Sponsored)

Liquidity is rising as the Fed shifts toward easier monetary policy.

Institutional capital continues flowing into crypto at record levels, while a pro-crypto administration accelerates favorable regulation.

Mid-term elections historically reward market-friendly policies—and after months of consolidation, conditions are aligning for a powerful move.

Nothing in crypto is ever guaranteed.

But this is one of the strongest setups seen in years—while prices remain relatively low.

Crypto Revolution reveals a disciplined system for building crypto wealth without gambling, sleepless nights, or chasing every price swing.

Get instant access to the book plus $788 in bonuses now.

© 2026 Boardwalk Flock LLC. All Rights Reserved.

2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

*The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

*Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Future Forward

The real opportunities in crypto usually show up before the charts react. They surface where builders gather, early users experiment, and new ideas get stress-tested in public.

Airdrops reward curiosity more than capital. Paying attention early, testing products, and showing up when things feel unfinished often matters more than catching a perfect entry later.

Token launches are where narratives face reality. Some projects earn traction fast, others stall, but either way, you learn quickly what actually resonates.

Conferences are where tomorrow's themes get traded quietly before they hit timelines and headlines. If you want early context instead of late confirmation, this is where it tends to form.

Crypto Conferences:

💎 Bitcoin Educators Academy ROATAN (Jan 20, 2026)

💎 WAM Morocco 2026 (Jan 20, 2026)

💎 DevosWeb3 Roundtable 2026 (Jan 21, 2026)

Upcoming Airdrops:

🎁 Seeker (SKR) Airdrop (Jan 21, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

🎁 SoSoValue (SOSO) Airdrop (Apr 2026)

Upcoming Token Launches:

🚀 ChimpX AI (CHIMP) IDO on Eesee (Jan 23, 2026)

🚀 Somate (SOMT) IDO on Spores (Jan 26, 2026)

🚀 AntDrop (ANT) IDO on KingdomStarter (Feb 2, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: What Are CBDCs Used For?

Central Bank Digital Currencies, or CBDCs, are digital versions of a country's existing currency issued by its central bank.

They are designed to work alongside cash and bank money, not replace crypto assets like Bitcoin.

One major use case is faster and cheaper payments. CBDCs can move money instantly between people, businesses, or governments without relying on multiple intermediaries.

Another use case is cross-border trade and settlements. Linked CBDC systems could reduce friction in international payments, especially between countries that trade frequently.

For you, CBDCs matter because they show how governments are modernizing money rails.

Even if you never use one directly, they can reshape how payments, banking, and financial access work around crypto markets.

Everything Else

Paradex rolled back its Starknet-based chain after a database migration error briefly priced Bitcoin at zero, triggering mass liquidations, eight hours of downtime, and renewed concerns about DEX infrastructure risk during upgrades.

Kazakhstan passed new crypto laws giving its central bank control over which coins can trade on licensed exchanges, signaling tighter oversight even as the country positions itself as a regional digital asset hub.

Privacy coins like Monero, Dash, and Dusk rose sharply despite a broader market sell-off, as traders rotated into assets seen as defensive amid rising surveillance, regulation, and geopolitical stress.

India's central bank proposed linking BRICS nations' CBDCs to streamline cross-border trade and reduce dollar reliance, a move that could escalate tensions with the US as trade frictions deepen.

A Polymarket trader reportedly earned $233,000 by exploiting thin weekend liquidity and automated bots in XRP prediction markets, exposing weaknesses in market design and sparking debate over manipulation versus savvy trading.

This week was a reminder that crypto doesn't move in one straight line.

If you track where builders are gathering, institutions are positioning, and real usage is scaling, you stay aligned with momentum before it becomes obvious.

Best Regards,

— Benjamin Vitaris

Crypto Intel