- Crypto Intel

- Posts

- Money Rotates, Builders Go Public, and Europe Gets Serious About Crypto

Money Rotates, Builders Go Public, and Europe Gets Serious About Crypto

Crypto just reminded everyone it doesn't move in a straight line—profits are being taken, liquidity's still strong, and the next winners are setting themselves up in plain sight.

While prices cool, big players are stepping onto US public markets and regulators are tightening the rails, meaning this phase isn't about hype—it's about positioning.

If you're trading this market or building in it, this week tells you exactly where capital, regulation, and long-term conviction are heading next.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

The market just cooled off—not because sentiment died, but because smart money locked in gains after a monster run.

At the same time, Animoca is taking Web3 into US capital markets and Europe is moving toward unified crypto supervision, showing this industry is getting more grown-up and more global.

If you're trying to figure out whether to wait, rotate, or lean in, these shifts give you the signal—the noise right now is price action, the real story is where infrastructure and regulation are going.

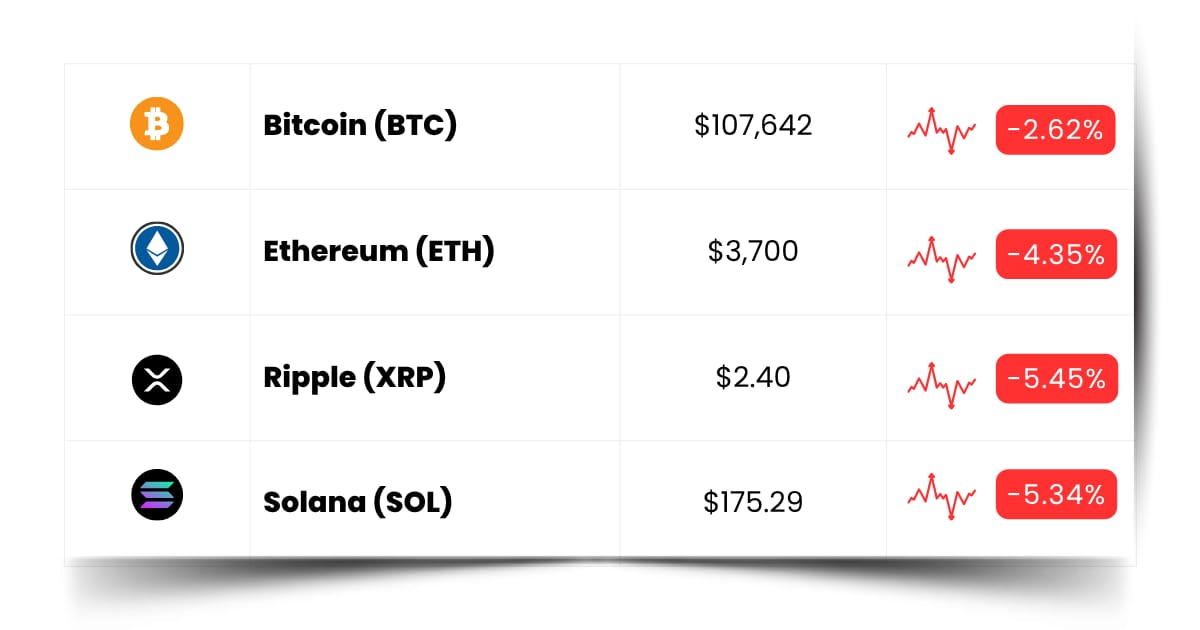

Markets

Dogecoin and Cardano Lead Sell-Off as Profit-Taking Hits Crypto and Gold Softens

Major tokens slid as much as 5% to start the week, marking crypto's worst October since 2015.

Bitcoin slipped toward $106,000 after failing to hold above $113,000, while Dogecoin and Cardano led losses with roughly 5% drops.

Profit-Taking and Weak Momentum

Analysts say there was no single catalyst—just classic profit-taking after last week's bounce.

Traders noted fading bullish momentum as Bitcoin repeatedly rejected the $113,000 level, a key line the market hasn't reclaimed convincingly.

Macroeconomic support didn't show up either, with sentiment cooling as investors waited for new clarity from the Fed.

Without strong fundamentals pushing the market, liquidity chased safer positioning instead of risk.

