- Crypto Intel

- Posts

- ETF Outflows Test Bitcoin's Nerve as Ripple Goes Corporate

ETF Outflows Test Bitcoin's Nerve as Ripple Goes Corporate

This week proved that crypto never waits for calm.

Bitcoin ETFs saw their sharpest outflows in months, Ripple made a billion-dollar move into corporate finance, and Uniswap cracked open Solana's $140 billion DeFi market.

If you're tracking where institutional money's pulling back—and where it's quietly redeploying—this issue shows you how conviction, infrastructure, and liquidity are reshaping crypto's next leg.

Final Days to Get $12 Cocktails for Life

On New Year’s Eve 2006, Death & Co’s opening night, its signature cocktails cost $12. Now Death & Co is offering that pricing for life to select investors.

But the real opportunity in owning Death & Co stock isn’t just the cocktail price, it’s sharing in the company’s growth potential.

They attract 10,000+ weekly bar visitors and project to make over $20M this year. And that’s just the start. They project revenue will grow 5.5X in just four years.

The award-winning hospitality brand is currently opening new bars and hotels in major US cities and international locations, with their newly debuted boutique hotel in Savannah attracting national media attention.

As a thank you for joining their investor community, Death & Co is offering exclusive benefits to shareholders, including investor happy hours, priority reservations, $12 cocktails for life, and more.

But the investment window ends on October 30, so you don’t have time to wait.

This is a paid advertisement for Death & Company’s Regulation A offering. Past performance is not indicative of future results. Please read the offering circular at invest.deathandcompany.com.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News — What This Means for You

Money is moving, just not all in the same direction.

ETF redemptions are testing short-term sentiment, Ripple's acquisition spree shows crypto firms are going full-stack, and Uniswap's Solana integration could rewrite the DEX playbook.

Each of these shifts tells a story about where capital feels safe, where innovation's heating up, and where you might want to keep your eyes next.

Markets

Bitcoin ETFs See $536 Million in Outflows as BTC Slips Below $110K

US-listed Bitcoin ETFs recorded $536 million in net outflows Thursday, the largest single-day withdrawal since August.

Ether ETFs also lost $56.8 million, breaking a two-week streak of consistent inflows.

ETF Exodus Meets Market Caution

Fidelity's FBTC saw $132 million leave, while BlackRock's IBIT and Grayscale's GBTC shed $29 million and $67 million, respectively.

Smaller issuers like Bitwise and VanEck also faced steady redemptions.

The selloff followed Bitcoin's fall from $126,000 highs after leveraged futures positions unwound.

Citi analysts said the correction underscored Bitcoin's growing correlation with equities amid macro uncertainty.

Reset or Red Flag?

Glassnode called the dip a "necessary reset" after one of the largest futures deleveraging events on record.

Meanwhile, Unchained noted that ETF options are now shaping flow behavior more than long-term conviction.

Despite volatility, Citi maintained its $133,000 year-end BTC target, citing sustained ETF participation.

Prediction markets are holding that line too, showing investors still expect a recovery.

Take: Short-term pain doesn't erase structural progress.

ETF outflows show traders taking profits, not giving up—if liquidity stabilizes, Bitcoin's next leg up could be built on stronger hands.

Crypto Treasuries

Ripple Set to Enter Corporate Treasury Business With $1B GTreasury Deal

Ripple is acquiring treasury software firm GTreasury for $1 billion, expanding beyond crypto payments into full-stack enterprise finance.

The deal, pending approval, gives Ripple access to Fortune 500 treasury departments managing billions in liquidity.

A Strategic Push Into TradFi

GTreasury's tools for cash, FX, and risk management will merge with Ripple's blockchain suite. The move positions Ripple as a one-stop shop for corporate money movement.

Brad Garlinghouse said combining both firms will "unlock trapped capital" and bring instant payments to legacy systems.

He emphasized blockchain's ability to replace outdated treasury infrastructure that slows global cash flow.

Acquisition Spree Continues

GTreasury marks Ripple's third major purchase this year after buying prime broker Hidden Road for $1.25 billion and stablecoin firm Rail for $200 million.

Ripple also runs a $840 million stablecoin on XRP Ledger and Ethereum.

By merging traditional finance tools with blockchain rails, Ripple is building an ecosystem that looks more like a fintech giant than a crypto startup.

It's a calculated bet that enterprises want blockchain tech without the learning curve.

Take: Ripple's pivot toward treasury services could reshape how corporations handle cash.

