- Crypto Intel

- Posts

- Hawkish Fed, Renewed Inflows, and a Breakout in RWAs

Hawkish Fed, Renewed Inflows, and a Breakout in RWAs

Bitcoin is holding its ground ahead of a Fed rate cut, crypto funds just logged another $716M in inflows after a massive $5.5B sell-off, and the SEC quietly closed a major tokenization probe that could reshape how RWAs grow in the US.

If you want to understand how these shifts might influence your next trade—not just the headlines—this edition walks you through what's real, what's noise, and where momentum may go next.

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Rates, inflows, and regulation all moved in the same week—and the market is already reacting.

Here are the stories that matter most right now and why they could influence your positioning next.

Markets

BTC Holds Steady as Fed Rate Cut Looms, but Rising Yields Signal Caution

Bitcoin pushed higher on Monday as traders positioned ahead of a widely expected Federal Reserve rate cut.

The move held BTC near $91,800 even as Treasury yields unexpectedly climbed.

A Hawkish Cut on the Table

The Fed is set to deliver a 25 bps cut, marking its third straight reduction and bringing cumulative easing to 175 bps since September 2024.

Cuts usually support risk assets, but rising yields suggest traders expect cautious forward guidance.

Rates are supposed to fall as cuts roll in, yet the 10-year yield jumped back to 4.15%, its highest level since late November.

That divergence hints that the cut itself isn't the story—the press conference is.

Powell's Message Is the Real Market Driver

Analysts warn Powell may signal a pause rather than a series of cuts in 2026.

Markets are already bracing for a "hawkish cut," where the Fed trims rates but cools expectations for more easing.

Soft labor data and slowing inflation do support looser policy, but the Fed is still wary of declaring victory on inflation.

Yields Are Reacting to Global Factors Too

Some traders argue the yield spike reflects deeper global shifts. Japanese rate hikes could lift global bond yields and force risk assets to deleverage.

Take: BTC holding steady into a messy macro picture is a quiet show of strength, but you shouldn't ignore the signal from yields.

If Powell leans hawkish, markets could wobble before finding their footing again—so staying nimble here matters more than guessing the Fed's script.

Institutions

Crypto Funds Log Second Week of Inflows After $5.5B Sell-Off

Crypto investment products posted $716 million in inflows last week, extending the rebound that began after four weeks of heavy selling.

BTC led the turnaround with $352 million in new capital.

AUM Rebounds but Has Ground to Recover

Total assets under management climbed back above $180 billion, an 8% jump from November lows.

The recovery is encouraging, but AUM is still far below its $264 billion all-time high.

CoinShares says small midweek outflows were tied to US inflation data that briefly soured sentiment. Even so, the week ended decisively positive across most regions.

BTC Dominates—but Chainlink Steals the Spotlight

Bitcoin funds captured nearly half of all inflows, reflecting renewed institutional confidence. XRP also saw major inflows, landing $244 million.

But Chainlink delivered the surprise of the week with a record $52.8 million in inflows.

That accounted for more than 50% of LINK's AUM and signals a strong institutional appetite for oracle infrastructure.

Issuers Show a Split Market

ProShares topped inflows with $210 million as investors favored its liquidity. Meanwhile, BlackRock—typically a magnet for capital—saw $105 million in outflows.

ARK and Grayscale also bled funds, continuing a longer-term trend of investors rotating away from their products.

Globally, the US, Germany, and Canada led inflows while Sweden posted the largest outflows.

Take: Two weeks of inflows don't guarantee you're at the start of a new leg higher, but they do show that institutions are stepping back in instead of stepping away.

When inflows return even during macro uncertainty, it usually means the market is rebuilding a foundation—slowly, but with intent.

Poll: Which crypto trend do you believe will last the longest? |

See Opportunities First (Sponsored)

Stop settling for “entry level.” You can trade smarter with better tools.

Most people stick to the basics because old platforms made it complicated.

Not anymore. Today’s brokers offer fast execution, flexible order types, fractional trading, and extended hours so you can act when it matters, not after.

If you're ready for more control and more ways to grow, start here.

