- Crypto Intel

- Posts

- Markets Waited on Powell—Crypto Traders Didn't

Markets Waited on Powell—Crypto Traders Didn't

Markets are shifting again—just not in the way you'd expect.

The Fed is hinting at the end of tightening, corporate treasuries are doubling down on Bitcoin, and Asia's stablecoin players are going public in the US.

If you want to stay ahead of what's moving real capital, this issue breaks down where conviction—and opportunity—are quietly building.

2025 Profit Catalysts (Sponsored)

Thousands of stocks were analyzed — only five made the cut.

This exclusive new report, “5 Stocks Set to Double,” highlights the companies that could be positioned for breakout growth as market trends shift heading into the new year.

Each one is backed by strong fundamentals and promising technical setups that could make early investors smile.

Past reports following this same system uncovered stocks that soared +175%, +498%, even +673%.

Download your free “5 Stocks Set to Double” report now before the clock hits midnight.

Your next big winner might be waiting inside.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News — What This Means for You

This week's headlines aren't just noise—they're signals.

The Fed's softening stance could reshape liquidity, DATs are redefining how companies hold Bitcoin, and OwlTing's Nasdaq debut shows stablecoins are entering the regulated big leagues.

If you're watching for where the next rotation lands, start here.

We'll show you what Powell's hint really means for risk assets, why "just buy the ETF" might still be the smartest move, and how Asia's stablecoin surge could change how you move money next.

Markets

Bearish BTC Sentiment Persists Despite Powell's Signal That QT May Be Nearing End

Federal Reserve Chair Jerome Powell hinted that the central bank may soon wrap up its balance sheet reduction program, known as quantitative tightening (QT).

The Fed's balance sheet has already dropped from $9 trillion to $6.6 trillion since 2022, marking one of the largest liquidity pullbacks in history.

Dovish Hints, Cold Market Reaction

Powell said reserves are nearing the "ample" level the Fed deems necessary to keep funding markets stable.

Traders took this as a dovish sign—but Bitcoin didn't.

The leading crypto stayed flat around $112,600 even as bond yields and the dollar fell.

Derivatives markets showed persistent bearishness, with BTC puts still commanding premiums over calls.

No Easy Win for Crypto Bulls

The slowdown in QT since mid-2024 means this isn't a full policy pivot.

Monthly Treasury redemptions are already capped, and the Fed appears cautious about reigniting excess liquidity.

Macro traders are reading this as a "pause, not a pivot."

Meanwhile, gold climbed above $4,200, and tech stocks edged higher, stealing some of crypto's usual safe-haven shine.

Take: Powell's tone sounded dovish, but Bitcoin barely blinked—a reminder that less tightening doesn't mean more liquidity.

For now, crypto markets want confirmation, not conversation. Stay alert but patient; the macro tide hasn't turned yet.

Institutional Investment

DATs Keep Buying Bitcoin, But ETFs Still Win the Performance Game

Digital Asset Treasuries (DATs)—companies hoarding Bitcoin through balance-sheet plays—are booming in number but not in returns. Most are still underperforming both Bitcoin and ETFs that track it.

The Promise vs. Reality

DATs like MicroStrategy, GameStop, and Trump Media built their pitch on financial engineering and leverage.

But clever accounting hasn't beaten simple exposure.

Only a few outliers, like Japan's Metaplanet and Twenty One Capital, managed to outperform BTC this year.

The rest remain underwater, weighed down by expensive debt and shrinking premiums.

Fragile Foundations

Analysts warn that the DAT trade works only when credit markets stay friendly.

If rates rise or premiums collapse, the strategy unravels fast.

Galaxy Digital likened it to the 1920s investment-trust bubble—profitable until confidence cracks.

NYDIG added that popular metrics like "mNAV" overstate performance by ignoring debt obligations.

Adoption Still Growing

Despite the flaws, corporate Bitcoin adoption is accelerating.

Nearly 40% more companies now hold BTC than three months ago, showing institutional interest is alive and well.

Take: DATs made Bitcoin corporate, but ETFs made it simple.

If you're after clean exposure without the financial gymnastics, ETFs still win on clarity, cost, and credibility.

Poll: Which crypto use case do you think is most overhyped? |

Regulation Breakthrough (Sponsored)

After years of uncertainty, crypto just got its biggest breakthrough.

Congress passed nationwide legislation—and the market surged past $4 trillion almost immediately.

Here’s what that means:

✓ Institutions now have a greenlight.

✓ Banks are preparing customer-facing crypto services.

✓ Wall Street is finally free to scale in.

