- Crypto Intel

- Posts

- Pardons, Perps, and Power Plays: Crypto's Tide Just Turned

Pardons, Perps, and Power Plays: Crypto's Tide Just Turned

This week, crypto stopped waiting for approval—it took it.

Trump's pardon of Binance's CZ reignited political momentum, JPMorgan's crypto-collateral plan bridged Bitcoin with Wall Street, and DeFi perps blew past $1 trillion in volume.

If you've been sitting on the sidelines, this might be your signal—because institutions, politics, and traders are all moving in the same direction again.

Final Days to Get $12 Cocktails for Life

On New Year’s Eve 2006, Death & Co’s opening night, its signature cocktails cost $12. Now Death & Co is offering that pricing for life to select investors.

But the real opportunity in owning Death & Co stock isn’t just the cocktail price, it’s sharing in the company’s growth potential.

They attract 10,000+ weekly bar visitors and project to make over $20M this year. And that’s just the start. They project revenue will grow 5.5X in just four years.

The award-winning hospitality brand is currently opening new bars and hotels in major US cities and international locations, with their newly debuted boutique hotel in Savannah attracting national media attention.

As a thank you for joining their investor community, Death & Co is offering exclusive benefits to shareholders, including investor happy hours, priority reservations, $12 cocktails for life, and more.

But the investment window ends on October 30, so you don’t have time to wait.

This is a paid advertisement for Death & Company’s Regulation A offering. Past performance is not indicative of future results. Please read the offering circular at invest.deathandcompany.com.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News — What It Means for You

Crypto's power balance is shifting fast. The White House, Wall Street, and DeFi all made moves this week that could redefine who controls the next bull run.

From Trump's full-blown policy pivot to banks opening their doors to Bitcoin and on-chain traders rewriting records, every headline points to the same thing: crypto's comeback isn't hype—it's structural.

These aren't just updates; they're turning points—and knowing where they lead could give you a serious edge before the crowd catches up.

Policy

Binance's CZ Wins Presidential Pardon From Donald Trump

Changpeng "CZ" Zhao just got one of crypto's most unexpected comebacks.

The Binance founder has been officially pardoned by US President Donald Trump, ending a two-year saga that once threatened to exile him from the industry's core markets.

From Prison to Pardon

CZ pleaded guilty in 2023 to violating the Bank Secrecy Act and served four months in prison.

His plea deal cost him $50 million personally and forced Binance to pay $4.3 billion in fines and submit to a court-appointed monitor.

Trump's team called the case part of the Biden administration's "war on crypto."

White House Press Secretary Karoline Leavitt said the prosecution damaged America's reputation as a hub for innovation and that the "war on crypto is over."

Back in the Spotlight

BNB jumped about 3% after the pardon hit the wires. CZ thanked Trump on X, saying he was "deeply grateful" and hinting at future plans to resume business activity in the US.

Democratic lawmakers weren't pleased. Senator Elizabeth Warren called it "corruption in broad daylight," accusing Trump of rewarding political donors and crypto allies.

Take: This pardon signals a seismic political shift.

With the White House now openly courting crypto votes, investors could see a friendlier policy climate—but expect partisan flare-ups and volatility as regulators, politicians, and markets recalibrate around Trump's pro-crypto stance.

Institutions

JPMorgan to Let Clients Use Bitcoin and Ethereum as Loan Collateral

Wall Street's biggest bank is finally letting crypto sit at the grown-ups' table.

JPMorgan is reportedly preparing a framework that would allow institutional clients to post Bitcoin and Ethereum as collateral for loans.

Bringing Crypto Into Credit

The plan, revealed by Bloomberg, would rely on a third-party custodian to hold the pledged tokens.

Clients could borrow against their crypto holdings without forcing JPMorgan to take direct custody of digital assets.

The pilot builds on the bank's earlier decision to accept crypto ETFs as collateral.

This time, it's extending that logic to the assets themselves—putting Bitcoin and Ethereum alongside Treasuries and gold in Wall Street's collateral ecosystem.

Risk and Reward

Industry voices called the move "inevitable," though not without irony.

Bitcoin was designed to eliminate counterparty risk, yet it's now being folded into the very credit systems it sought to disrupt.

Analysts noted that banks will need new models to manage 24/7 price swings, real-time margin calls, and custodial solvency.

The program could go live by year-end, with expanded adoption likely to follow among competing lenders.

Take: If JPMorgan pulls this off, it could legitimize crypto as a mainstream financial asset.

For investors, it means more liquidity options—but also a reminder that as crypto integrates with traditional finance, it becomes more exposed to its risks, not just its rewards.

