- Crypto Intel

- Posts

- Institutions Panic, DeFi Stalls, and China Quietly Reenters the Game

Institutions Panic, DeFi Stalls, and China Quietly Reenters the Game

Crypto just hit one of its loudest turning points of the year as institutional money capitulated, DeFi revealed a $12 billion efficiency hole, and China slipped back into Bitcoin mining with surprising strength.

If you want to stay one step ahead of the next big rotation, this breakdown gives you exactly what's shifting—and what it means for your positioning.

Rosé Can Have More Sugar Than Donuts?

No wonder 38% of adults prefer health-conscious beverages.

Meanwhile, companies like AMASS Brands are raking in sales by tapping into this trend, creating a huge opportunity for investors.

AMASS has made over $80M to date, including $33M in 2023 alone, thanks to products like their top-selling zero-sugar Summer Water rosé (it’s tariff-free, too). That’s just one of their portfolio’s 15+ diverse brands, already distributed across 40,000+ retail locations, including Whole Foods, Erewhon, and more.

It’s only the beginning. That’s why they just reserved the Nasdaq ticker $AMSS. Celebs like Adam Levine and Derek Jeter have already invested. And you now have the chance to join them before AMASS grows their retail footprint 3X by 2028.

But the window to secure up to 23% bonus stock ends soon. Maximize your stake as an early-stage AMASS Brands shareholder while you can.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

The last few days showed how fast the market can reshape itself when the biggest players start panicking, the core infrastructure cracks, and old powerhouses quietly come back online.

Bitcoin ETF chaos, a DeFi liquidity freeze, and China's mining resurgence all collided at once—and each one has a direct impact on where your next moves should go.

Markets

Bitcoin ETFs Smash $40B in Weekly Trading Volume as Institutions Hit the Panic Button

Bitcoin ETFs just locked in their biggest trading week ever, with more than $40 billion flowing through US spot products.

BlackRock's IBIT carried the whole market on its back, pulling nearly 70% of the volume.

Record Activity Meets Record Stress

Friday alone saw $11 billion in ETF trading, with $8 billion of it coming from IBIT as volatility pushed investors into aggressive repositioning.

That surge didn't come from excitement—it came from pure fear as redemptions exploded across every major fund.

Bitcoin's 23% monthly drop left most ETF holders underwater, given that the average entry price now sits above $90,000.

IBIT itself hit its lowest level since April, adding more pressure to already-shaky sentiment.

Capitulation Signals Take Over

Institutional investors have pulled more than $3.5 billion from Bitcoin ETFs this month, washing away months of inflows in a matter of days.

The speed of these outflows challenges the idea that ETFs are purely long-term "set it and forget it" vehicles.

Many traders now worry that macro headwinds—not just crypto-specific fears—are driving the stampede toward the exits.

With fears of a broader slowdown rising, the ETF market has become the clearest window into institutional stress.

Take: When institutions start hitting the eject button this violently, it usually means they're bracing for impact—not celebrating discounts.

If you're positioning here, focus on pacing yourself and tracking flows, because panic-driven volume often marks the later stages of selling even if the bottom isn't in yet.

Web3

'Liquidity Crisis' Hits DeFi as $12B Sits Idle and 95% of Capital Goes Unused

A new 1inch report just confirmed what many DeFi traders have felt for months: most of the liquidity in major pools simply isn't doing anything.

Between Uniswap v2, v3, v4, and Curve, as much as 95% of all capital sits idle.

Billions Sitting in the Wrong Places

In Uniswap v2, only about 0.5% of liquidity sits in active trading ranges, leaving almost $1.8 billion effectively sleeping.

That level of inefficiency explains why fees remain low even when volumes spike.

Fragmentation is also out of control, with more than seven million pools across the ecosystem splitting liquidity to the point of exhaustion.

This makes trade routing harder and dramatically reduces returns for liquidity providers.

Retail LPs Carry the Worst Damage

According to the report, about half of retail LPs are losing money once impermanent loss is factored in.

Net deficits have already surpassed $60 million, fueled by JIT attacks and overly complex pool structures.

One Uniswap v3 pool alone saw more than $30 million in profits evaporate due to strategic manipulation.

It's a reminder that being an LP is rarely the passive-income strategy people hope for.

Take: DeFi isn't broken, but the current liquidity model absolutely is—especially if you're a smaller LP trying to earn real yield.

If you're exploring these markets, stick to protocols with predictable fee structures and watch for Aqua-style systems that could finally give liquidity providers a fairer playing field.

