- Crypto Intel

- Posts

- Crypto Slows Down to Speed Up: Here's Your Play for the Week

Crypto Slows Down to Speed Up: Here's Your Play for the Week

Bitcoin is bouncing, but the stress hasn't left the market.

Institutions aren't panicking, Japan is laying groundwork for future ETF demand, and derivatives are quietly telling you where the real risk sits.

This week isn't about chasing a bounce—it's about understanding who's still confident, who's hedging, and where patience is starting to matter.

Limited Time (Sponsored)

Every market cycle produces a select group of companies that drastically outperform the rest.

The latest screening has pinpointed the 5 Stocks Set to Double, each showing rare traits linked to early stage momentum.

These names carry the same type of indicators that have historically appeared ahead of strong rallies.

Earlier reports featured stocks that delivered +175%, +498%, and +673%.

Get the Free 5 Stocks Set to Double Report.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Three signals are shaping the tape right now.

Bitcoin is rebounding but still fragile, regulators in Japan are preparing the next phase of ETF access, and institutions are signaling conviction without urgency.

Together, they tell you this market isn't broken—it's paused.

If you can read that difference, you're not reacting to noise; you're aligning with how capital is actually behaving.

Markets

Bitcoin Rebounds From One-Month Low, but Stress Lingers Under the Surface

Bitcoin bounced more than 2% from Sunday's $86,000 low after CME futures reopened, briefly reclaiming $88,000 before momentum faded.

The broader structure still shows lower highs and lower lows, keeping the short-term trend pointed downward.

Risk-off sentiment remains dominant as investors rotate into gold and silver, both of which hit record highs.

That shift continues to frame Bitcoin less as a haven and more as a macro-sensitive risk asset tied to equities.

Derivatives Signal Near-Term Anxiety

Futures open interest has stabilized around $22.6 billion, suggesting the worst of deleveraging may be over.

Funding rates are mostly neutral, but negative rates on OKX point to localized hedging and cautious positioning.

Options markets are flashing louder warnings, with strong demand for short-term protection and implied volatility flipping into backwardation.

Front-end volatility spiked above 41%, showing traders are paying up to hedge immediate price risk.

Altcoins Hold Their Ground

While Bitcoin struggled, Ether and XRP both gained nearly 3%, and privacy and metaverse tokens outperformed in thin liquidity.

The CoinDesk 80 index remains positive year-to-date, highlighting relative strength outside Bitcoin-heavy benchmarks.

Low liquidity since October's $19 billion liquidation event has exaggerated moves in both directions. That environment is rewarding speed and selectivity rather than broad-based conviction.

Take: This rebound looks tactical, not structural.

For you, derivatives stress suggests caution near-term, but stabilizing open interest hints that forced selling pressure may be easing rather than accelerating.

ETFs & Regulation

Japan Weighs Crypto ETF Framework With 2028 on the Table

Japan's Financial Services Agency is reportedly exploring rule changes that could allow crypto assets to qualify for ETFs as early as 2028.

The move would open regulated access to Bitcoin and other assets through traditional brokerage accounts.

While not an approval, the discussions mark a shift in regulatory tone. Japan currently prohibits crypto ETFs, keeping direct exposure outside its ETF framework.

Policy Signal, Not a Green Light

Officials have not confirmed a timeline, and any change would require consultations and formal rule revisions. For now, crypto ETFs remain unavailable under Japan's existing policies.

Nikkei estimates Japanese crypto ETFs could eventually reach 1 trillion yen, or roughly $6.4 billion, though that figure depends heavily on market conditions.

The projection remains speculative until rules are finalized.

Institutions Are Positioning Early

Nomura and SBI are expected to be among the first movers if approvals come through. SBI has already outlined plans for Bitcoin-XRP and gold-crypto ETF products pending regulatory clearance.

Japan's finance minister recently pointed to US crypto ETFs as inflation hedges, reinforcing a more open stance toward digital assets.

That rhetoric suggests regulators are at least preparing for change.

Take: Japan isn't rushing, but it's aligning.

For you, this signals longer-term expansion of regulated demand rather than an immediate catalyst, with Asia gradually catching up to US ETF adoption.

