- Crypto Intel

- Posts

- Privacy Roars Back, Crypto Starts Earning, and Institutions Double Down

Privacy Roars Back, Crypto Starts Earning, and Institutions Double Down

Forget waiting around for macro headlines—the crypto market is already in move.

Privacy is pumping, real usage is generating real revenue, and Strategy just proved Bitcoin isn't a side bet anymore.

If you're building, trading, or just trying to stay ahead of the next rotation, this week's stories show where the smart money is pointing.

Myth: Pet insurance doesn’t cover everything

Many pet owners worry that insurance won’t cover everything, especially routine care or pre-existing conditions. While that’s true in many cases, most insurers now offer wellness add-ons for preventive care like vaccines, dental cleanings, and check-ups, giving you more complete coverage. View Money’s pet insurance list to find plans for as low as $10 a month.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

This isn't hype; everything is backed by real market movements.

Zcash just flipped Monero, on-chain revenue is nearing $20B as users pay to use crypto (not speculate on it), and Strategy is turning Bitcoin into a global credit engine.

If you're looking for where this market is really heading—not just what's trending on X—this week's signals give you a front-row seat to crypto.

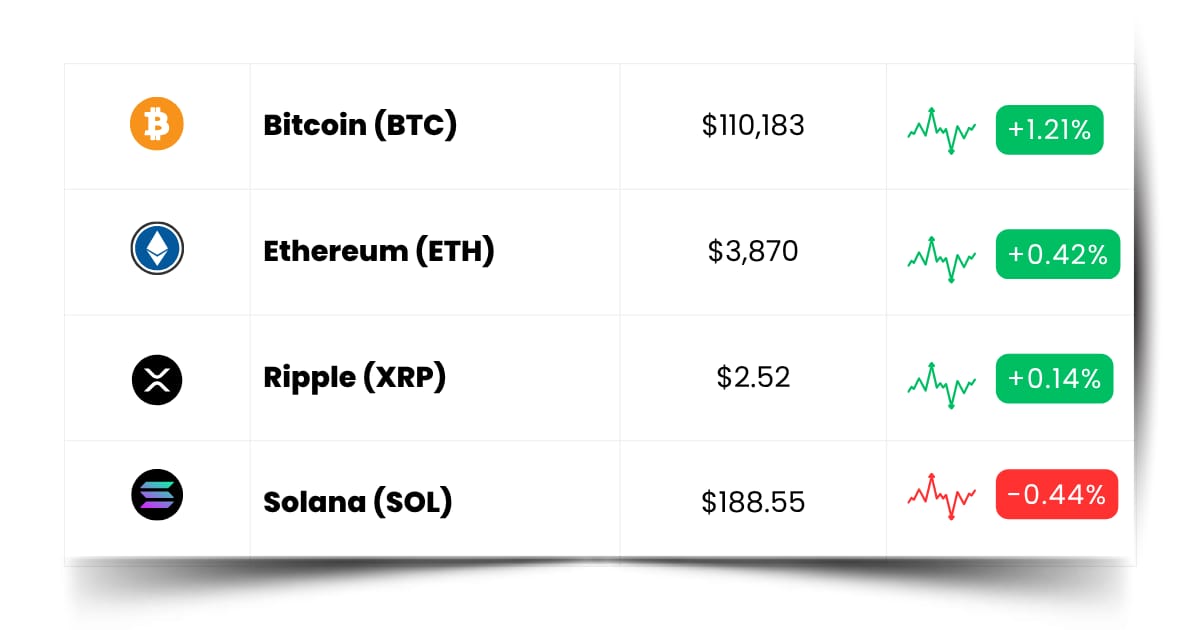

Markets

Zcash Flips Monero as Privacy Crypto Demand Surges

Zcash shocked the market this week with a 45% rally, hitting an eight-year high near $388 and overtaking Monero as the largest privacy-focused cryptocurrency.

Its market cap jumped to roughly $6.2 billion, defying the broader market chop and signaling that privacy tokens might be back in style.

Momentum Meets Macro Missteps

The surge came as investors reacted to rising geopolitical uncertainty and stalled US-China tariff negotiations.

Privacy coins tend to shine when traders feel watched, pressured, or uncertain—and this week checked all three boxes.

Arthur Hayes also poured fuel on the fire by predicting ZEC could hit $10,000, sparking retail momentum and algorithmic entries.

