- Crypto Intel

- Posts

- Crypto Slides, Liquidations Spike, and Regulators Shift

Crypto Slides, Liquidations Spike, and Regulators Shift

Crypto didn't just dip this week—it fell straight into extreme-fear territory as liquidity dried up, leverage blew out, and regulators signaled a fundamental shift in how crypto will be policed going into 2026.

If you're trying to understand where the next opportunities—and the real risks—are hiding, this is the breakdown you can't skip.

$6B Team Just Unleashed Cinderella on a $2T Market

Cinderella isn’t looking for her glass slipper— she’s busy smashing the $2T media market to pieces.

Elf Labs spent a decade at the US Patent & Trademark office in a historic effort to lock up 100+ historic trademarks to icons like Cinderella, Snow White, Rapunzel and more — characters that have generated billions for giant studios. Now they’re fusing their IP with patented AI/AR to build a new entertainment category the big players can’t copy.

And the numbers prove it’s working.

In just 12 months they raised $8M, closed a nationwide T-Mobile–supported telecom deal, launched patented interactive content, and landed a 200M-TV distribution partnership.

This isn’t a startup. It’s a takeover. And investors are sprinting to get in.

Lock in your ownership now

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

This week handed you a perfect snapshot of how fast crypto can flip when liquidity shrinks and sentiment collapses.

Bitcoin's slide toward $80K, nearly $2 billion in liquidations, and a dramatic pullback in SEC enforcement all reshaped the landscape in ways that directly affect your positioning for the next move.

Top Picks (Sponsored)

Many investors are seeing solid gains in today’s market, but solid gains often hide opportunities with far greater potential.

A new analysis highlights the 5 Stocks Set to Double, selected from thousands of companies showing early signs of powerful growth.

These picks feature strong fundamentals and technical indicators that often appear before meaningful upside.

Past editions of this research uncovered gains of +175%, +498%, and +673%.

Download the 5 Stocks Set to Double. Free Today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Markets

Liquidity Thins Out as Bitcoin and Ether Get Dragged Into a Sharp Market Reset

Crypto markets tumbled toward April lows as liquidity vanished from order books, turning every sell order into a sharper move.

Bitcoin and Ether dropped more than 10% in 24 hours, with altcoins sinking as much as 20%.

Liquidity Vanishes as Order Books Hollow Out

Market depth never recovered from October's liquidation wave, leaving exchanges thin and highly sensitive to selling pressure.

Analysts say this hollow liquidity is why price swings are hitting harder than they should.

Sentiment also cratered, with the Fear & Greed Index hitting 11/100 for the first time since mid-2023.

INJ, NEAR, ETHFI, APT, and SUI all plunged between 16% and 18% as traders pulled bids and waited for stability.

Derivatives Hit Maximum Stress

Volatility spiked fast, with Bitcoin's BVIV jumping to 64% and Ether's index hitting 87%, its highest since April.

Options desks leaned heavily toward puts as traders rushed for downside protection.

Open interest collapsed across multiple assets, with Bitcoin's OI dropping from 752K BTC to 700K BTC in a single day.

Some traders even grabbed deep-out-of-the-money puts on BlackRock's IBIT at the $15 strike.

Take: Liquidity shocks feel awful in the moment, but they often mark the late stage of a sell-off.

If you're watching for long-term entries, these extreme fear pockets tend to be where the strongest reversals begin—just don't rush in like you're catching a falling knife without a plan.

Act Fast (Sponsored)

I'd like to give you a free copy of our brand-new report: 7 Best Stocks for the Next 30 Days.

Our objective, mathematical stock prediction system has consistently outperformed the market — delivering strong returns over decades.

This just-released Special Report reveals the 7 most explosive stocks from our top-ranked selections.

Fewer than 5% of stocks qualify to be one of our “7 Best.”

These could be the most exciting short-term trades in your portfolio.

Don’t wait — see these picks before your next trade.

Download it now, absolutely free.

[Click Here for the Free Report]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Markets

$1.7B in Liquidations Hit as Bitcoin Slides Toward the $80K Danger Zone

Bitcoin plunged below $85,000 as nearly $2 billion in leveraged positions were wiped out across the market.

The drop pushed BTC back to levels last seen before the ETF boom, erasing its year-to-date gains.

Leverage Gets Obliterated

BTC briefly fell to $81,600 before bouncing toward $84,000 as forced liquidations cascaded through futures markets.

