- Crypto Intel

- Posts

- Macro Shakes Bitcoin, So Momentum Finds New Targets

Macro Shakes Bitcoin, So Momentum Finds New Targets

Macro fear hits Bitcoin—but traders find other ways to win.

Bitcoin is trading your headlines, not your hopium—macro fear is driving price, institutions are managing risk, and smart money is quietly repositioning. If you're trying to figure out whether this is noise or signal, this is the week that shows the difference.

This isn't about panic—it's about understanding where pressure is coming from and where opportunity quietly forms.

Key Date (Sponsored)

Many are wondering why so many countries are frantically buying gold right now.

The truth is that this is just the beginning of a much larger story...

One that could send gold soaring to even bigger highs this month.

But the best way to cash in on gold's upside potential might surprise you.

One firm says this stock (less than $50) could be the best way to get started.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Three forces are shaping the tape right now. Bitcoin is reacting to global macro stress, ETFs are flashing institutional caution, and enforcement actions are reminding the market that crypto crime is getting harder to hide.

Together, they tell you one thing clearly—this market is being driven by structure, not sentiment, and positioning matters more than narratives.

Markets

Bitcoin Slips Toward $88,000 as Macro Risk Dominates Davos Week

Bitcoin slipped back toward $88,800 after a brief push above $90,000 faded, signaling exhaustion rather than recovery. The move unfolded as risk appetite weakened across European equities, currencies, and bonds.

The pullback did not happen in isolation. European stocks extended their worst losing streak since November, while bond-market support faded and safe-haven demand surged elsewhere.

Risk-Off Is Running the Show

Gold jumped to fresh record highs above $4,860 an ounce, underscoring a clear shift toward capital protection. US equity futures edged lower, reinforcing that risk assets were losing sponsorship across the board.

Bitcoin initially found support as Japanese government bonds rebounded earlier in the week. That relief proved temporary once broader macro pressure reasserted itself.

Politics Adds Fuel to Volatility

Uncertainty intensified ahead of President Donald Trump's address in Davos, where renewed tariff threats against Europe resurfaced. Trade tension linked to Greenland negotiations weighed on currencies and pressured sentiment globally.

Crypto was already fragile after more than $1 billion in forced liquidations earlier this week. The market is still digesting that leverage flush rather than building fresh conviction.

Take: This move looks driven by macro stress, not crypto-specific weakness. For you, it reinforces that Bitcoin is trading like a global risk barometer—expect volatility to track headlines until macro clarity returns.

Regulation & Crime

Guernsey Seizes $11.4M Linked to OneCoin Crypto Fraud

Authorities in Guernsey seized $11.4 million tied to the OneCoin scam, enforcing a German forfeiture order under updated proceeds-of-crime laws. The funds were reportedly held in a local bank account linked to the shell company Aquitaine Group Limited.

The seizure marks a rare recovery in one of crypto's most notorious fraud cases. OneCoin collapsed in 2017 after raising as much as $5 billion without ever operating a real blockchain.

A Long Trail of Missing Funds

Investigators have spent years tracing OneCoin proceeds across jurisdictions and offshore structures. Ruja Ignatova, the so-called Cryptoqueen, remains missing and is still on the FBI's most-wanted list.

Despite the headline, the recovered funds represent only about 0.2% of the estimated total losses. Most assets remain out of reach due to jurisdictional barriers and missing private keys.

Prevention Beats Recovery

Security experts say OneCoin launched before modern on-chain detection tools existed. Today's monitoring systems can flag abnormal transaction patterns much earlier.

Privacy-enhancing techniques now complicate recovery even further. In 2024, privacy coins accounted for 42% of dark web crypto transactions.

Take: This seizure shows enforcement is catching up—but slowly. For you, the real lesson is that prevention and transparency matter more than hoping stolen funds get recovered years later.

oll: Which crypto moment feels unreal? |

Real Value (Sponsored)

The world is rapidly shifting to cashless systems, with countries like China leading the way.

As the U.S. rolls out FEDNOW, it’s clear that convenience could come at a steep price—your freedom.