Zcash rallied from $272 to $355 shortly after Hayes' call, proving that crypto still listens when OGs talk.

Retail Stacks In, Whales Lighten Up

New ZEC holders jumped 63% this week, suggesting retail interest is accelerating.

But whales sold roughly $700,000 in ZEC during the same period, showing some smart-money hesitation at these levels.

Still, traders are buzzing about the token's 10x surge in just two months, calling its decoupling from market sentiment "remarkable."

Even skeptics admit this isn't a low-cap gamble—it's a multi-billion-dollar breakout in a narrative many thought was dead.

Take: Privacy is having a moment again, and Zcash just reminded everyone how fast forgotten narratives can return.

If you're watching this sector, keep the hype in check—parabolic moves rarely travel in a straight line, but narrative momentum can stay irrational longer than expected.

On-Chain Economy

On-Chain Revenue Nears $20B as Crypto Matures Beyond Speculation

A new 1kx report shows users are on track to pay nearly $20B in on-chain fees in 2025, signaling real economic activity—not just speculation.

The sector generated $9.7B in the first half alone, marking one of the most sustainable growth years for decentralized networks.

From Hype to Habits

User-paid fees now cover trading, gaming, subscriptions, asset issuance, and identity tools across dozens of chains.

That's a big shift from the last cycle, where most activity hinged on leverage and liquidations.

Daily fees have increased more than 10x since 2020, growing at roughly 60% annually.

While this year's totals may not surpass the 2021 peak, the activity mix looks healthier and more diversified.

Tokenization and Real-World Utility Rise

Tokenized real-world assets surpassed $35B in value, doubling in a year as banks like JPMorgan and BNY Mellon push assets on-chain.

Meanwhile, emerging verticals like DePIN and consumer crypto apps are starting to pay their own way—literally.

As 1kx puts it, rising fees show users see real value in blockchains and are willing to pay to participate.

The market now rewards networks that generate sticky activity instead of pure hype cycles.

Take: Crypto isn't just trading anymore—it's earning.

Higher fees mean people are actually using these systems, and if the trend continues, you might want to look at protocols with real revenue and not just real memes.

Poll: If you could have only one crypto wallet, which type would it be? |

Verified. Regulated. Rewarding. (Sponsored)

This emerging company just made history by tokenizing a dividend-paying security on Ethereum—an industry first in the U.S. markets.

With $200 million allocated for buybacks and deep crypto reserves, it’s signaling a serious long-term strategy.

Backed by respected financial leadership, the firm could soon become one of the most talked-about blockchain success stories of 2025.

[Click Here To See the Company Making Blockchain History]

Corporate Bitcoin

Strategy (MicroStrategy) Eyes Global Credit Expansion as Profits Surge

Strategy reported blockbuster results with $12B in operating income and $8.6B in net income over the first nine months of 2025, flipping last year's losses into massive gains.

The firm is now preparing to expand into international credit markets backed by Bitcoin and digital assets.

S&P 500 and Balance Sheet Ambitions

This marks Strategy's second quarter qualifying for potential S&P 500 inclusion—something almost unthinkable when it was viewed as a leveraged Bitcoin bet.

Executives reaffirmed plans to eliminate convertible debt by 2029, helping strengthen its long-term credit profile.

The company now has roughly $689M in annual dividend and interest obligations, but continues to scale revenue and raise capital sustainably.

It's already raised $20B across equity and debt this year, nearly matching 2024's total.

Saylor Stays Bullish, Market Watches

Michael Saylor says a maturing Bitcoin market and derivatives growth temporarily compress valuation multiples, but expects digital credit expansion to drive long-term equity upside.

Strategy believes it is positioned to become the dominant global issuer of crypto-linked credit assets.

With shares up 6% pre-market and sitting near $270, Wall Street is clearly buying into Saylor's next phase.

If the firm cracks the S&P 500, we may see Bitcoin gain a new kind of legitimacy—whether crypto skeptics like it or not.

Take: Strategy isn't just holding Bitcoin anymore—it's building a financial empire around it.

If the company lands in the S&P 500 and succeeds in issuing crypto-based credit globally, this story goes from bold bet to blueprint for corporate crypto adoption.

Coin Leaderboard

Crypto Pulse

Everybody's talking about Zcash flipping Monero and Saylor turning Bitcoin into a credit engine—but micro-caps stole their piece of the spotlight too.