For investors, it's a clear sign that blockchain is no longer a side project—it's becoming the financial backbone itself.

Trivia: What was the first altcoin ever created? |

Tomorrow’s Five (Sponsored)

Timing is everything in the market — and these five stocks could be poised for a major move.

Each has been highlighted in a brand-new special report available today.

Similar research has uncovered stocks that went on to deliver eye-popping gains.

Don’t wait until it’s too late to see what’s inside.

The clock runs out tonight.

[Unlock the Free Report Now]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

DeFi

Uniswap Adds Solana Support in $140B Liquidity Expansion

Uniswap has added Solana integration to its web app, connecting users directly to over a million Solana tokens through Jupiter's Ultra API.

The move marks Uniswap's first major multi-chain leap since launching Unichain earlier this year.

Cross-Chain Power Play

Solana swaps will now route through Jupiter, which processed $140 billion in DEX volume in the past month.

Uniswap becomes the first major partner to leverage Jupiter's Ultra API, opening massive liquidity access for traders.

Developers say the integration wasn't custom-built for Solana—it's part of a new architecture designed for fast cross-chain expansion.

Engineering lead Danny Daniil said the move also helps position Unichain as "the best chain for trading."

Next Phase for DeFi Aggregation

Uniswap's Solana support could attract new users from both ecosystems as liquidity pools converge.

It also strengthens the protocol's foothold in an increasingly competitive DEX aggregator market.

By blending Solana's speed with Uniswap's reach, the integration could set a new benchmark for cross-chain trading UX.

It's not just a technical milestone—it's a statement about where DeFi's next growth wave is heading.

Take: Uniswap's Solana expansion is more than a bridge—it's a blueprint for DeFi's next evolution.

For traders, it means deeper liquidity and better pricing; for investors, it signals that cross-chain is the future battleground for decentralized finance.

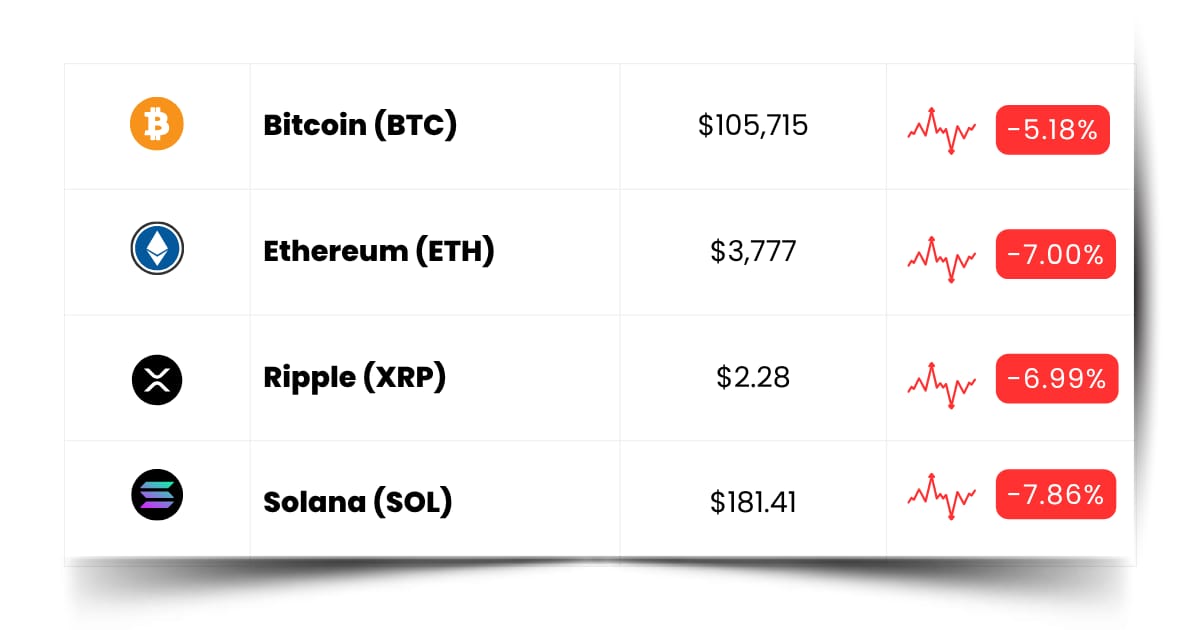

Coin Leaderboard

Crypto Pulse

The ETF crowd hit sell, but the degens hit buy. As Bitcoin slipped under $110K, capital started leaking into smaller tokens with faster stories and higher conviction.