Trivia: What’s the main purpose of a seed phrase? |

Fast-Changing Market (Sponsored)

New AI-driven initiatives are opening the door to a select group of companies poised for potential gains.

A free research report showcases 9 AI stocks benefiting from increased domestic investment, data expansion and emerging policy tailwinds.

These firms are showing real operational strength not hype.

Strong positioning now may matter more than ever.

See the Free Report

Mining

China Quietly Reclaims 14% of Global Bitcoin Mining as Underground Activity Surges

China is back in the mining game with an estimated 14% global share, despite its 2021 ban.

Reuters reports that miners are returning to regions like Xinjiang and Sichuan, where cheap electricity and surplus data-center capacity are hard to resist.

Underground Miners Move Fast

Some former operators have restarted rigs in areas with abundant hydropower, taking advantage of local surpluses.

CryptoQuant believes as much as 20% of global mining capacity may now sit within China's borders.

Local rig manufacturers like Canaan are also seeing a strong rebound in domestic sales.

They're benefiting from higher Bitcoin prices and weaker overseas demand caused by US tariff uncertainty.

Policy Softens Without Officially Changing

China hasn't reversed its mining ban, but signs of flexibility are showing up through Hong Kong's stablecoin legislation and conversations around a yuan-backed stablecoin.

These policy shifts suggest Beijing may be warming to selective digital-asset innovation.

Meanwhile, miners say enforcement has become less aggressive, allowing underground operations to expand as long as they avoid drawing attention.

That gray zone has created opportunities for quiet scaling.

Take: China's mining comeback adds fresh competition at a time when global miner revenue is already under heavy pressure.

If you're watching the mining sector, keep an eye on difficulty drops and energy-cost advantages, because those factors will decide who survives the current squeeze and who gets washed out.

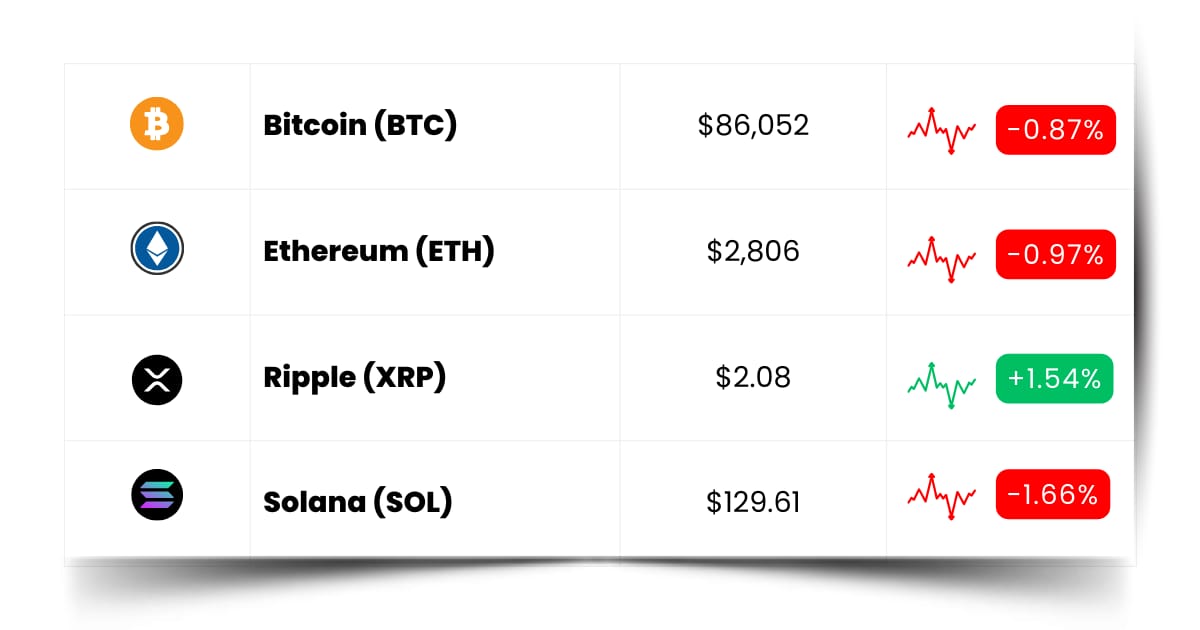

Coin Leaderboard

Crypto Pulse

Some corners of the market clearly didn't get the memo about institutional panic, DeFi gridlock, or China's mining resurgence—because a few small caps just went vertical.