Long-Term Holders Step In to Sell

Glassnode data shows long-term Bitcoin holders have tripled their selling since June.

Many of them bought around $93,000 earlier this year, locking in gains while spot volume topped $300 billion in October.

That volume surge signals strong two-way liquidity, even if the price dipped. In other words, buyers are still here—but they're picky, not chasing green candles.

Gold Eases After China Reverses Tax Rebate

Gold steadied near $4,000 after an early drop triggered by China ending tax rebates for select gold retailers.

The move could slow demand in one of the world's biggest bullion markets after a record-setting rally.

Despite the pullback, gold remains up more than 50% year-to-date. Bitcoin has been moving more in sync with gold lately as both respond to rate expectations and global risk sentiment.

Take: This isn't panic—it's rotation. When strong hands take profits and volume stays healthy, you're seeing a digestion phase, not the end of the trend, so if you're long-term, this is where you tighten conviction instead of emotions.

Finance

Animoca Brands Targets Nasdaq in Reverse Merger to Build Web3 Powerhouse

Animoca Brands has filed to list on Nasdaq through a reverse merger with Singapore-based Currenc Group.

The combined company would become the first publicly listed conglomerate spanning digital assets, gaming, NFTs, AI, and DeSci.

Strategic Shift Into Broader Digital Assets

The move gives US public-market investors direct exposure to crypto gaming, altcoins, and tokenized IP at scale.

Animoca plans to open a New York office to support the shift and court institutional investors.

Currenc will spin off its non-core AI and remittance businesses to streamline ahead of the deal. After completing that, shareholders would vote on the combination, with a closing targeted for 2026.

Revenue Growth Highlights Momentum

Animoca said its Digital Assets Advisory arm earned $165 million in 2024, up 116% year-over-year.

Meanwhile, the Web3 gaming and NFT division declined 40% to $110 million, showing a shift away from pure gaming hype toward a broader digital asset economy.

Currenc's stock has already more than doubled in the past week, set to open near $3.78. Markets seem to like the bet on a diversified crypto-native investment vehicle.

Take: This move signals that big-vision Web3 companies aren't waiting for traditional IPO approvals—they're hacking the system, and if you're looking at long-term exposure to crypto culture + infrastructure, this could one day be one of the flagship vehicles.

Trivia: Which crypto is famous for smart contracts and decentralized apps? |

High-Potential Alert (Sponsored)

Most investors focus on what already moved.

The smart ones focus on what’s about to.

This newly released 5-stock report reveals companies showing early momentum patterns that have historically preceded massive breakouts.

Each one has been screened for earnings acceleration, demand trends, and strong fundamentals — the traits shared by previous top performers.

But this exclusive report won’t be available for long — it’s free until midnight tonight.

[Get the Free 5 Stocks Set to Double Report Now]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Policy

EU Weighs "SEC-Style" Crypto and Stock Oversight Under ESMA

The European Commission is considering centralizing supervision of crypto exchanges and financial markets under ESMA.

The proposal aims to cut red tape across member states and build a unified capital market competitive with the US.

A Push Toward Stronger Market Integration

Today, national regulators control most oversight, slowing cross-border operations and raising compliance costs.

Centralizing at ESMA would streamline licensing and potentially reduce regulatory loopholes.

Christine Lagarde has publicly backed the idea of a "European SEC" to monitor both traditional and crypto markets.

The draft is expected in December, with ESMA gaining final say in cross-border disputes.

MiCA Enforcement Questions Resurface

France has already signaled concern over crypto firms shopping for lax jurisdictions under MiCA's passporting system.

It's now the third country to push for ESMA control, joining Austria and Italy in calling for harmonized enforcement.

Under MiCA, firms licensed in one country can operate across the EU, but fragmentation remains. Central supervision could tighten standards and reduce regulatory arbitrage.

Take: Europe wants to compete with the US on capital markets—and stronger, unified crypto oversight is part of that ambition, so if you're operating or investing in EU crypto, expect tighter guardrails but potentially smoother scaling across borders.

Coin Leaderboard

Crypto Pulse

The headlines were all about sell-offs, Nasdaq ambitions, and European regulators sharpening their pencils.

But under the surface, micro-caps kept dancing—because momentum doesn't disappear in crypto, it just hides until it finds a fresh spark.