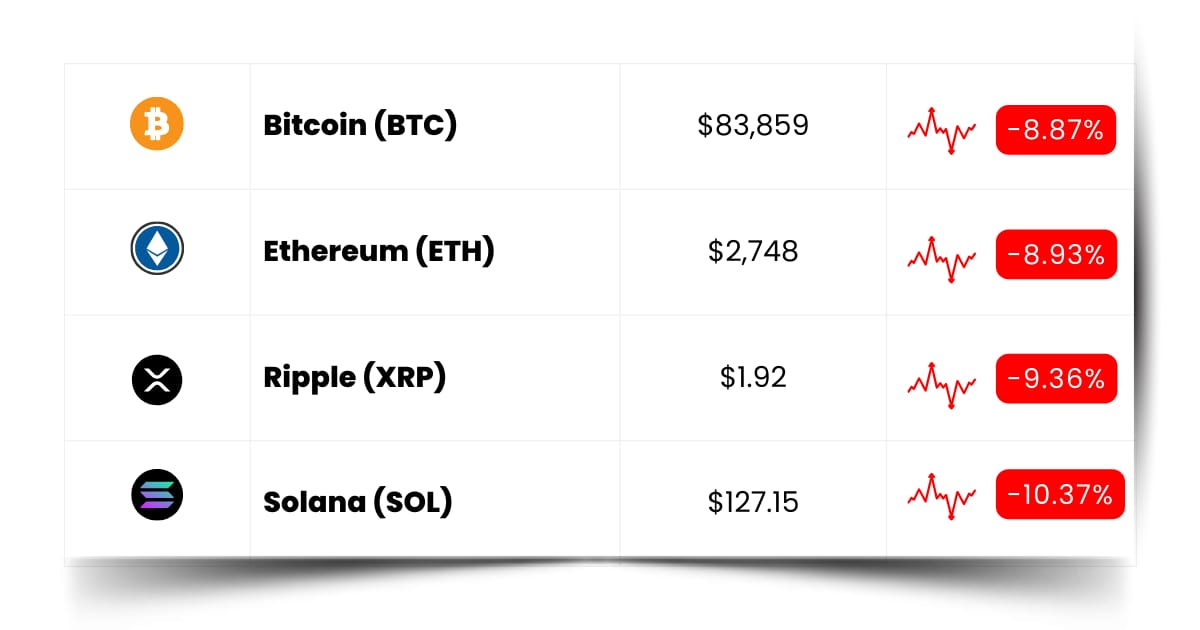

Ether, Solana, XRP, BNB, and Cardano fell 8%–15%, with majors retracing up to 35% from November highs.

CoinGlass data showed $964 million in Bitcoin liquidations and $407 million in Ether unwinds in 24 hours.

The largest single liquidation was a $36.7 million BTC position on Hyperliquid.

Macro Pressure Adds Fuel

Global equities posted their worst week in seven months, adding another layer of fear to an already fragile crypto market.

Treasuries rallied, signaling a broad shift away from risk assets.

US Bitcoin ETFs logged more than $900 million in outflows on Thursday, their second-worst day ever.

Perpetual futures open interest has dropped 35% since October, draining liquidity from every move.

Take: Extreme-fear levels like this don't tell you when a bottom is in, but they often tell you the worst panic is already underway.

If you're staying active here, focusing on smaller position sizes and slower entries can help you ride the next recovery instead of getting caught inside the liquidation engine.

Poll: If crypto became your primary savings tool, what would you choose? |

Policy

SEC Takes a Softer Touch Under Atkins as Enforcement Activity Falls Sharply

SEC enforcement actions fell nearly 30% in fiscal year 2025 under Chair Paul Atkins, marking a sharp shift from the Gensler era.

Public-company cases dropped alongside crypto-related actions, reflecting a broader realignment of priorities.

A Softer Stance, but Not a Free Pass

Cornerstone Research noted that the drop is consistent with previous leadership transitions at the SEC.

Several investigations into crypto firms were quietly abandoned, including the high-profile case against Coinbase.

The SEC's new examination priorities for 2026 didn't explicitly mention cryptocurrencies, signaling a less aggressive tone.

Staff shortages from the 43-day government shutdown also played a role in slowing enforcement activity.

Regulation Is Still on the Table

Republican Senate leaders expect a full digital-asset market-structure bill to advance by early 2026.

The proposal could shift more authority to the CFTC, especially for commodity-like crypto assets.

