- Crypto Intel

- Posts

- Europe Gets Tough, ETFs Get Hit, and Low-Caps Get Loud

Europe Gets Tough, ETFs Get Hit, and Low-Caps Get Loud

Bitcoin ETFs just saw their largest outflows in two weeks, Italy opened a full-scale review into crypto risks, and the EU is pushing to centralize supervision under ESMA.

If you want to understand how these regulatory and institutional shifts could shape your next move—not just the headlines—this edition breaks down where the pressure is building and where the opportunity may open next.

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Institutions, regulators, and policymakers all made decisive moves this week—and the ripple effects are already hitting your screen.

Here are the top stories that shaped the crypto market lately.

Markets

Bitcoin ETFs Shed $194M as Institutions Unwind Basis Trades

Spot Bitcoin ETFs saw $194.6 million in outflows on December 5, marking the biggest withdrawal in two weeks.

Most of the pressure came from BlackRock's IBIT fund, which accounted for $113 million of the total.

A Sharp Reversal After Days of Strength

This drop follows a stretch of five straight days of net inflows, showing how quickly sentiment can flip when macro pressure rises.

Bitcoin stayed relatively stable despite the outflows, slipping just 1.7% to around $91,315.

Basis Trades Start to Unwind

Analysts say the selling is largely tied to institutions exiting basis trades, where traders long spot ETFs and short Bitcoin futures to capture low-risk spreads.

As those spreads narrow, the incentive to hold the trade disappears, triggering coordinated outflows.

Rajiv Sawhney of Wave Digital Assets says this unwind may be nearing completion.

He expects the broader market to consolidate higher heading into the new year once the pressure clears.

Macro Forces Add New Stress

Concerns about a possible December 19 rate hike from the Bank of Japan are adding fuel to the unwind.

Higher Japanese rates could disrupt the yen carry trade, a strategy that has historically amplified volatility in Bitcoin during periods of macro tightening.

Past episodes tied to yen carry stress have caused sharp 20% drops and spikes in ETF outflows.

That history alone is enough for traders to keep their risk tighter than usual right now.

Take: This kind of outflow doesn't mean institutions are abandoning Bitcoin—it means they're adjusting their leverage.

If you're positioning here, think of this as noise inside a bigger trend, but one that can still whip the market short-term if the BOJ surprises in December.

Regulation

Italy Launches a Full Review of Crypto Risks as Europe Tightens Oversight

Italy has kicked off an "in-depth review" of crypto-related risks as digital assets become more intertwined with mainstream finance.

Regulators say fragmented rules and rising market exposure make a closer examination unavoidable.

Rising Interconnections Raise the Stakes

The review is led by the Macroprudential Policy Committee, which includes top officials from the Bank of Italy, the treasury, and insurance regulators.

Their concern centers on how retail investors are accessing crypto exposure both directly and through traditional financial products.

Europe Worries About Fragmented Global Rules

Italy's move comes as regulators across Europe warn that inconsistent global oversight is creating blind spots.

With crypto markets pushing past $3 trillion, those gaps can quickly spill into traditional financial channels.

Ruchir Gupta of Gyld Finance says fragmented rules push higher-risk activity into weaker jurisdictions.

He expects global supervision to converge by 2026 as the US finalizes clearer frameworks that Europe can benchmark against.

A Shift From "Peripheral" to "Systemic" Scrutiny

Italy's central bank has already warned that crypto's rapid integration with finance could become a stability risk.

They pointed to sharp price movements after the Trump administration embraced pro-crypto policies as evidence of the market's growing macro sensitivity.

Europe is also entering a broader phase of aggressive supervision, driven by MiCA's rollout.

Regulators want stronger licensing, tighter AML oversight, and clearer governance before crypto becomes fully embedded in consumer finance.

Take: Stronger oversight may sound heavy, but it gives you something crypto rarely had: clarity.

If Italy's review helps standardize rules across Europe, you end up with safer platforms, better disclosures, and a region that increasingly becomes a "gold standard" instead of a regulatory maze.

Poll: Where do you keep most of your crypto? |

Next Jump (Sponsored)

Many investors are seeing solid gains in today’s market, but solid gains often hide opportunities with far greater potential.

A new analysis highlights the 5 Stocks Set to Double, selected from thousands of companies showing early signs of powerful growth.

These picks feature strong fundamentals and technical indicators that often appear before meaningful upside.