TRADOOR rocketed 114%, USDAI nearly doubled on a massive quote boost, and RAIN snapped out of its slump with a 96% blast, proving that momentum doesn't wait for macro narratives to calm down.

Tradoor (TRADOOR) $2.52 (+114.27%)

TRADOOR exploded 114.27% today, locking in the top spot on the Crypto Pulse leaderboard with one of the cleanest moves of the week.

USDai (USDAI) $1.96 (+97.04%)

USDAI ripped nearly 100% higher after the project boosted the USDAI quote by $250 million, sending fresh momentum across the token's markets.

Rain (RAIN) $0.007045 (+96.82%)

RAIN snapped out of its month-long drift and erupted 96.82% in a sharp comeback that caught most traders off guard.

Crypto’s Next Wave (Sponsored)

A growing number of sophisticated investors are using a streamlined strategy to position for the next major crypto cycle.

This complimentary guide reveals their approach starting with a core holding, expanding into targeted momentum plays, and finishing with a bold long-term vehicle built for amplified growth.

The offer expires soon, and the download count is rising fast.

Delay could mean missing the moment entirely.

Download the Strategy While It’s Free

Future Forward

The next breakout projects aren't living in the spotlight—they're tucked away in testnets that crash twice a day, Discord servers with 14 people online, and GitHub repos held together with duct tape and ambition.

You only find them if you're willing to explore the weird corners everyone else scrolls past without thinking.

These builders aren't chasing likes or timing hype cycles—they're solving quiet problems that suddenly become loud once the rest of crypto realizes how important they are.

And by the time the crowd shows up with confetti, the early explorers are already off experimenting with the next strange idea that looks impossible right up until it works.

Crypto Conferences:

💎 FinTech North Manchester Conference 2025 (Nov 25, 2025)

💎 World Financial Innovation Series Indonesia 2025 (Nov 25, 2025)

💎 MEET ICT Bahrain Conference 2025 (Nov 25, 2025)

Upcoming Airdrops:

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

🎁 Wolf Game Wool (WOOL) Airdrop (Nov 14, 2025 - Jan 15, 2026)

Upcoming Token Launches:

🚀 Blink Galaxy (BG) TGE and Distribution (Dec 1, 2025)

🚀 EarnPark (PARK) Token Sale Tier 4 (Dec 3, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Aerodrome Finance?

Aerodrome Finance is a decentralized exchange built on Coinbase's Base network, designed to make swapping tokens fast, cheap, and easy without giving up control of your assets.

It works like a giant marketplace that lets you trade straight from your wallet, with every transaction settled on Base's low-fee Layer-2 rails.

What makes Aerodrome stand out is its focus on deep, sticky liquidity, which helps keep slippage low even during busy market hours.

It uses incentive mechanisms that reward liquidity providers over time, giving the protocol a way to attract long-term liquidity rather than quick mercenary capital.

Aerodrome has also become a core pillar of the broader "Aero ecosystem," especially after its merger with Velodrome, which expanded liquidity across both Base and Optimism.

This gives traders more reliable execution and gives builders a powerful DeFi base layer to plug into.

If you're exploring Base, Aerodrome is one of the key places to start—it's fast, it's cheap, and it's already powering a huge chunk of trading activity across the network.

Just make sure you access it through verified domains or ENS mirrors, especially during periods of front-end turbulence.

Everything Else

The ECB says stablecoin risks in Europe are still minimal thanks to low retail use and MiCA rules, but warns that global alignment is needed as adoption grows.

DOGE jumped over 3% on ETF hype while cat-themed memecoins quietly outperformed, proving once again that the strangest corners of the market move hardest.

A San Francisco homeowner was robbed of $11 million in crypto in a violent "delivery driver" attack, highlighting the sharp rise in physical threats against holders this year.

Thailand's Bitkub is exploring a $200 million Hong Kong IPO as the exchange looks for a friendlier market after Thailand's stock listings slumped in 2025.

Aerodrome Finance suffered a DNS-based front-end attack that rerouted users to phishing sites, prompting urgent warnings to avoid its main domains and use ENS mirrors instead.

Crypto is loud, unpredictable, and sometimes downright unreasonable—but beneath all that chaos, there's always a pattern forming for anyone who's paying attention.

Stay curious, move with intention, and don't be afraid to explore a little deeper than everyone else, because that's where the next wave of real opportunities usually hides.

Best Regards,

— Benjamin Vitaris

Crypto Intel