Poll: What’s the most dangerous phrase in crypto? |

Slow Erosion (Sponsored)

They mocked your values and expected everyday Americans to stay financially exposed.

Now the dollar faces pressure, global conflicts threaten stability, and inflation quietly eats away at savings.

Doing nothing is exactly what powerful interests are counting on as uncertainty grows.

This Patriot’s Tax Shield explains how real, physical gold can help defend wealth during political and economic disruption.

A free Wealth Protection Guide reveals how Trump’s agenda could impact gold and why timing matters now.

Click here to get the FREE Wealth Protection Guide now.

Institutional Sentiment

Majority of Institutions Say Bitcoin Is Undervalued: Coinbase

Around 71% of institutional investors surveyed by Coinbase believe Bitcoin is undervalued between $85,000 and $95,000.

Only 4% said it was overvalued, despite prices sitting more than 30% below October's all-time high.

The survey reflects a market still digesting October's $19 billion liquidation cascade. Since then, price action has been range-bound and fragile.

Conviction Without Urgency

Nearly 80% of institutions said they would hold or buy more if prices fell another 10%. More than 60% have already held or increased exposure since October.

That stance suggests patience rather than panic. Institutions appear comfortable waiting through volatility rather than chasing rebounds.

Macro Headwinds Still Matter

Geopolitical tensions and renewed tariff threats continue to weigh on sentiment. Gold above $5,000 and a doubling in silver prices highlight where defensive capital is flowing.

Coinbase expects potential tailwinds later in 2026 if the Federal Reserve delivers two rate cuts. For now, macro uncertainty remains the dominant force.

Take: Institutions sound calm, not bullish.

For you, this points to accumulation on weakness rather than aggressive buying, with confidence intact but timing still dictated by macro pressure.

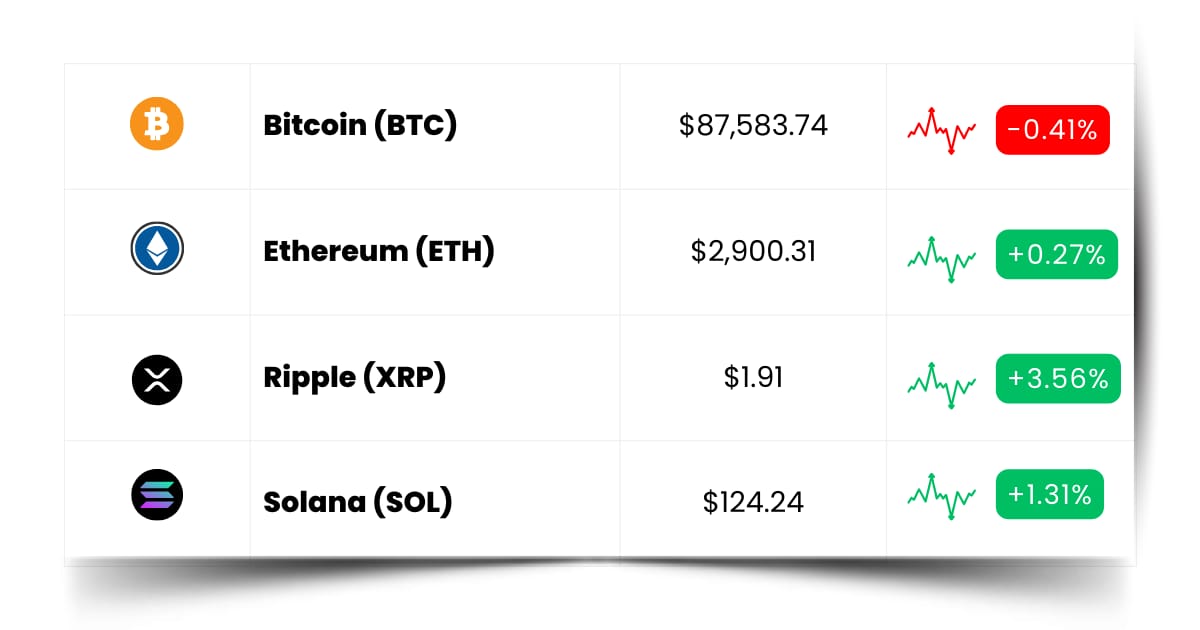

Coin Leaderboard

Crypto Pulse

Bitcoin is hesitating, institutions are patient, and policy is moving on a long clock—but momentum didn't wait around.