Past editions of this research uncovered gains of +175%, +498%, and +673%.

Download the 5 Stocks Set to Double. Free Today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Policy

EU Moves to Shift All Crypto Supervision to ESMA

The European Commission has proposed transferring crypto oversight from individual member states to the EU's markets regulator, ESMA.

The goal is to eliminate fragmented supervision and fully integrate financial markets across the bloc.

A Push for Consistency Across 27 Countries

Regulators say national-level supervision has led to diverging rule interpretations since MiCA's introduction.

ESMA taking over would centralize oversight, making it easier for companies to operate across borders without navigating inconsistent local frameworks.

Concerns from Member States Sparked the Move

France, Austria, and Italy previously raised alarms that MiCA's rollout wasn't unified enough.

Their view is that inconsistent enforcement opens the door to regulatory arbitrage, where companies flock to lenient jurisdictions while serving users in stricter ones.

The Commission argues that integrated supervision will boost competitiveness by helping EU markets scale faster.

They also say the shift will finally give crypto the same coordinated oversight used in other financial sectors.

What an ESMA-Led System Looks Like

ESMA today mostly coordinates national regulators rather than directly supervising firms.

This proposal would change that by giving ESMA "direct supervisory competences," moving it closer to a US SEC-style authority.

The proposal still needs approval from the European Parliament and the European Council. But if passed, it would mark the EU's most significant crypto regulatory pivot since MiCA itself.

Take: A unified EU regulator may feel like more bureaucracy, but it actually reduces friction for you.

Stronger consistency means safer platforms, smoother cross-border products, and fewer surprises when the rules change—giving the entire European crypto market room to grow instead of splintering.

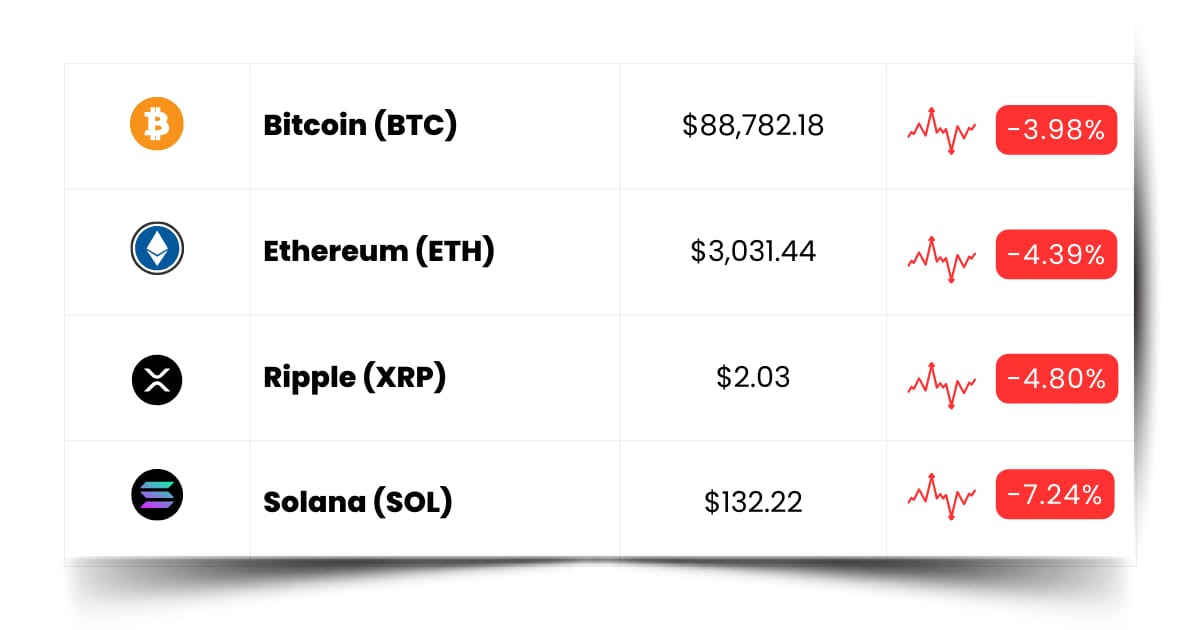

Coin Leaderboard

Crypto Pulse

The big stories this week were all about regulators tightening their grip and institutions reshuffling their positions—but the small caps clearly didn't get the memo.