Trivia: What’s the largest NFT marketplace by volume? |

Profit Watchlist Ready (Sponsored)

The market won’t wait—and neither should you.

Our research team identified 5 rare stocks positioned for explosive upside.

What’s inside this report?

Bulletproof fundamentals

Momentum building now

A clear roadmap of why they made the cut

These reports have a history of spotting triple-digit gainers.

Access is free until midnight.

[Click now to download instantly]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

DeFi

DeFi Perps Trading Volume Blows Past $1 Trillion in Record Month

Decentralized perpetuals are having their breakout moment.

Trading volume across DeFi perps platforms has already topped $1 trillion in October—blowing past August's record with a week still to go.

Protocols Powering the Surge

Data from DefiLlama shows Hyperliquid leading with $317 billion in trades, followed by Lighter, Aster, and edgeX.

A single day, October 10, saw $78 billion traded—an all-time high for decentralized derivatives.

Perps appeal to traders because they run 24/7, offer high leverage, and allow speculation on both sides of the market.

The combination of flexibility and speed has turned DeFi perps into a magnet for risk-hungry traders.

Closing the Gap With CEXs

Centralized exchanges like Binance and Bybit still dominate, handling $95 billion daily between them.

But decentralized competitors are catching up fast as interfaces improve and liquidity deepens.

Infinex founder Kain Warwick said Hyperliquid "finally got it right," scaling DeFi perps for mass use after nearly a decade of experimentation.

MetaMask's recent integration with Hyperliquid further simplified on-chain access.

Take: A trillion-dollar month for DeFi perps is more than a milestone—it's a market shift.

For investors, it signals growing confidence in on-chain trading and a migration of risk-taking behavior from centralized to decentralized venues, where transparency might just be the new alpha.

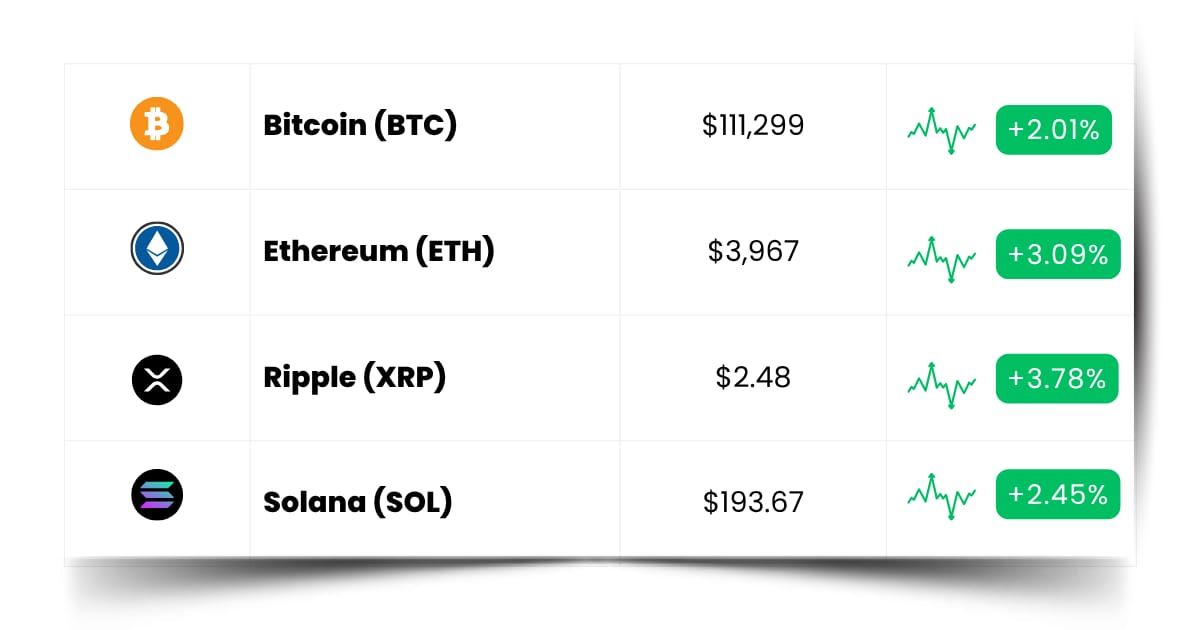

Coin Leaderboard

Crypto Pulse

Momentum didn't slow down—it just changed shape.

As politics, institutions, and DeFi all made power moves this week, traders chased fresh stories with conviction instead of caution.

aPriori doubled overnight on its Binance Alpha debut, CLANKER nearly hit triple digits after Farcaster's acquisition buzz, and PIPPIN bounced back from its crash like nothing happened.

