- Crypto Intel

- Posts

- Rates, Rules, and Roadmaps: Crypto's Next Phase Is Already Here

Rates, Rules, and Roadmaps: Crypto's Next Phase Is Already Here

Markets are holding their breath, but not standing still.

Bitcoin's calm before the Fed's next move, Australia's long-awaited regulatory clarity, and Ethereum's Fusaka fork all signal one thing—crypto's next chapter is about progress, not panic.

Whether you're trading, building, or just watching from the sidelines, this week's headlines show the shift from uncertainty to evolution—and that's where opportunity usually starts.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News — What It Means for You

Caution is the mood, but conviction is creeping back in.

Bitcoin's resilience, Australia's regulatory reset, and Ethereum's upgrade show how crypto's fundamentals are quietly strengthening even as liquidity thins.

Between policy, progress, and price action, the stories driving this week's market aren't just noise—they're the roadmap for what comes next.

If you're paying attention, the signals are already forming.

Markets

🇺🇸 Bitcoin Holds $113K as Traders Brace for Fed Week

Bitcoin stayed steady near $113,000 ahead of a pivotal Federal Reserve meeting that could define the market's next move.

Liquidity is thinning, nerves are high, and everyone's waiting to see if Powell brings relief or more restraint.

Liquidity Tightens as Caution Builds

The crypto market has gone quiet ahead of the Oct. 28–29 Federal Open Market Committee (FOMC) meeting, where a 25-basis-point rate cut is widely expected.

That would lower benchmark rates to the 4.00%–4.25% range—music to the ears of traders looking for fresh liquidity.

But beneath the calm surface, liquidity is drying up fast across centralized exchanges.

Order-book depth is now at roughly 40% of pre-October levels, showing how defensive traders have become after a brutal month of liquidations.

Risk Appetite Still Flickering

Analysts say institutional inflows and ETF demand are keeping the market from slipping further.

Even as short-term risk tolerance drops, capital from traditional finance is proving surprisingly sticky.

Bitcoin remains above both its 50-day and 200-day moving averages, giving bulls hope that $108K support will hold.

FxPro's Alex Kuptsikevich called the $117K–$120K area a "key resistance zone" that could spark momentum if breached.

Take: Markets are walking a tightrope between fear and hope.

A clean rate cut could breathe life back into Bitcoin's uptrend—but if Powell signals slower easing, expect volatility to hit hard around $114K.

Policy

🇦🇺 Australia's Long-Awaited Crypto Guidance Brings Clarity—and Complications

Australia's financial watchdog just dropped long-awaited crypto guidance that could reshape how exchanges and stablecoin issuers operate.

While the update adds much-needed clarity, it also brings a new set of headaches for local players racing to comply.

New Rules, Familiar Uncertainty

The Australian Securities and Investments Commission (ASIC) now requires companies offering crypto financial products to apply for an Australian Financial Services License by June 30.

It's a big step toward mainstream regulation—but it's also piling pressure on firms to adapt fast.

Under the new rules, Bitcoin and gaming NFTs are exempt from licensing, but stablecoins, tokenized assets, and staking services are not.

Yield-bearing tokens and wrapped assets fall squarely under ASIC's "financial products" umbrella.

Implementation Is the Real Test

Industry leaders say the challenge isn't the policy—it's execution. Limited local expertise, banking access, and insurance capacity could slow compliance, turning a legal issue into a logistical nightmare.

Still, most agree it's a positive move for the sector's credibility.

"It gives us visibility on ASIC's position," said Amy-Rose Goodey of the Digital Economy Council of Australia, noting that businesses finally know where they stand.

Take: Australia's update is a win for clarity but a warning shot for complexity.

If regulators can keep pace with industry needs, it could cement the country's position as a crypto-friendly hub—but execution will decide whether this becomes a launchpad or a choke point.

Poll: How do you learn about crypto? |

Get Report Free (Sponsored)

Imagine turning a “good” portfolio into a great one.

Analysts have identified 5 stocks with the strongest potential to double or more within the next 12 months — backed by exceptional growth indicators and powerful market catalysts.

These aren’t hype plays — they’re fundamentally sound opportunities selected from thousands of contenders.

Past editions of this exclusive report have spotlighted gains of +175%, +498%, even +673%.¹ The newest picks could be just as explosive.

But hurry — this special report is free only until midnight.