Jelly-My-Jelly (JELLYJELLY) $0.1195 (+99.85%)

JELLYJELLY ripped nearly 100% in 24 hours after getting slammed earlier this week, proving micro-cap volatility cuts both ways when buyers return.

0G (0G) $1.39 (+36.81%)

0G snapped a month-long downtrend with a 36.8% rebound, showing fresh momentum.

XSwap (XSWAP) $0.05024 (+35.76%)

XSWAP jumped 35.7% after announcing a Chainlink partnership aimed at powering instant cross-chain token launches.

Limited-Time Access (Sponsored)

Investors are watching closely as 7 select stocks begin to show signs of short-term strength.

Each one met strict criteria for growth, valuation, and momentum — indicators that have historically pointed to potential breakouts.

The opportunity may be short-lived, so timing is everything.

Review the report now and see which stocks could be poised for strong performance this month.

Click Here for the Free 7 Best Stocks Report

Future Forward

The next big moves aren't happening on price charts—they're being stitched together in dev channels, testnets, and tiny alpha leaks that most people scroll past.

By the time Crypto Twitter screams about it, the early seats are already taken.

Stealth airdrops, private test phases, and protocols quietly opening their gates to early adopters are where the edge is right now.

If you're only staring at charts and waiting for influencers to bless your bags, you're basically showing up to the buffet after the plates are empty.

Crypto Conferences:

💎 Frankfurt Crypto Conference 2025 (Nov 4, 2025)

💎 Money Expo Oman 2025 (Nov 4, 2025)

💎 DIGITAL FORENSICS CONFERENCE 2025 (Nov 4, 2025)

Upcoming Airdrops:

🎁 Monad (MON) Airdrop (Nov 3, 2025)

🎁 RealLink (REAL) Airdrop (Nov 3, 2025)

Upcoming Token Launches:

🚀 MemeMarket (MFUN) TGE and Distribution (Nov 5, 2025)

🚀 Friendly Giant AI (GIANTAI) IDO on Spores (Nov 10, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Balancer?

Balancer is a decentralized exchange that lets people trade tokens and provide liquidity without relying on a traditional middleman.

Instead of buyers and sellers matching orders like a normal exchange, Balancer uses automated smart contracts to handle trades.

What makes Balancer special is its ability to build custom liquidity pools with multiple tokens and flexible weightings—meaning you don't need a simple 50/50 pair like Uniswap.

You can have a pool that's 80% ETH and 20% stablecoins, or even pools with eight different assets that rebalance automatically.

Balancer v2 combined all liquidity into one shared vault, making swaps more efficient and letting developers build new pool types on top of the core system.

It's like having a giant financial engine, and anyone can plug in new trading logic without rebuilding the whole protocol.

In simple terms: Balancer is the "build-your-own-DEX" platform of crypto—powerful, flexible, and designed for creative DeFi use cases.

Just remember, with great flexibility comes responsibility; even the most advanced systems need airtight security, and exploits remind us that innovation always carries risk.

Everything Else

Balancer suffered an apparent exploit—roughly $110M in osETH, WETH, and wstETH drained across V2 vaults on Sonic/Polygon/Base—with the exploiter consolidating funds, BAL down ~5%, and forked projects like Beets Finance also hit.

In a 60 Minutes interview, President Trump defended pardoning Binance founder CZ, saying he didn't know him and calling prior actions a Biden "witch hunt" while brushing off questions about his family's stablecoin deal.

French MPs advanced a measure to tax "unproductive wealth" including large crypto holdings—1% above €2M—framing it as pro-investment reform even as industry voices warn it could force sales and signal anti-crypto bias.

HIVE Digital hit 23 EH/s of Bitcoin capacity and is converting sites into liquid-cooled, AI-ready data centers, targeting ~36,000 GPUs by 2026.

Zerohash secured a MiCA license via the Dutch AFM, positioning as EU stablecoin infrastructure, as rumors swirl that Mastercard may acquire it for $1.5B–$2B amid expanding stablecoin settlement pilots.

This market rewards the people who stay curious and keep moving while everyone else doomscrolls and second-guesses themselves.

Don't let sideways price action fool you—foundations are getting laid, and the next wave always hits when everyone thinks they're safe to look away.

Best Regards,

— Benjamin Vitaris

Crypto Intel