LAB, PUNDIAI, and PIPPIN all launched in the same breath, proving momentum never really dies—it just holds its breath until the right spark hits.

LAB (LAB) $0.2329 (+83.42%)

LAB bounced back hard with an 83% surge after several days of steady declines.

Pundi AI (PUNDIAI) $1.59 (+80.71%)

PUNDIAI exploded 80% higher after nearly a month of moving sideways, finally breaking out as fresh volume returned to the AI token trade.

pippin (PIPPIN) $0.03156 (+74.06%)

PIPPIN ripped 74% in just 24 hours, snapping its brief pullback and reminding traders how quickly micro-caps can wake up once liquidity rotates back in.

Access Free Now (Sponsored)

The market is shifting fast, and certain stocks are starting to separate themselves from the rest.

A new list reveals 7 short-term opportunities based on a proven approach that’s historically outperformed broad market averages.

These stocks didn’t land here by chance — each one was selected for its potential to deliver strong near-term performance.

Investors who review this list early could be steps ahead of the next big move.

Only a few companies qualify each time, making this an especially exclusive opportunity.

See which 7 stocks are gaining momentum now — and do it before the next price jump.

Click Now for the 7 Best Stocks — Free Access Today

Future Forward

The next big moves aren't happening in the charts—they're brewing quietly on launch calendars, Discord whispers, and dev updates nobody reads until it's too late.

The smartest players aren't waiting for hype—they're positioning before anyone tweets "gm."

This is where stealth airdrops, surprise token launches, and early-access ecosystems do their damage.

If you're only looking at price candles, you're already playing catch-up—the next rotation is built in the shadows before it shows up on your watchlist.

Crypto Conferences:

💎 Noderunners Conference 2025 (Nov 1, 2025)

💎 BitPlebs Summit 2025 (Nov 1, 2025)

💎 AI Expo Europe 2025 (Nov 2, 2025)

Upcoming Airdrops:

🎁 Monad (MON) Airdrop (Nov 3, 2025)

🎁 RealLink (REAL) Airdrop (Nov 3, 2025)

Upcoming Token Launches:

🚀 MemeMarket (MFUN) IDO on Polkastarter (Nov 3, 2025)

🚀 Friendly Giant AI (GIANTAI) IDO on Spores (Nov 10, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: Who Is Sam Bankman-Fried?

Sam Bankman-Fried—often called SBF—was once one of crypto's biggest names.

He founded FTX, a crypto exchange that exploded in popularity and made him a billionaire who hung out with world leaders and ran Super Bowl ads.

Then everything unraveled.

FTX collapsed in 2022 after customer funds went missing and huge holes appeared in the company's balance sheet, leading to criminal charges and a conviction for fraud.

SBF has always claimed he didn't mean to do anything wrong, blaming chaos, bad risk management, and advisors—but courts disagreed.

Today, he's serving time while still trying to argue he could have fixed everything if he kept control, making him one of the most controversial figures in crypto history.

In plain English: SBF went from crypto genius to cautionary tale.

His story is a reminder that transparency and proper safeguards matter—and that in crypto, hype can disappear fast, but consequences don't.

Everything Else

Revolut launched 1:1 USD-to-stablecoin swaps with no fees or spreads for its 65 million users, making on- and off-ramping frictionless across USDC and USDT and signaling a new phase of mainstream fintech embracing crypto rails.

Sam Bankman-Fried resurfaced online, claiming FTX was never insolvent and blaming lawyers for the collapse, pushing a narrative that contradicts filings as he angles for a presidential pardon despite long-shot odds.

Riot Platforms beat expectations with a surprise profit and record revenue, boosted by strong Bitcoin mining performance and rapid data-center expansion as it positions itself as a diversified digital infrastructure play.

The T3 Financial Crime Unit—backed by Tether, Tron, and TRM Labs—has now frozen $300 million in illicit funds, earning praise from global law enforcement and showcasing how crypto-native enforcement is scaling fast.

Coinbase posted $1.9 billion in quarterly revenue with transaction volume surging and Base turning profitable, underscoring rising retail activity, growing institutional flows, and stronger economics across its ecosystem.

Whether you're stacking knowledge, stacking sats, or stacking early-access tokens like a degen with discipline, keep showing up.

Quiet markets turn into loud winners—just not for the people who sleep through the setup.

Best Regards,

— Benjamin Vitaris

Crypto Intel