COMPARE THE TOP PLATFORMS

Regulation

SEC Ends Probe Into Ondo Finance, Signaling a Major Policy Shift for RWAs

The SEC has officially closed its multi-year investigation into Ondo Finance with no charges, ending a case that began under the Biden-era enforcement push.

The probe examined whether Ondo's tokenized RWAs and the ONDO token were unregistered securities.

A Turning Point for Onchain Assets in the US

Ondo says the decision reflects a broader regulatory reset under new SEC leadership.

Chair Paul Atkins has closed multiple high-profile crypto cases, including those involving Coinbase, Ripple, and Kraken.

Back in 2024, the environment for tokenization firms was defined by fear and unclear rules. Ondo, being early and scaling fast, became one of the biggest test cases for the industry.

Tokenization Moves Toward Mainstream Acceptance

Ondo says this outcome marks the end of one chapter and the beginning of another, where tokenized securities become embedded in US capital markets.

The company expects RWAs to become core financial infrastructure.

Many US-based tokenization platforms still offer most products overseas due to regulatory constraints.

But recent approvals suggest that the barrier is starting to loosen on both sides of the Atlantic.

Europe and the US Are Entering a New Phase Together

Ondo Global Markets recently secured approval to offer tokenized stocks to European investors.

Rival platform Securitize also obtained dual approval to operate as both an Investment Firm and a TSS in the EU.

Take: This decision doesn't just clear Ondo—it clears a path.

If you're watching the RWA sector, this is one of the strongest signals yet that tokenized assets are moving from the edges of finance to the center, and the players building early infrastructure may benefit the most as clarity improves.

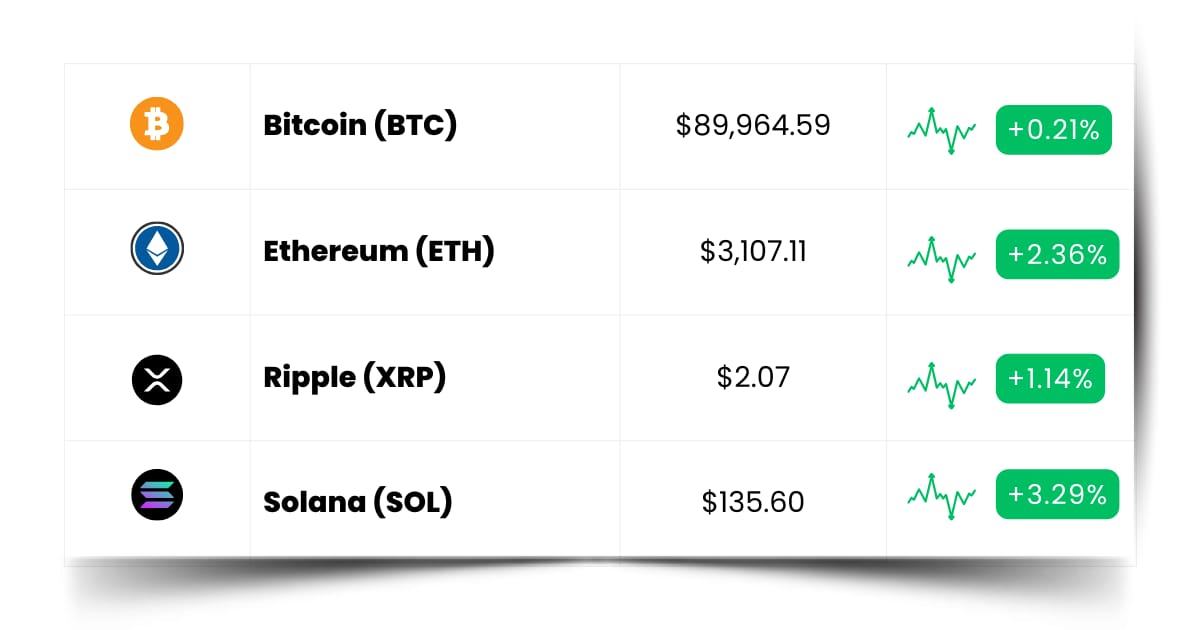

Coin Leaderboard

Crypto Pulse

Even with macro headwinds, regulatory shakeups, and a Fed decision hanging over the week, the low caps kept swinging.

