- Crypto Intel

- Posts

- From Street Protests to Bank Apps, Here’s What’s Shaping Crypto This Weekend

From Street Protests to Bank Apps, Here’s What’s Shaping Crypto This Weekend

Crypto is getting pulled in three directions at once—and each one affects you differently.

Lawmakers are redrawing the rule2s, people under pressure are using Bitcoin as a lifeline, and banks are finally letting everyday investors buy crypto without leaving their apps.

This is not noise or hype; it's about who controls access, custody, and opportunity next.

Liquidity Turning (Sponsored)

Liquidity is rising as the Fed shifts toward easier monetary policy.

Institutional capital continues flowing into crypto at record levels, while a pro-crypto administration accelerates favorable regulation.

Mid-term elections historically reward market-friendly policies—and after months of consolidation, conditions are aligning for a powerful move.

Nothing in crypto is ever guaranteed.

But this is one of the strongest setups seen in years—while prices remain relatively low.

Crypto Revolution reveals a disciplined system for building crypto wealth without gambling, sleepless nights, or chasing every price swing.

Get instant access to the book plus $788 in bonuses now.

© 2026 Boardwalk Flock LLC. All Rights Reserved.

2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

*The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

*Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Three forces are shaping this week in crypto.

US lawmakers are renegotiating market structure, Bitcoin is being used as financial protection in real-world crises, and European banks are opening the door to regulated crypto trading.

Together, they show where power is concentrating, where risk is shifting, and how crypto is quietly becoming harder to ignore—even if prices are not screaming about it yet.

Policy

Senate Democrats Reopen Talks With Crypto Industry on Market Structure Bill

US Senate Democrats are planning a Friday call with crypto industry representatives after abruptly postponing a key Senate Banking Committee hearing on the market structure bill.

The delay followed last-minute resistance inside the committee and Coinbase stepping away from the negotiations.

The pause did not kill the bill, but it exposed how fragile the current compromise has become.

Lawmakers are now trying to reset the conversation before momentum slips further.

A Reset, Not a Retreat

Democrats from both the Senate Banking Committee and the Agriculture Committee are expected to join the call alongside crypto policy groups.

That broader lineup suggests leadership wants alignment across committees before moving forward again.

Stablecoin rewards programs are expected to be a central sticking point.

Those incentives sit right at the intersection of banking concerns, consumer protection, and crypto innovation.

Committees Pulling in Different Directions

While the Banking Committee delayed its markup, the Agriculture Committee is still scheduled to move ahead later this month.

That split matters because it shapes which regulators ultimately oversee large parts of the crypto market.

Some lawmakers remain uneasy with the draft, even without Coinbase's withdrawal. The resistance cuts across party lines, showing this is more about structure than politics.

Industry Still at the Table

Despite the turbulence, crypto advocates are not walking away. Reopening talks so quickly signals both sides still see value in getting something passed.

The industry knows imperfect clarity is often better than no clarity at all. For lawmakers, the pressure is building to avoid another year of legislative gridlock.

Take: This looks less like a collapse and more like a recalibration, but time is not unlimited.

For you, the key signal is that regulation is still moving, just slower and messier, which keeps policy risk alive but also keeps long-term clarity on the table.

Adoption

Iranians Turn to Bitcoin as Protests Grow and the Rial Collapses

As protests spread across Iran and the rial plunged, Iranians began withdrawing Bitcoin from exchanges into personal wallets at a rising pace.

Blockchain data shows a clear spike in self-custody during periods of unrest and internet restrictions.

The move reflects urgency rather than speculation. When access to banks and currency collapses, control matters more than convenience.

Self-Custody Becomes Survival

Chainalysis observed a sharp rise in Bitcoin withdrawals from Iranian exchanges during the protests. That pattern suggests people were prioritizing ownership over liquidity.

The rial's collapse has been extreme, erasing purchasing power in weeks. Bitcoin's fixed supply and portability made it an obvious escape valve.

A Familiar Global Pattern

This behavior mirrors what has happened in other crisis-hit regions. When governments tighten controls, people gravitate toward assets that cannot be frozen or censored.

Bitcoin offers liquidity and optionality when traditional systems fail. That appeal grows strongest when fear replaces trust.

Power Players Are Watching Too

Crypto is not just a grassroots tool in Iran. Addresses linked to the Islamic Revolutionary Guard Corps now account for more than half of Iran's tracked crypto activity.

That overlap highlights a tension between Bitcoin's ideals and real-world usage. Decentralization does not pick sides.

Take: This story is not about price action, but about Bitcoin's role under pressure.

