- Crypto Intel

- Posts

- Markets Crack, ETFs Bleed, and a New Altcoin ETF Breaks Records

Markets Crack, ETFs Bleed, and a New Altcoin ETF Breaks Records

If you're trying to understand what this pullback actually means for your portfolio, this week's data tells a clear story: leverage unwound violently, ETF money is rotating, and altcoin demand isn't slowing down.

These moves show you where the big players are repositioning—and where opportunity tends to open up next.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Crypto just went through one of the sharpest resets in months, and the flow of money paints a very different story than the price charts.

Bitcoin broke support, ETFs saw historic outflows, and yet a brand-new XRP ETF launched with record demand—meaning the market isn't dying, it's reshuffling right in front of you.

Markets

Bitcoin Breaks Below $97K as $880M in Longs Wiped Out

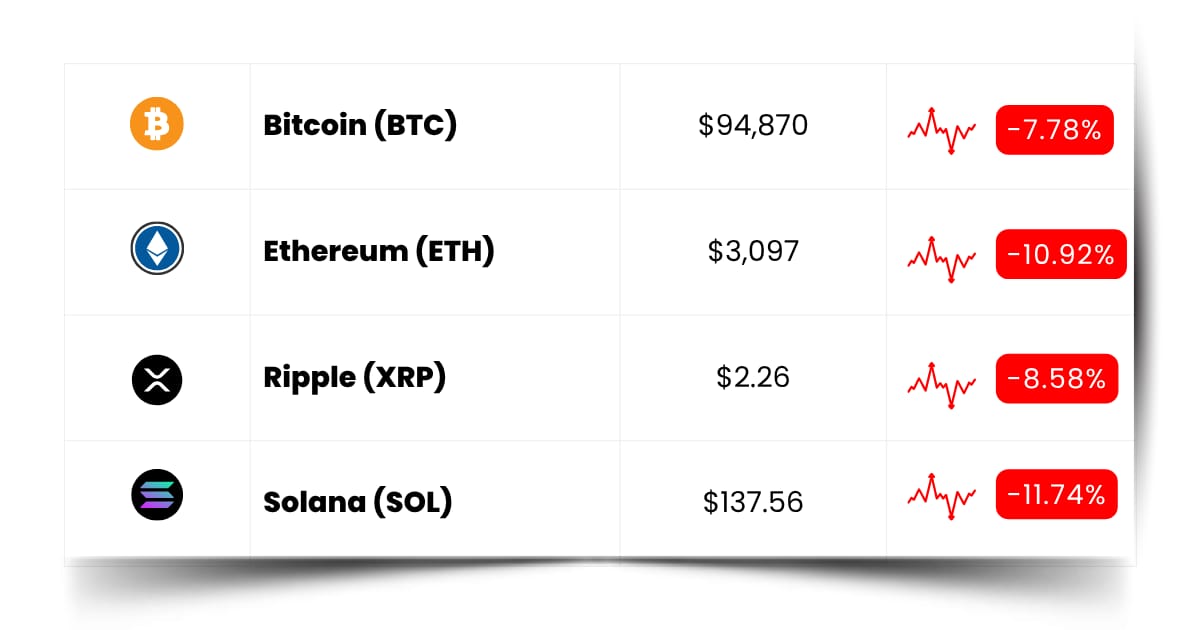

Bitcoin dropped below $97,000 for the first time since May, dragging majors like Ether, Solana, XRP, DOGE, and Cardano down around 8%. Risk appetite snapped as traders rushed to cut exposure.

Leverage Flush Meets Macro Pressure

About $1 billion in leveraged crypto positions were liquidated in 24 hours, with roughly $887 million coming from crowded longs.

A single oversized BTC long made up one of the biggest individual losses.

Major venues like Bybit, Hyperliquid, and Binance each saw heavy long liquidations, highlighting how one-sided positioning had become after last week's bounce.

Positive funding and rising open interest turned into fuel once the price reversed.

Once Bitcoin lost $100,000, liquidity thinned and price slid toward the $97,000 zone.

Thin spot volumes amplified every move, leaving little room for clean exits or confident dip-buying.