RIF went parabolic, XPIN hit an ATH on BNB chain heat, and ZKC reminded everyone why post-listing rallies are still one of crypto's purest adrenaline rushes.

The message is clear—momentum doesn't die, it migrates.

Rifampicin (RIF) $0.01044 (+790.69%)

RIF skyrocketed 790.69%, topping today's Crypto Pulse leaderboard and stealing the spotlight from every major mover on the charts.

XPIN Network (XPIN) $0.003183 (+86.59%)

XPIN jumped 86.59% to a new all-time high, fueled by renewed momentum across the BNB ecosystem.

Boundless (ZKC) $0.3103 (+66.47%)

Three weeks after its Binance debut, ZKC rallied 66.47% as fresh liquidity and post-listing hype kicked in.

Powering Next Wave (Sponsored)

From global tensions to record U.S. defense budgets, one thing is certain: defense is back in focus.

Our analysts have identified 7 defense-related companies poised to capture billions in new contracts as 2025 closes.

From drone technology to next-gen cybersecurity, these aren’t legacy names — they’re the innovators driving a new era of defense modernization.

Get in before Q4’s biggest government spending wave hits.

[Download your free “7 Defense Stocks for 2025’s Final Rally” report.]

Future Forward

The next breakout probably isn't hiding in your charts—it's waiting on a date you haven't circled yet. Smart traders know momentum doesn't start in headlines; it starts in calendars.

Conferences, airdrops, token launches—these are the moments when liquidity meets timing.

Find the ones that fit your plan, set those reminders, and be early while the crowd's still reacting.

Crypto Conferences:

💎 BTC Balkans 2025 (Oct 18, 2025)

💎 ETHShanghai 2025 (Oct 18, 2025)

💎 Canadian Lenders Summit 2025 (Oct 20, 2025)

Upcoming Airdrops:

🎁 Matchain (MAT) Airdrop (Oct 19, 2025)

🎁 DFDV Staked SOL (DFDVSOL) Airdrop (Oct 23, 2025)

Upcoming Token Launches:

🚀 Adix (ADIX) IDO on Kommunitas (Oct 18, 2025)

🚀 Momentum (MMT) IDO on Buidlpad (Oct 22, 2025)

🚀 Meteora (MET) TGE and Distribution (Oct 23, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Uniswap?

Uniswap is a decentralized exchange (DEX) that lets anyone swap tokens directly from their wallet—no bank, broker, or sign-up needed.

It runs entirely on smart contracts, meaning code handles the trades instead of a company.

Instead of using traditional order books, Uniswap relies on liquidity pools—big, shared vaults of tokens supplied by users.

When you trade, you're swapping directly against these pools, and a small fee goes back to the people who provided the liquidity.

Because anyone can list a token, Uniswap often becomes the first stop for new coins entering the market.

It's where projects test demand, traders hunt early opportunities, and price discovery happens in real time.

In simple terms, Uniswap is crypto's automated market maker—a trading engine built on transparency and math, not middlemen.

It's proof that finance doesn't need permission, just participation.

Everything Else

Federal Reserve Governor Michael Barr warned that poorly designed stablecoin reserves—like uninsured deposits or volatile repo—can trigger run risk and urged robust, harmonized rules under the GENIUS Act to prevent regulatory arbitrage, a stance Circle largely endorsed.

Nasdaq-listed Zeta Network raised about $231 million via a private placement payable in Bitcoin or SolvBTC to fortify its balance sheet, bringing yield-bearing BTC exposure on-chain while signaling growing TradFi comfort with institutional Bitcoin rails.

Florida's HB 183 is back to let the state allocate up to 10% into digital assets with tougher custody and fiduciary standards—paired with HB 175 to tighten stablecoin requirements—pushing a diversified, rules-first approach as other states inch forward and California locks in crypto property rights.

Binance finally won approval to take majority control of Korea's GOPAX, clearing a two-year review to re-enter the market and work through GOFi repayments, though analysts expect limited disruption in a landscape still dominated by Upbit and Bithumb.

KPMG says stablecoins can cut cross-border settlement from days to seconds and costs by up to 99%, freeing trapped capital and adding real-time auditability, with JPMorgan and PayPal already proving the rails at scale.

That's our coverage for today; thanks for reading! Reply to this email with feedback or any cryptocurrencies you want me to check out.

Best Regards,

— Benjamin Vitaris

Crypto Intel