XNY, LUNC, and POWER all punched higher anyway, proving that even in a week full of policy resets and ETF turbulence, traders are still chasing the charts that move fast, not the headlines that move slow.

Codatta (XNY) $0.005720 (+11.65%)

XNY snapped a month-long downtrend with a 11.65% breakout in the past 24 hours. Traders jumped back in as momentum finally shifted in its favor.

Terra Classic (LUNC) $0.00004964 (+70.33%)

LUNC climbed 70.33% on a wave of community-driven activity and rising liquidity. Scarcity narratives added fuel to an already energetic move.

Power Protocol (POWER) $0.1131 (+39.76%)

POWER rallied 39.76% after landing in Bitget's Innovation and GameFi zone. The listing gave the token fresh visibility and a rush of speculative inflows.

Fast Gains (Sponsored)

I'd like to give you a free copy of our brand-new report: 7 Best Stocks for the Next 30 Days.

Our objective, mathematical stock prediction system has consistently outperformed the market — delivering strong returns over decades.

This just-released Special Report reveals the 7 most explosive stocks from our top-ranked selections.

Fewer than 5% of stocks qualify to be one of our “7 Best.” These could be the most exciting short-term trades in your portfolio.

Don’t wait — see these picks before your next trade.

Download it now, absolutely free.

[Click Here for the Free Report]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Future Forward

Airdrops, token launches, and crypto conferences are where the next wave of momentum usually sneaks in long before price charts catch on.

These moments are the earliest hints of which ecosystems are heating up, which teams are actually shipping, and where attention is quietly drifting before it becomes obvious.

If you watch these events closely, you start spotting patterns that most traders miss.

Airdrops reveal where new communities are forming, TGEs show which projects are ready for their first big stress test, and conferences give you a front-row seat to the ideas that will define the next market narrative.

Crypto Conferences:

💎 Bitcoin Baden 2025 (Dec 6, 2025)

💎 Algorand India Summit 2025 (Dec 6, 2025)

💎 Limitless Crypto Super Event 2025 (Dec 7, 2025)

Upcoming Airdrops:

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

Upcoming Token Launches:

🚀 GrantiX (GRANT) IDO on Huostarter (Dec 15, 2025)

🚀 Spur Protocol (SON) IDO on Huostarter (Dec 16, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What are Tokenized Bonds?

Tokenized bonds take traditional bonds—government or corporate debt—and represent them as digital tokens on a blockchain.

You still get interest payments and maturity dates, but the whole process runs on faster, programmable rails instead of old financial plumbing.

Because these bonds live on-chain, they can settle in minutes instead of days.

They're also easier to track, easier to transfer, and available to a wider range of investors without needing layers of intermediaries or brokerage infrastructure.

Tokenized bonds also make it possible to build new financial tools around them.

You can plug them into DeFi-style systems, automate payouts through smart contracts, or pair them with digital currencies like CBDCs for even smoother settlement.

For you, the takeaway is simple: tokenized bonds bring traditional finance into a world where speed, transparency, and accessibility are the default.

They don't replace the old system—they upgrade it in a way that gives everyday users cleaner access to markets that were once locked behind institutional walls.

Everything Else

Cantor Fitzgerald slashed its price target on Strategy by 60% but told clients forced-sale fears are overblown, saying the firm still has enough liquidity and Bitcoin momentum to stay stable.

India's top anti-smuggling agency warned that stablecoins like USDT are replacing hawala networks in drug and gold trafficking, calling for stronger regulations to close the gaps criminals are exploiting.

China's state-linked Hua Xia Bank tokenized $600 million in yuan bonds for digital yuan holders, signaling how the country is doubling down on CBDCs while keeping private stablecoins on a tight leash.

Coinbase and Chainlink launched a Base–Solana bridge that lets you move SOL and SPL tokens directly into Base apps, pushing the industry closer to truly interoperable, always-on crypto markets.

Polymarket is hiring an in-house trading team to bet against users, a move critics say risks turning the prediction market into a sportsbook and undermining the trust that made it stand out in the first place.

As the market keeps shifting, the smartest thing you can do is stay curious enough to notice the quiet signals and bold enough to act before they turn into headlines.

Use this momentum, follow the threads that stand out to you, and keep positioning yourself where the next move starts—not where everyone else finally notices it.

Best Regards,

— Benjamin Vitaris

Crypto Intel