Atkins emphasized that the SEC won't be "lax" and aims to build a clearer regulatory foundation rather than rely on heavy enforcement.

The shift marks a move toward rules-first oversight rather than regulation-by-litigation.

Take: A lighter enforcement footprint doesn't mean crypto has a free runway—it just means the rules are finally being rewritten instead of fought in court.

If you're navigating this market, clearer guardrails could make 2026 far smoother than the regulatory chaos of the last few years.

Coin Leaderboard

Crypto Pulse

Even with the market throwing a full-blown liquidity tantrum, some small caps decided they weren't interested in joining the panic.

ELF blasted 83%, U launched over 52%, and PIEVERSE rode its new listings straight into a 43% jump—proving that even in the messiest weeks, momentum finds a way to break through the noise.

aelf (ELF) $0.06535 (+83.56%)

ELF tore through the volatility and ripped 83.56% higher, claiming the top spot on today's Crypto Pulse leaderboard.

Union (U) $0.006066 (+52.29%)

U completely ignored the market gloom and launched 52.29% upward in one of the cleanest reversals of the day.

Pieverse (PIEVERSE) $0.3748 (+43.34%)

PIEVERSE popped 43.34% after fresh listings on Binance and Bitget sent a wave of new liquidity its way.

Future Forward

The next wave of winners won't come from the loudest accounts on X—they're being built quietly in half-broken testnets, tiny Discord channels, and GitHub repos that feel more like digital garages than startups.

You usually spot them only if you're willing to wander into the weird corners everyone else scrolls past.

These builders aren't trying to farm likes or craft the perfect hype cycle—they're fixing the problems no one else notices until suddenly everyone is talking about them.

By the time the spotlight finally hits, the early explorers have already moved on to the next odd idea that looks ridiculous until it isn't.

Crypto Conferences:

💎 Crypto Horizons 2025 (Nov 22, 2025)

💎 DEXT FORCE Festival 2025 (Nov 22, 2025)

💎 Australian Crypto Convention 2025 (Nov 22, 2025)

Upcoming Airdrops:

🎁 Mina Protocol (MINA) Airdrop (Nov 22, 2025)

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

Upcoming Token Launches:

🚀 Blink Galaxy (BG) TGE and Distribution (Dec 1, 2025)

🚀 EarnPark (PARK) Token Sale Tier 4 (Dec 3, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Base?

Base is a fast, low-cost blockchain built on top of Ethereum, designed to make crypto apps feel as smooth as the regular apps you use every day.

It's developed by Coinbase, which means you can access it easily from the tools you already use without needing to juggle a dozen wallets or networks.

Because Base is a "Layer-2," it processes transactions off-chain and then settles them back on Ethereum, giving you the security of Ethereum without the high fees.

This makes it a popular home for NFTs, gaming projects, on-chain social apps, and the newer creator coins you're seeing pop up everywhere.

Developers love Base because it's simple to build on, and users love it because it's cheap and fast—two things crypto has historically struggled with.

That combination is why so many new projects launch there first before expanding anywhere else.

If you're exploring the ecosystem, just remember that Base moves quickly—new tokens, new apps, and new tools appear almost daily.

Staying curious here pays off, because the early experiments often turn into the trends everyone else talks about months later.

Everything Else

The memecoin market just hit its lowest point of 2025 as $5 billion vanished in a single day, signaling that traders are pulling back hard from the most speculative corners of crypto.

Two trading bots walked away with over $1.3 million by sniping Base founder Jesse Pollak's creator coin at launch, exposing how the network's new flashblocks make it easier for bots to front-run fresh tokens.

Ark Invest doubled down on crypto equities for the second day in a row, scooping up nearly $40 million in Coinbase, Bitmine, Circle, and Bullish shares even as the broader market sold off.

Mike Selig just cleared a major hurdle on his path to becoming the next CFTC chair, positioning a long-time digital-asset policy expert to take the lead as Congress pushes forward on market-structure reform.

Prediction-market giant Kalshi reportedly hit an $11 billion valuation after raising $1 billion, fueled by explosive trading growth and a wave of regulatory wins reshaping the US prediction-market landscape.

Crypto can look chaotic on days like these, but that chaos is exactly where new opportunities take shape.

When you stay curious, stay nimble, and keep paying attention—even when the market feels upside down—you give yourself a front-row seat to the moments most people only recognize in hindsight.

Best Regards,

— Benjamin Vitaris

Crypto Intel