With digital currencies, those who control the ledger control your ability to speak, transact, and live freely.

Stay informed and safeguard your future. Download our guide on CBDCs and protect your wealth.

ETFs

Bitcoin and Ether ETFs See Heavy Outflows as Institutions Turn Cautious

Spot Bitcoin ETFs recorded $483 million in net outflows in one day, led by selling in GBTC and FBTC. Ether ETFs followed with $230 million in outflows, snapping a five-day inflow streak.

The withdrawals came as global macro pressure intensified. US–EU trade tensions and Japanese bond sell-offs tightened liquidity across risk markets.

Risk Reduction, Not Panic

Analysts describe the flows as institutional caution rather than capitulation. Rising yields and geopolitical uncertainty are pushing funds to reduce exposure temporarily.

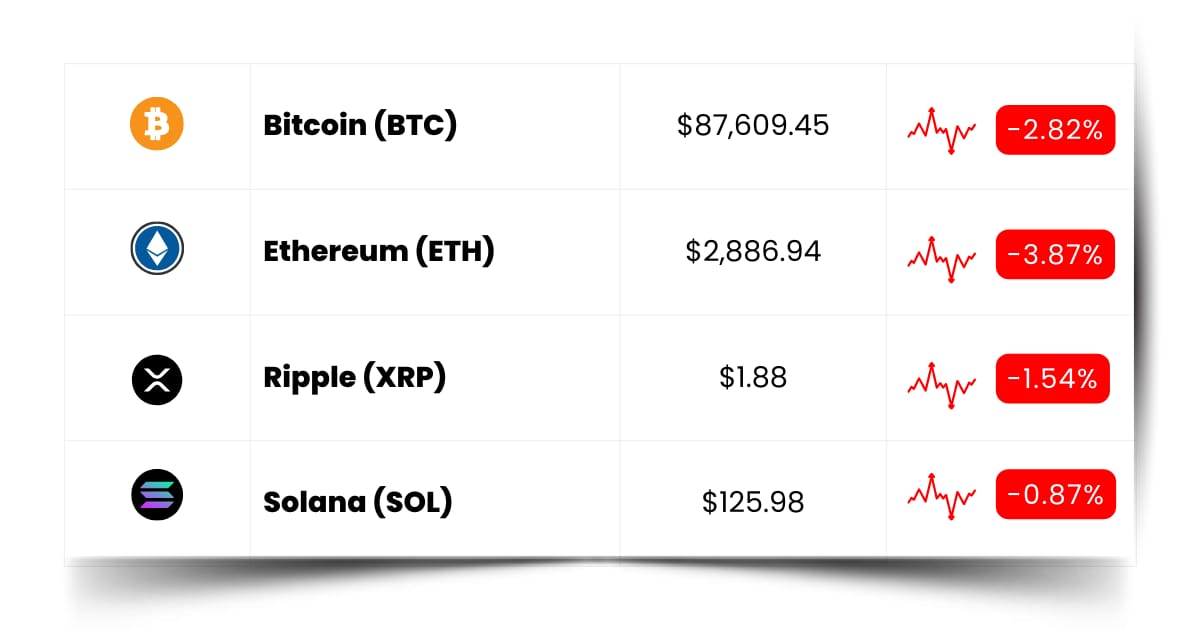

Bitcoin slipped below $89,000, while Ether traded under $3,000 as the outflows hit. XRP ETFs also saw record single-day exits, while Solana ETFs bucked the trend with modest inflows.

Whales Still Accumulating

Despite ETF selling, larger Bitcoin holders quietly added over 36,000 BTC in nine days. Smaller wallets trimmed exposure, highlighting a split between long-term and retail behavior.

On-chain data shows newer whales now control more of Bitcoin's realized cap. That shift can increase volatility during macro-driven moves.

Take: ETF outflows signal caution, not rejection. For you, this looks like institutions managing risk while larger holders accumulate underneath—often a setup that resolves once macro pressure eases.

Coin Leaderboard

Crypto Pulse

Macro pressure is squeezing Bitcoin, ETFs are flashing caution, and institutions are trimming risk—but speculative capital didn't leave the building. It just rotated.