[Access the 5 Stocks to Double Report – 100% Free Now]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Ethereum

Ethereum's Fusaka Fork Sets Stage for December Mainnet Launch

Ethereum just cleared its final testnet hurdle, moving one step closer to the highly anticipated Fusaka upgrade.

The fork promises better scalability, faster transactions, and a stronger foundation for the network's next growth phase.

Major Milestone Before Mainnet

Fusaka went live on the Hoodi testnet, marking the last rehearsal before its Dec. 3 mainnet debut.

Developer teams like Nethermind called it another "smooth upgrade," reinforcing confidence after months of preparation.

The update includes key Ethereum Improvement Proposals (EIPs) such as PeerDAS, which allows validators to process smaller data chunks instead of full blobs.

This means faster and more efficient layer-2 activity across the board.

Scalability in Focus

Fusaka also raises gas limits and optimizes execution to pave the way for parallel processing—letting multiple smart contracts run simultaneously.

It's a major leap toward solving Ethereum's long-standing scalability trilemma.

Ether's price momentum adds to the buzz, with ETF inflows and corporate adoption driving fresh highs.

The upgrade will roll out in three phases, followed by the Glamsterdam fork that continues Ethereum's "Surge" roadmap.

Take: Fusaka is shaping up to be one of Ethereum's most meaningful upgrades since The Merge.

If it delivers smoother performance without compromising security, it could strengthen Ethereum's dominance just as the next bull cycle gains steam.

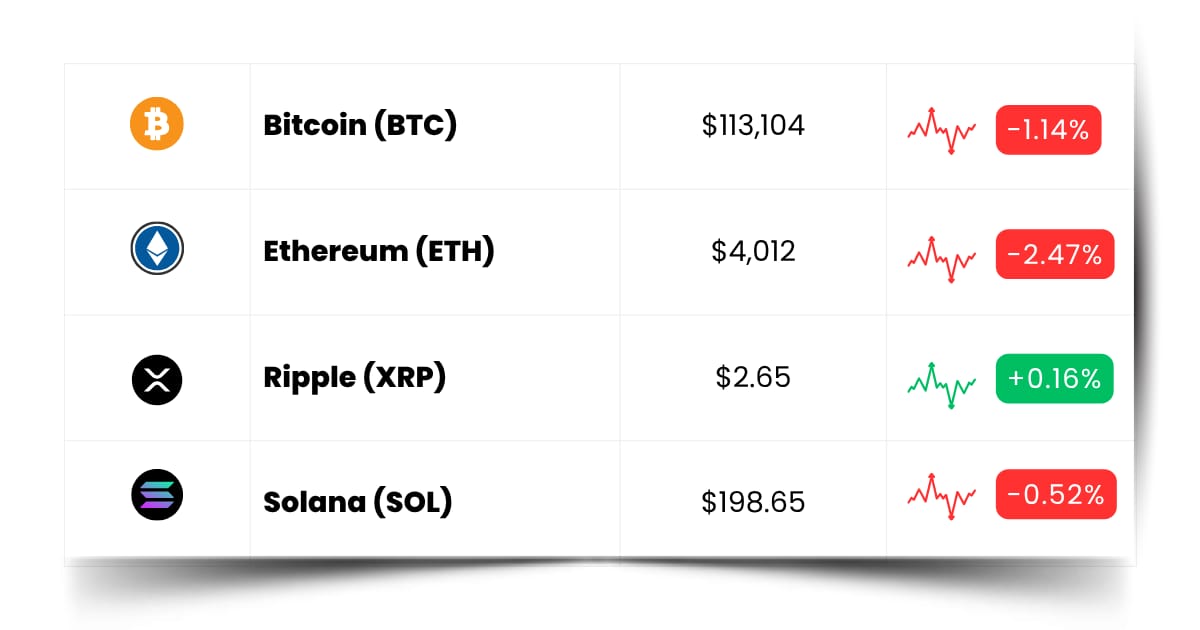

Coin Leaderboard

Crypto Pulse

Quiet charts, loud moves—that's the mood this week.

As Bitcoin held its ground before the Fed, traders shifted gears, chasing pockets of real momentum hiding beneath the macro noise.

PIGGY stole the spotlight with a 49% rip that turned microcap whispers into full-blown chatter.