ZEUS, POWER, and RDNT all ripped higher, reminding everyone that momentum doesn't wait for perfect conditions—it just needs a spark and a crowd willing to chase it.

Zeus Network (ZEUS) $0.02893 (+38.5%)

ZEUS snapped its month-long slide and rocketed 38.5% today, reclaiming momentum with one of its strongest single-day moves this quarter.

Power Protocol (POWER) $0.2723 (+41.07%)

POWER extended last week's breakout with another 41.07% surge, showing that speculative flows aren't cooling off anytime soon.

Radiant Capital (RDNT) $0.01318 (+30.05%)

RDNT bounced back from two tough weeks, climbing 30.05% as traders rotated back into beaten-down lending plays looking for quick upside.

Timing Made Easy (Sponsored)

He remembers what it was like second-guessing every trade, missing the right moments.

That changed when he developed one indicator that simplified everything.

For 30 years, it helped him know exactly when to get in and when to step aside.

Now, he’s giving that same signal away for free, because he believes every investor deserves a fair shot at trading success.

This isn’t guesswork. It’s clarity.

[Unlock the free indicator today]

Future Forward

Airdrops, token launches, and crypto conferences are where momentum quietly starts building long before the rest of the market catches on.

These moments act like early warning signals—showing you which ecosystems are heating up and where builders are actually delivering.

Watch them closely, and you'll start noticing patterns most traders overlook.

Airdrops reveal where new communities are forming, TGEs expose which projects are ready for real traction, and conferences bring the next big narratives out of backrooms and onto the main stage.

If you keep an eye on these early catalysts, you're not just reacting to the market—you're getting ahead of it. That's where the real edge sits.

Crypto Conferences:

💎 Tokenized Capital Summit Abu Dhabi 2025 (Dec 9, 2025)

💎 ICMA FinTech and Digitalisation Forum 2025 (Dec 9, 2025)

💎 ABS Fintech Specialty Finance Forum 2025 (Dec 9, 2025)

Upcoming Airdrops:

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

Upcoming Token Launches:

🚀 GrantiX (GRANT) IDO on Huostarter (Dec 15, 2025)

🚀 Spur Protocol (SON) IDO on Huostarter (Dec 16, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is OKX?

OKX is one of the world's largest crypto exchanges, built for traders who want speed, flexibility, and access to a wide range of digital assets.

It offers spot trading, derivatives, staking, and a highly active marketplace that appeals to both beginners and advanced users.

What sets OKX apart is its mix of centralized exchange tools and Web3 features.

You can trade on the exchange, but you can also connect a wallet and explore DeFi, NFTs, and on-chain dApps without leaving the platform.

The platform is known for its liquidity and fast execution, which makes it attractive during volatile markets.

It also offers robust risk-management features—something you'll appreciate if you've ever watched a position swing faster than you could refresh your screen.

For you, the takeaway is simple: OKX is a hybrid gateway to both centralized and decentralized crypto activity, giving you the flexibility to trade, explore, and interact with Web3 in one place.

If you want a single platform that can grow with you as you learn the space, OKX covers a lot of ground without forcing you to choose between CeFi and DeFi.

Everything Else

BPCE is rolling out in-app crypto trading for 2 million French banking customers, giving them access to BTC, ETH, SOL, and USDC with plans to scale the service to 12 million users by 2026.

Binance secured full ADGM approval to operate exchange, clearing, and brokerage services through its regulated Nest entities, reinforcing Abu Dhabi's push to become a global crypto hub.

Bitcoin's long-term holders hit a cyclical low as seasoned wallets eased their selling, signaling that the heaviest spot-driven pressure may already be behind the market.

Two Casascius wallets holding 2,000 BTC moved for the first time in over a decade, raising speculation about security concerns around aging physical coins.

Mantra's CEO urged holders to withdraw OM from OKX after accusing the exchange of posting incorrect migration timelines, escalating tensions ahead of the token's planned chain move.

Keep leaning into the trends that actually show momentum—whether that's liquidity shifting, new communities forming, or builders shipping—and you'll stay a step ahead while everyone else waits for confirmation.

Best Regards,

— Benjamin Vitaris

Crypto Intel