Most investors still haven’t caught on.

Our free book, Crypto Revolution, breaks down what this means for you—and how to get positioned before the next adoption wave.

You’ll also receive $788 in free bonus resources when you claim your copy.

[Claim Your Free Copy Now]

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Stablecoins

Taiwanese Stablecoin Firm OwlTing Secures Nasdaq Listing Amid Regulatory Momentum

OwlTing, a Taiwan-based stablecoin infrastructure company, is set to debut on the Nasdaq under ticker OWLS this Thursday.

The direct listing highlights both transparency and the growing appeal of regulated blockchain firms in the US market.

A New Era for Asian Blockchain Firms

OwlTing chose the Nasdaq Global Market for its stricter listing standards and global reach.

The move signals confidence in mainstream investor appetite for stablecoin-related businesses.

Stablecoins now process roughly $30 billion in daily transactions, yet they remain under 1% of global payment flows.

Analysts expect circulation to surge toward $2 trillion by 2028.

Regulation and Competition Heat Up

New laws like the GENIUS Act are redefining digital currency compliance.

Meanwhile, heavyweights like Stripe, Ripple, and Circle are racing to secure federal banking charters.

Major banks from Goldman Sachs to UBS are also exploring a G7-backed stablecoin, underscoring how institutional this market has become.

OwlTing's pivot from e-commerce to blockchain payments now looks perfectly timed.

Take: OwlTing's Nasdaq debut isn't just a win for one company—it's proof that regulated stablecoin infrastructure is going mainstream.

If this trend holds, stablecoins could soon become the backbone of global payments rather than just the rails of crypto.

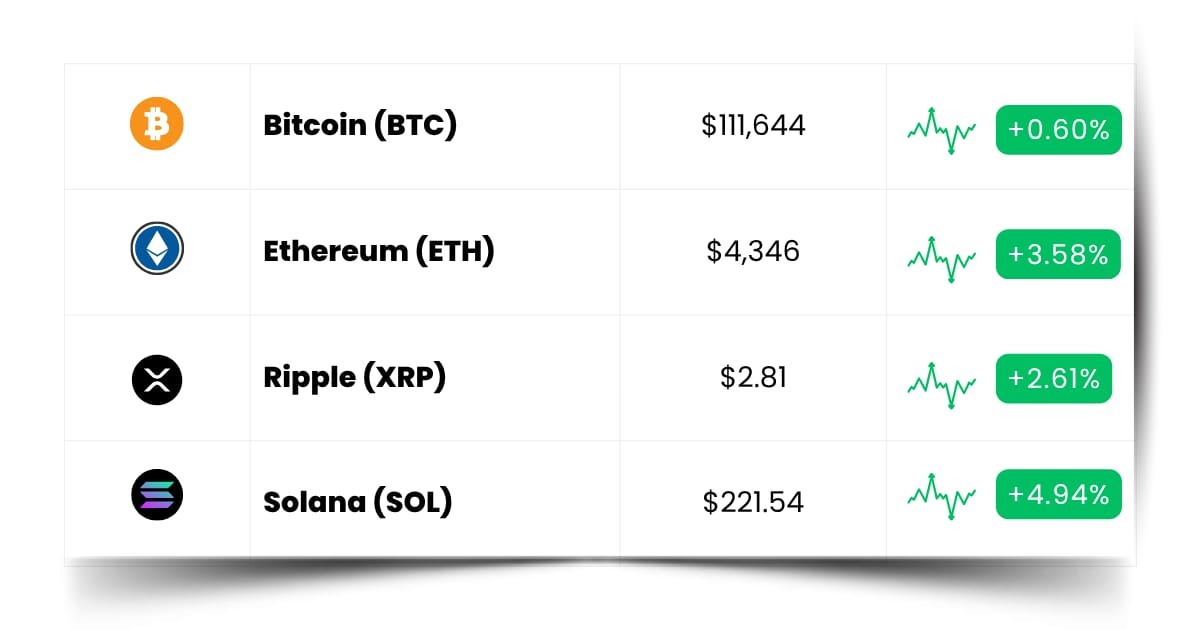

Coin Leaderboard

Crypto Pulse

Momentum found a new home this week—and it's not just Bitcoin.

Fresh listings, revived narratives, and ecosystem rallies lit up the charts as traders rotated into anything with a catalyst and a story to match.

CLO blasted 260% out of the gate after its Binance Alpha debut, COAI ripped 125% as AI tokens regained their spark, and BAS kept climbing alongside BNB's roaring chain activity.