For you, it reinforces why Bitcoin keeps demand even in hostile environments, which quietly strengthens its long-term case beyond trading cycles.

Poll: What would you do if Bitcoin hit $1M tomorrow? |

Download Free Report (Sponsored)

The biggest gains often start where few are looking.

Analysts just released a free report on 5 overlooked stocks showing strong earnings momentum and insider confidence.

These could be the next leaders of the coming market cycle.

The report is free to download, but only for a limited time.

[Access the Free 5 Stocks Report Now]

Institutions

KBC Bank to Launch Bitcoin and Ether Trading Under MiCA

Belgian banking giant KBC plans to roll out Bitcoin and Ether trading through its Bolero investment platform starting February 16.

The service will use KBC's own custodial setup and operate under Europe's new MiCA framework.

For Belgian retail investors, this brings crypto inside familiar banking rails. That alone changes who feels comfortable participating.

Banks Step Into Crypto's Core

KBC says it will be the first Belgian bank to offer crypto trading in a fully regulated setup. The move follows years of preparation and regulatory signaling.

Customers will be able to buy and sell crypto without leaving their bank's ecosystem. That removes the friction that has kept many on the sidelines.

MiCA Still Finding Its Shape

Belgium only finalized its MiCA implementation this month. While KBC claims compliance, no MiCA licenses have yet appeared on ESMA's public register.

That gap shows how fast banks are moving relative to regulators. The framework exists, but its enforcement is still settling.

Europe's Regulatory Split

Some EU states want centralized oversight under ESMA, while others prefer national control. That debate could shape how easily crypto services scale across borders.

KBC's launch lands right in the middle of that tension. Banks are pushing forward regardless.

Take: This is another sign that crypto adoption is shifting from apps to institutions.

For you, bank-led access under MiCA lowers perceived risk and broadens participation, which tends to support steady, structural growth rather than hype-driven spikes.

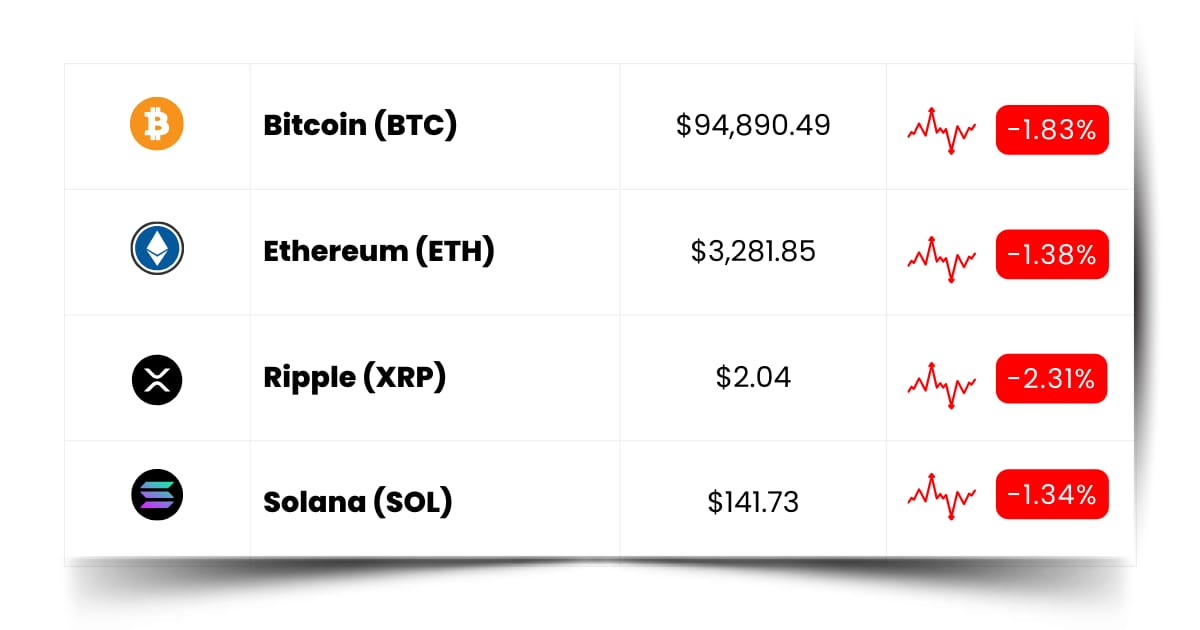

Coin Leaderboard

Crypto Pulse

The market is talking in two very different volumes right now.