China's latest data showed slowing industrial production and falling fixed-asset investment, while odds of a December Federal Reserve rate cut fell after cautious commentary.

Asian stocks dropped, and crypto again traded like high-beta macro risk as investors rotated into cash.

Take: Leverage washouts like this are painful, but they often clear the field for stronger hands.

If macro volatility cools and Bitcoin stabilizes in the mid-$90Ks, this could look more like a harsh reset than the start of a lasting downtrend.

ETFs

Bitcoin ETFs Bleed $869M in Second-Highest Outflow on Record

US-listed spot Bitcoin ETFs saw $869.86 million in net outflows on Thursday, the second-largest daily bleed since launch.

Over the past three weeks, these funds have lost a combined $2.64 billion as sentiment turned cautious.

Risk-Off Rotations Take Over

The exodus came as Bitcoin slipped below the key $100,000 level and risk appetite faded on Wall Street.

Ether ETFs were also hit, registering $259.72 million in outflows in their worst day since mid-October.

These moves show that even structured, regulated products aren't immune when macro jitters flare.

For many institutions, ETFs have become a convenient way to dial exposure up or down without touching spot exchanges.

Bitcoin now trades near $97,500, down more than 5% on the day and 11% month-to-date.

That drawdown mirrors broader weakness across tech and growth assets as traders reassess the rate outlook.

Behind the scenes, interest-rate expectations have shifted as Federal Reserve officials strike a cautious tone on cuts.

With odds of a December cut slipping, some investors are choosing to lock in profits and wait for clearer signals.

Take: ETF flows often move ahead of headlines and retail sentiment, turning before price does.

If you watch this channel closely, shrinking outflows—or the first return to net inflows—could be your earliest clue that big money is quietly stepping back in.

Trivia: What’s the term for creating a new crypto coin? |

Clear Winners (Sponsored)

The difference between a “good trade” and a wealth-building move?

Timing and precision.

Our analysts just dropped a new report: 5 Stocks Set to Double.

Inside, you’ll find:

Companies with fundamentals built for staying power

Technical setups flashing breakout signals

Analyst insights you won’t find anywhere else

Past reports uncovered winners that soared +175%, +498%, even +673%.¹

This free edition expires at midnight.

[Get your copy before the window closes]

XRP

Canary's XRP ETF Leads 2025 Launches With $58M Day-One Volume

Canary Capital's XRPC ETF launched with a standout $58 million in first-day trading volume, the strongest debut among more than 900 US ETF launches this year.

It narrowly edged out Bitwise's Solana ETF, which posted $57 million on its first day.

A Breakout Debut for Regulated XRP Exposure

The XRPC ETF is the first US spot ETF tied directly to XRP, giving institutions regulated access to the payments-focused asset.

The debut highlights a growing appetite for altcoin exposures that go beyond Bitcoin and Ethereum.

Despite the ETF's big opening-day volume, XRP's spot price barely moved, suggesting traders are treating it as a longer-term allocation vehicle.

That trend mirrors other altcoin ETF launches, where product demand grows even if immediate price action doesn't.

The strong start also comes as institutions search for assets with real-world utility, and the XRP Ledger's payment-oriented design fits that narrative well.

Investors appear increasingly willing to diversify across multiple chains via regulated instruments.

Whether early volume holds will depend on broader market resilience as risk sentiment remains shaky.

Still, XRPC and BSOL are clearly setting the benchmark for 2025's altcoin ETF lineup.

Take: Early success doesn't guarantee long-term flows, but it does show where attention is shifting.

If institutions continue rotating into altcoin ETFs, it's a sign that the next phase of adoption may center on diversified, utility-driven exposure rather than just the big two.

Coin Leaderboard

Crypto Pulse

Some coins clearly didn't get the memo about the market-wide panic.

RIF ripped +61.75% after last week's crash, ALPHA erased a month of losses in a single candle, and SHARP bounced hard with a clean 24% reset.

Even on the days Bitcoin gets rag-dolled and ETFs bleed billions, small caps keep proving they live in their own universe.

The big money is rotating cautiously, but down here in the trenches, momentum flips fast—and the traders paying attention always spot it first.