GWEI, SKR, and ACU are running because traders are chasing catalysts that don't care about Davos speeches or ETF flows. This is a tape where headlines slow the majors, and momentum hunts anything with a clean trigger.

ETHGas (GWEI) $0.02716 (+86.21%)

GWEI jumped 62.85% after Binance Alpha confirmed the launch of a GWEI airdrop, pulling fast momentum into the token.

Solana Mobile Seeker (SKR) $0.01274 (+58.62%)

SKR climbed 54.41% as Solana Mobile's token airdrop went live, driving a surge in short-term trading interest.

Acurast (ACU) $0.1323 (+71.48%)

ACU rose 39.24% over the past 24 hours following its KuCoin listing, as fresh exchange liquidity brought the token into focus.

High-Quality Names (Sponsored)

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

See His Breakdown of the Seven Stocks You Should Own Here.

Future Forward

The earliest edges in crypto rarely show up on price charts first. They show up where builders ship half-finished ideas, users test things before they're polished, and momentum starts quietly forming.

Airdrops reward attention, not size. Showing up early, clicking through products, and engaging before hype kicks in often matters more than timing a perfect trade later.

Token launches are where stories meet reality. Some projects prove demand fast, others fade just as quickly—but both teach you what the market actually wants.

Conferences are where tomorrow's narratives get shaped before they trend. If you want context before confirmation, this is where it usually starts.

Crypto Conferences:

💎 W3Node Conference and Hackathon (Jan 22, 2026)

💎 Block Mountain 2026 (Jan 22, 2026)

💎 Crypto Gathering 2026 (Jan 22, 2026)

Upcoming Airdrops:

🎁 Rainbow (RNBW) Airdrop (Jan 26, 2026)

🎁 Tradoor (TRADOOR) Airdrop (Feb 2026)

🎁 SoSoValue (SOSO) Airdrop (Apr 2026)

Upcoming Token Launches:

🚀 ChimpX AI (CHIMP) IDO on Eesee (Jan 23, 2026)

🚀 Somate (SOMT) IDO on Spores (Jan 26, 2026)

🚀 AntDrop (ANT) IDO on KingdomStarter (Feb 2, 2026)

Which event are you most excited for? Let us know!

Crypto Know-How: What Was the OneCoin Scam?

OneCoin was marketed as a revolutionary cryptocurrency, but it never had a real blockchain. It relied on flashy events, aggressive sales tactics, and promises of guaranteed returns to pull people in.

Instead of mining or real transactions, OneCoin used internal databases to fake balances. Early participants were paid with money from newer investors, making it a classic Ponzi-style scheme.

When regulators closed in around 2017, the operation collapsed and its founder, Ruja Ignatova, disappeared. Authorities estimate investors lost up to $5 billion globally.

For you, OneCoin matters because it shows what crypto scams often look like in practice—big promises, vague tech, and pressure to recruit others. Real crypto works in public, on-chain, and without needing trust in a single person.

Everything Else

Binance will list Ripple's RLUSD stablecoin for spot trading on Ethereum this week, giving the $1.3 billion stablecoin its biggest liquidity boost yet, while XRP Ledger support is expected to follow.

Bitcoin search interest and social chatter dropped sharply in 2025 despite record prices, showing that price action alone is no longer enough to pull broad retail attention back into the market.

Galaxy Digital is launching a $100 million hedge fund split between crypto tokens and fintech stocks, signaling that large players are positioning to trade volatility rather than bet on a straight-line rally.

New submissions to the SEC are pushing for clearer rules around self-custody and DeFi trading, adding pressure on lawmakers to balance investor protection with innovation as CLARITY negotiations continue.

Vitalik Buterin proposed simplifying Ethereum staking with protocol-level distributed validators, a move aimed at making large-scale staking more secure and less dependent on centralized providers.

Crypto right now is less about chasing moves and more about reading signals. If you pay attention to where capital is cautious, where builders are active, and where ideas are still forming, you stay one step ahead—without needing the market to spell it out for you.

Best Regards,

— Benjamin Vitaris

Crypto Intel