Policy talks are dragging on, banks are inching into crypto under new rules, and Bitcoin is doing its job quietly in the background—while fast money is ripping into anything with momentum.

U, OWL, and AIA are flying because traders are not waiting for clarity or confirmation.

They are chasing listings, rebounds, and pure speed while the bigger stories reshape the playing field underneath.

This is the kind of market where patience builds positions and urgency hunts breakouts.

Union (U) $0.006127 (+105.39%)

U held onto its momentum after Wednesday and climbed back to the top of the Crypto Pulse leaderboard, ripping another 105.39% in the last 24 hours as traders kept pressing the move.

Owlto Finance (OWL) $0.1109 (+72.56%)

OWL nearly doubled after landing listings on multiple exchanges, including BitMart and Gate.io, giving the token fresh liquidity and a new wave of attention.

DeAgentAI (AIA) $0.1365 (+36.28%)

After sliding for most of the week, AIA snapped back hard, reclaiming its losses and pushing to a monthly high with a 36.28% surge in a single day.

Shield Your Savings (Sponsored)

Economic confidence weakens when debt rises, wars expand, and currencies lose trust.

Many investors stay frozen while purchasing power quietly slips away.

History favors those who move early when political shifts change the landscape.

This Patriot’s Tax Shield outlines how tangible gold can serve as a defensive asset in uncertain times.

A free Wealth Protection Guide explains why Trump’s return could reshape demand for gold.

Click here to download the FREE Wealth Protection Guide now.

Future Forward

The earliest edges in crypto rarely show up in price charts first—they show up where people are building, testing, and quietly shipping.

Conferences, airdrops, and token launches are where those signals surface before the rest of the market notices.

Airdrops reward attention, not bankroll size, which means showing up early can matter more than timing a trade.

The wallets that benefit later are usually the ones that were explored when things still felt experimental.

Token launches are where ideas meet reality, because hype has to survive real users and real capital. Some projects pass that test quickly, while others fade just as fast.

Conferences are where future narratives get traded face-to-face before they ever hit social feeds.

If you want a sense of what might matter next quarter, that is where the hints usually start leaking.

Crypto Conferences:

💎 BitcoinDay Naples 2026 (Jan 17, 2026)

💎 Forex Block Summit 2026 (Jan 17, 2026)

💎 Pocket Gamer Connects London 2026 (Jan 19, 2026)

Upcoming Airdrops:

🎁 Seeker (SKR) Airdrop (Jan 21, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

🎁 SoSoValue (SOSO) Airdrop (Apr 2026)

Upcoming Token Launches:

🚀 PENXCHAIN (PENX) IDO on Fount (Jan 17, 2026)

🚀 Somate (SOMT) IDO on Spores (Jan 26, 2026)

🚀 AntDrop (ANT) IDO on KingdomStarter (Feb 2, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is MiCA?

MiCA stands for Markets in Crypto-Assets, and it is the European Union's rulebook for how crypto companies can operate across Europe.

Think of it as a single set of standards instead of 27 different national rulebooks.

Under MiCA, crypto platforms must meet clear requirements around custody, transparency, and consumer protection.

If they do, they can offer services across the EU without reapplying country by country.

MiCA does not tell you which coins to buy or sell. What it does is define who can legally offer crypto services and how they must protect users.

For you, MiCA matters because it lowers uncertainty.

When rules are clearer, bigger players feel safer entering the market, and that tends to bring steadier growth instead of wild, fragile hype cycles.

Everything Else

Belarus has created a legal framework for state-supervised "cryptobanks," allowing licensed banks to offer token-based services under central bank and Hi-Tech Park oversight while keeping crypto firmly inside government-approved channels.

California fined Nexo $500,000 for issuing thousands of crypto-backed loans without a state license, complicating its plans to re-enter the US market after already paying $45 million in prior federal and state settlements.

Moldova announced plans to introduce its first crypto law by 2026, aligning with the EU's MiCA framework while making it clear that crypto will be treated as a speculative asset, not a payment method.

Polygon cut staff as it pivots toward a payments-first strategy built around stablecoins and on-chain money movement, following up to $250 million in acquisitions tied to that narrower focus.

Ethereum network activity nearly doubled as new users poured in and stablecoin usage surged, pushing daily transactions to all-time highs while fees stayed near historic lows.

This week showed you something important: crypto keeps moving forward even when the spotlight shifts elsewhere.

If you stay focused on where access is expanding, rules are forming, and real users are showing up, you give yourself a head start before the crowd catches on.

Best Regards,

— Benjamin Vitaris

Crypto Intel