Rifampicin (RIF) $0.01279 (+61.75%)

RIF roared back after its November 10 crash, jumping 61.75% in the past 24 hours and securing the top spot on today's Crypto Pulse leaderboard.

Stella (ALPHA) $0.01142 (+46.81%)

ALPHA snapped its month-long downtrend with a sharp 46.81% rebound, wiping out its 30-day losses in a single move.

Sharp (SHARP) $0.005427 (+24.33%)

SHARP bounced back quickly after a brief dip, climbing 24.33% as buyers stepped in to reclaim lost ground.

Fresh Market Insights (Sponsored)

A proven model that has historically outpaced the market just released its new rankings.

Only 7 stocks qualified for this month’s exclusive list.

These names have shown the strongest signals for short-term growth.

Get the full list while it is still available free of charge.

See the 7 Best Stocks Before Your Next Trade

Future Forward

The next big winners in crypto aren't sitting on the front page of X—they're being quietly stitched together in late-night Discord calls, half-finished GitHub commits, and testnets even the devs forget to announce.

These are the projects you only stumble onto when you go looking for the weird stuff no one else is paying attention to.

The teams behind them aren't chasing hype cycles or influencer clout; they're too busy shipping things that actually work.

By the time the masses realize what's happening, the early users have already moved on to the next experiment—and that's where the real edge always hides.

Crypto Conferences:

💎 Blockchain Campus Conference Luzon (Nov 15, 2025)

💎 Staking Summit Buenos Aires 2025 (Nov 15, 2025)

💎 ACM International Conference 2025 (Nov 15, 2025)

Upcoming Airdrops:

🎁 Nubila Network (NB) Airdrop (Nov 17, 2025)

🎁 peaq (PEAQ) First Yield Payout (Dec 2025)

Upcoming Token Launches:

🚀 ArcaneVault (AV) IDO on Spores (Nov 17, 2025)

🚀 Blink Galaxy (BG) TGE and Distribution (Dec 1, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Grayscale?

Grayscale is one of the biggest gateways for traditional investors to get exposure to crypto without touching an exchange or a wallet.

Think of it as the bridge that lets institutions buy Bitcoin and other assets inside familiar investment wrappers like ETFs and trusts.

The company originally became famous for the Grayscale Bitcoin Trust (GBTC), which helped bring billions of dollars of big-money capital into crypto long before spot Bitcoin ETFs even existed.

Investors liked it because they could buy Bitcoin through their brokers the same way they bought stocks.

Today, Grayscale runs a whole lineup of crypto investment products, ranging from Bitcoin to diversified "crypto baskets" that spread exposure across multiple coins.

Its business model is simple: make crypto accessible to people who want regulated, traditional investment structures.

The reason Grayscale matters now is that it helps show what institutions are actually doing behind the scenes.

When money flows into (or out of) Grayscale products, it's often one of the earliest signs of how traditional finance feels about where crypto is heading next.

Everything Else

The Czech National Bank created a $1 million test portfolio that includes Bitcoin, marking the first time a central bank has put BTC directly on its balance sheet as it experiments with blockchain-based assets.

Grayscale filed for a US IPO, signaling that one of crypto's biggest asset managers is pushing deeper into public markets even as revenue softens and ETF competition accelerates.

The Independent Community Bankers of America urged regulators to block Sony Bank's trust charter, arguing its stablecoin plan sidesteps traditional banking safeguards and could blur the line between deposits and digital money.

The dYdX community approved a major tokenomics update that boosts buybacks from 25% to 75% of protocol revenue, tightening supply and tying token incentives more directly to platform activity.

Emory University's endowment doubled its stake in the Grayscale Bitcoin Mini Trust to roughly $52 million, underscoring how even conservative institutional funds are slowly increasing their Bitcoin exposure through ETFs.

Crypto never moves in a straight line, but the people who consistently win are the ones who stay curious and keep exploring corners of the market everyone else overlooks.

Use the noise as background music, follow the flows that actually matter, and don't be afraid to dig into the strange, the experimental, and the early-stage ideas—because that's usually where the next cycle starts taking shape.

Best Regards,

— Benjamin Vitaris

Crypto Intel