It's proof that no matter how wild the headlines get, smart money still finds a way to turn chaos into opportunity.

In a week where Trump handed out pardons and JPMorgan embraced Bitcoin, these tokens showed that market sentiment isn't waiting for approval—it's already moving on.

aPriori (APR) $0.6303 (+114.79%)

APR skyrocketed 114.79% after its Binance Alpha debut, turning its listing hype into one of the week's biggest breakouts.

tokenbot (CLANKER) $48.61 (+99.41%)

CLANKER rallied 99.41% after Farcaster's acquisition news reignited demand for social and bot-driven tokens.

pippin (PIPPIN) $0.02630 (+75.03%)

PIPPIN bounced back strong, climbing 75.03% as traders piled in on its sharp post-crash recovery momentum.

Time-Sensitive Picks (Sponsored)

Markets are shifting fast — and new leaders are already emerging.

Our team just finished a deep analysis of 7 stocks showing early momentum signals that could translate into strong near-term performance.

These companies are positioned for potential price jumps as earnings season approaches, with improving fundamentals and strong institutional interest.

The best setups never stay quiet for long — and these seven could be next in line.

Access your free report: “7 Stocks Ready for Their Next Move.”

Future Forward

Your next edge isn't in the charts—it's in the countdowns.

The biggest moves start quietly, in the buildup to token launches, airdrops, and TGEs that set the next wave of liquidity in motion.

Winning traders aren't reacting to breakouts—they're mapping them weeks in advance.

If you want to catch the next big rotation, start circling the dates now, because timing beats hype every single time.

Crypto Conferences:

💎 India Blockchain Tour Mumbai Node 2025 (Oct 25, 2025)

💎 Bitkub Summit 2025 (Oct 25, 2025)

💎 iFX EXPO Asia 2025 (Oct 26, 2025)

Upcoming Airdrops:

🎁 Router Protocol (ROUTE) Airdrop (Oct 28, 2025)

🎁 Monad (MON) Airdrop (Nov 3, 2025)

Upcoming Token Launches:

🚀 Seedli Capital (SEEDLI) IDO on IXIRPAD (Oct 25, 2025)

🚀 MemeMarket (MFUN) IDO on TrustSwap (Oct 27, 2025)

🚀 Friendly Giant AI (GIANTAI) IDO on Spores (Oct 27, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Hyperliquid?

Hyperliquid is a decentralized exchange built specifically for perpetual futures trading—basically, a DeFi version of Binance Futures with no middlemen.

It lets traders open long or short positions on crypto assets with leverage, all directly on-chain.

What sets Hyperliquid apart is its speed and scalability.

It's built on a custom Layer-1 chain optimized for real-time trading, so transactions settle almost instantly without the gas spikes or lag you see on Ethereum-based platforms.

It also brings professional-grade tools—like order books, advanced charts, and cross-margin trading—into the DeFi world, giving on-chain traders the same experience they'd expect from a top-tier centralized exchange.

In plain English: Hyperliquid makes decentralized trading feel fast, smooth, and familiar.

It's proof that DeFi doesn't have to compromise on performance—and that the line between CEXs and DEXs is finally starting to blur.

Everything Else

Crypto spot trading on major centralized exchanges jumped 31% in Q3 to $4.7 trillion, signaling renewed investor activity as Bitcoin's summer rally reignited market confidence and lifted volumes across Binance, Bybit, and other top platforms.

Swiss bank Sygnum teamed up with BTC lending startup Debifi to launch MultiSYG, a Bitcoin-backed loan platform using multi-signature wallets so borrowers can keep partial control of their crypto while accessing regulated credit services.

Interpol and Afripol arrested 83 people and flagged $260 million in illicit crypto and fiat as part of Operation Catalyst, a major crackdown on terrorist financing and cybercrime in Africa backed by Binance's blockchain forensics team.

Revolut secured a MiCA license from Cyprus regulators, allowing it to offer fully compliant crypto trading and staking across all 30 EEA markets as part of its new "Crypto 2.0" expansion.

Hyperliquid Strategies filed with the SEC to raise $1 billion for its HYPE token treasury, marking a bold move to fund on-chain liquidity growth through token accumulation and staking rewards in the expanding DeFi ecosystem.

Crypto's rhythm is changing—faster, louder, and more unpredictable than ever.

The winners aren't just watching; they're adapting, experimenting, and finding signal in the chaos.

So keep your eyes open and your conviction sharper than ever—the next big move is already loading, and it won't wait for anyone to catch up.

Best Regards,

— Benjamin Vitaris

Crypto Intel