It's a reminder that even when the macro mood feels muted, micro narratives can still go full throttle.

The big movers aren't waiting for Powell or Wall Street—they're chasing flow, traction, and timing.

In a market fueled by liquidity whispers and narrative pivots, catching the next one early is still the cleanest edge there is.

Yei Finance (CLO) $0.5944 (+260.32%)

Fresh off its Binance Alpha listing, CLO rocketed 260.32% as traders piled into the newly launched token.

ChainOpera AI (COAI) $19.40 (+125.84%)

After cooling off from its all-time high, COAI rebounded sharply with a 125.84% surge, reigniting momentum around AI-driven protocols.

BNB Attestation Service (BAS) $0.1111 (+123.40%)

BAS extended its rally with a 123.40% gain, fueled by renewed BNB Chain activity and broader ecosystem strength.

Surge Potential Ahead (Sponsored)

Some stocks take months or years to move. Others? They can move in weeks.

That’s why we’ve just released a FREE report: 7 Best Stocks for the Next 30 Days.

Less than 5% of all publicly traded companies meet the strict criteria to make this list.

These are hand-selected from thousands of candidates — the very best positioned for potential short-term upside.

If you’re looking for fresh ideas to fuel your next trade, this is the list to start with.

[Download your FREE copy now] before you place your next trade.

Timing is everything in the market.

Don’t wait until these moves are yesterday’s news.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Future Forward

Your next big win probably isn't hiding in a chart—it's sitting in a date you haven't circled yet.

The smartest traders aren't chasing candles; they're front-running catalysts that move markets before headlines do.

Conferences, airdrops, token launches—this is where conviction turns into opportunity.

Pick two events that fit your strategy, set those alerts, and get ready to act while everyone else is still scrolling through yesterday's news.

Crypto Conferences:

💎 RegTech Summit London 2025 (Oct 16, 2025)

💎 Legends4Legends 2025 (Oct 16, 2025)

💎 Instant Payments Summit 2025 (Oct 16, 2025)

Upcoming Airdrops:

🎁 Matchain (MAT) Airdrop (Oct 19, 2025)

🎁 DFDV Staked SOL (DFDVSOL) Airdrop (Oct 23, 2025)

Upcoming Token Launches:

🚀 FacilPay (FACIL) IDO on Spores (Oct 16, 2025)

🚀 Adix (ADIX) IDO on Kommunitas (Oct 18, 2025)

🚀 Momentum (MMT) IDO on Buidlpad (Oct 22, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Was LuBian?

LuBian was once one of the world's largest Bitcoin mining pools, processing transactions and securing the network from deep inside China and Iran.

Think of it as a digital gold mine—powerful computers working nonstop to earn BTC for their operators.

In 2020, LuBian vanished almost overnight after a massive hack drained over 127,000 Bitcoin, worth more than $14 billion today.

Investigators later linked the theft to the Prince Group's criminal network in Cambodia, which ran large-scale online scam operations using the stolen crypto.

After years of silence, a wallet tied to LuBian suddenly moved over $1 billion in Bitcoin in 2025, sparking fresh speculation about who actually controls the funds.

The US government has since seized the coins in what it calls the largest crypto confiscation in history.

LuBian's story is a stark reminder that even in crypto, "out of sight" doesn't mean gone.

Security, transparency, and accountability aren't optional—they're the difference between building wealth and watching it disappear.

Everything Else

The UK Electoral Commission will update its crypto donation rules after Reform UK reportedly became the first political party in the country to accept a crypto contribution, sparking debate over transparency and foreign influence in campaign funding.

A dormant wallet tied to the hacked LuBian mining pool moved 9,757 BTC worth $1.1 billion after three years of silence, raising questions about whether the coins are being secured or liquidated as US authorities pursue related forfeiture cases.

Ripple is expanding its institutional custody network to Africa through a partnership with South Africa's Absa Bank, marking another step in its strategy to power blockchain infrastructure across emerging markets.

NFT markets are showing signs of recovery after losing $1.2 billion in last week's crypto crash, though major collections like BAYC and CryptoPunks remain deep in the red as liquidity and sentiment slowly return.

US authorities seized over $14 billion in Bitcoin from Cambodia's Prince Group in what they called the largest-ever crypto confiscation, charging the company's leader in a sweeping crackdown on global "pig butchering" scam networks.

Markets move in cycles, but insight moves first.

Keep your curiosity switched on, your strategy flexible, and your conviction steady—because in crypto, the quietest signals often spark the loudest gains.

Best Regards,

— Benjamin Vitaris

Crypto Intel