MDT followed with a 34% climb after RewardMe 2.0 reignited its ecosystem, while OBT leapt 26% on the buzz around phone number-based stablecoin transfers.

These plays didn't wait for Powell or policy—they ran on story, speed, and speculation.

In a market this cautious, every breakout is a reminder: conviction moves faster than headlines, and timing still writes the biggest checks.

Piggycell (PIGGY) $2.21 (+49.24%)

PIGGY topped the Crypto Pulse leaderboard with a 49.24% rally, leading the day's breakout pack as traders piled into high-momentum microcaps.

Measurable Data Token (MDT) $0.0242 (+34.16%)

MDT climbed 34.16% after the launch of RewardMe 2.0, which added new staking and reward mechanics that reignited on-chain activity.

Oobit (OBT) $0.04228 (+26.38%)

OBT jumped 26.38% after unveiling a phone number-based stablecoin transfer tool, fueling excitement around frictionless crypto payments.

Exclusive Access Today (Sponsored)

Every few weeks, a select number of stocks emerge with the kind of momentum investors look for.

Back-tested by decades of market data, this system has more than doubled the S&P 500’s average annual gain.

The newest report features just seven stocks that meet the highest standards for potential price movement.

Fewer than one in twenty even qualify.

Download the report today to see which stocks are positioned for near-term growth.

Click Here to Download the 7 Best Stocks Report — FREE

Future Forward

The next wave of opportunity isn't hiding on charts—it's hiding on calendars. From stealth airdrops to token launches with zero hype, momentum is being built in silence long before the crowd notices.

The sharpest traders aren't watching prices—they're watching timing. The ones who win big are the ones who show up early, ready to move before the market remembers where the noise came from.

Crypto Conferences:

💎 Assets on Blockchain 2025 (Oct 30, 2025)

💎 Onchain Festival 2025 (Oct 30, 2025)

💎 12th Annual FinTech and Banking Summit 2025 (Oct 30, 2025)

Upcoming Airdrops:

🎁 Monad (MON) Airdrop (Nov 3, 2025)

🎁 RealLink (REAL) Airdrop (Nov 3, 2025)

Upcoming Token Launches:

🚀 MemeMarket (MFUN) IDO on Polkastarter (Nov 3, 2025)

🚀 Friendly Giant AI (GIANTAI) IDO on Spores (Nov 10, 2025)

🚀 Play AI (PLAI) TGE and Distribution (Q4 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Are Crypto Options?

Crypto options are like giving yourself a "maybe" button for trading.

They let you lock in the right—but not the obligation—to buy or sell a cryptocurrency at a specific price later, depending on where the market moves.

There are two main types: calls and puts. A call option lets you buy an asset at a set price (if you think it'll go up), while a put option lets you sell it (if you think it'll drop). You pay a small fee upfront—called a premium—for the flexibility.

Traders use options to hedge against losses or make leveraged bets without tying up massive capital.

It's a way to manage risk or amplify rewards without going all in.

In plain English: crypto options are insurance for your trades—or a calculated way to bet on where the market's heading next.

The key is knowing when to exercise your right and when to walk away.

Crypto's latest chapter isn't about chaos—it's about control.

The frenzy is fading, but the builders, traders, and innovators who keep showing up are setting the tone for what comes next.

Everything Else

Visa announced plans to support four new stablecoins across four blockchains, expanding its crypto settlement network and letting banks mint and burn their own tokens through Visa's platform.

DBS and Goldman Sachs completed the first-ever interbank crypto options trade, marking a major step in bringing traditional finance tools like hedging and structured derivatives into Asia's digital asset markets.

Western Union revealed it will launch a Solana-based stablecoin called USDPT next year with Anchorage Digital, aiming to cut remittance costs and expand global access to faster blockchain payments.

Bitwise's new Solana ETF drew $69.5 million in first-day inflows—nearly six times its rival's debut—as institutions piled into Solana exposure with direct staking yields and low fees.

Norway's tax authority reported a 30% jump in declared crypto holdings, with over 73,000 citizens disclosing $4 billion worth of assets, showing growing compliance as governments tighten reporting rules.

The market's evolving fast, and every headline—from Fed moves to new forks—adds another piece to the bigger puzzle. Stay curious, stay sharp, and don't just follow the trend—find the rhythm before everyone else hears the beat.

Best Regards,

— Benjamin Vitaris

Crypto Intel