It slipped into thinner corners of the market, where speed matters more than certainty and volatility cuts both ways.

U, WOJAK, and BTR are running because this tape is rewarding motion, not conviction. When the majors pause, fast money looks elsewhere—and right now, it's finding room to move.

Union (U) $0.007508 (+207.63%)

U exploded higher with a 207.63% move as volatility ripped through thin liquidity.

Wojak (WOJAK) $0.01215 (+77.79%)

WOJAK staged a sharp rebound, jumping 77.79% in the past 24 hours as momentum snapped back.

Bitlayer (BTR) $0.1232 (+83.24%)

BTR extended its 2026 breakout with a 83.24% gain, keeping buyers firmly in control.

Beyond Big Tech (Sponsored)

A new set of 7 AI stocks are DOMINATING the market.

Here’s why one financial guru says they could be the most famous companies in the world by 2030.

Future Forward

The biggest crypto moves rarely start on a chart. They start when builders ship half-finished ideas, early users poke at them, and attention quietly gathers before price ever shows up.

Airdrops usually reward curiosity, not capital.

Using products early, clicking around, and paying attention before timelines light up often matters more than trying to buy at the perfect moment later.

Token launches are live stress tests.

Some attract instant liquidity, others fade fast, but both show you what the market is actually willing to engage with—not what Twitter says it should like.

Conferences are where narratives get tried out before they stick. If you want to spot what might matter next, this is where the first real signals tend to surface.

Crypto Conferences:

💎 VOLTAGE 2026 (Jan 28, 2026)

💎 WAGMI Miami 2026 (Jan 28, 2026)

💎 Satoshi Roundtable XII (Jan 29, 2026)

Upcoming Airdrops:

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

🎁 SoSoValue (SOSO) Airdrop (May 2026)

Upcoming Token Launches:

🚀 AntDrop (ANT) IDO on KingdomStarter (Feb 2, 2026)

🚀 PENXCHAIN (PENX) IDO on Fount (Feb 3, 2026)

🚀 Magicblock (BLOCK) Presale (Feb 5, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: How Japan Regulates Crypto

Japan treats crypto as a regulated financial product, not a free-for-all.

Exchanges must register with the Financial Services Agency and follow strict rules around custody, disclosures, and consumer protection.

That's why Japan doesn't yet have crypto ETFs. Regulators have allowed spot trading for years, but packaged investment products tied directly to crypto are still outside the framework.

What's changing now is intent. Policymakers are openly discussing how crypto could fit into ETFs in the future, with stronger safeguards built in from the start.

For you, Japan matters because it moves slowly—but deliberately. When Japan shifts, it usually signals long-term legitimacy rather than short-term hype.

Everything Else

Crypto investment funds saw $1.73 billion in weekly outflows—the largest since November 2025—as Bitcoin and Ether led selling while selective capital rotated into Solana and a handful of smaller altcoins.

The UK's Financial Conduct Authority has entered the final consultation phase on sweeping crypto rules, signaling tighter oversight ahead as firms prepare for a new licensing regime expected to open in 2026.

Ark Invest bought $21.5 million worth of Coinbase, Circle, and Bullish shares as Bitcoin dipped below $90,000, sticking to its long-running playbook of buying crypto equities during market weakness.

Metaplanet raised its full-year revenue outlook above $100 million after Bitcoin-linked income surged, showing how yield strategies can offset large paper losses during price corrections.

Matcha Meta warned users to revoke approvals tied to SwapNet after a smart-contract exploit drained up to $16.8 million on Base, underscoring how contract risk—not price—remains one of crypto's biggest threats.

Crypto doesn't reward certainty—it rewards awareness.

When you notice where builders are showing up, where regulators are tightening, and where capital is waiting instead of rushing, you stop chasing moves and start understanding timing.

Best Regards,

— Benjamin Vitaris

Crypto Intel