- Crypto Intel

- Posts

- Tariffs, Tokens, and Turning Points: Crypto Finds Its Next Catalyst

Tariffs, Tokens, and Turning Points: Crypto Finds Its Next Catalyst

Markets finally caught a breather after weeks of chaos.

A possible US-China tariff truce steadied risk sentiment, Japan's first yen-backed stablecoin marked a historic shift for Asia, and Zcash reminded everyone that privacy still sells in crypto.

If you've been waiting for direction, this week brought it—stability, regulation, and revival are back on the table, and smart traders are already positioning for what's next.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News — What It Means for You

The panic is cooling, and confidence is creeping back in.

Bitcoin's rebound, Japan's stablecoin debut, and Zcash's breakout all point to one thing—momentum is shifting from fear to opportunity.

Between trade diplomacy, financial innovation, and narrative-driven rallies, crypto is finding fresh fuel in places no one expected.

These aren't random headlines—they're signals that the next market leg could already be forming.

Markets

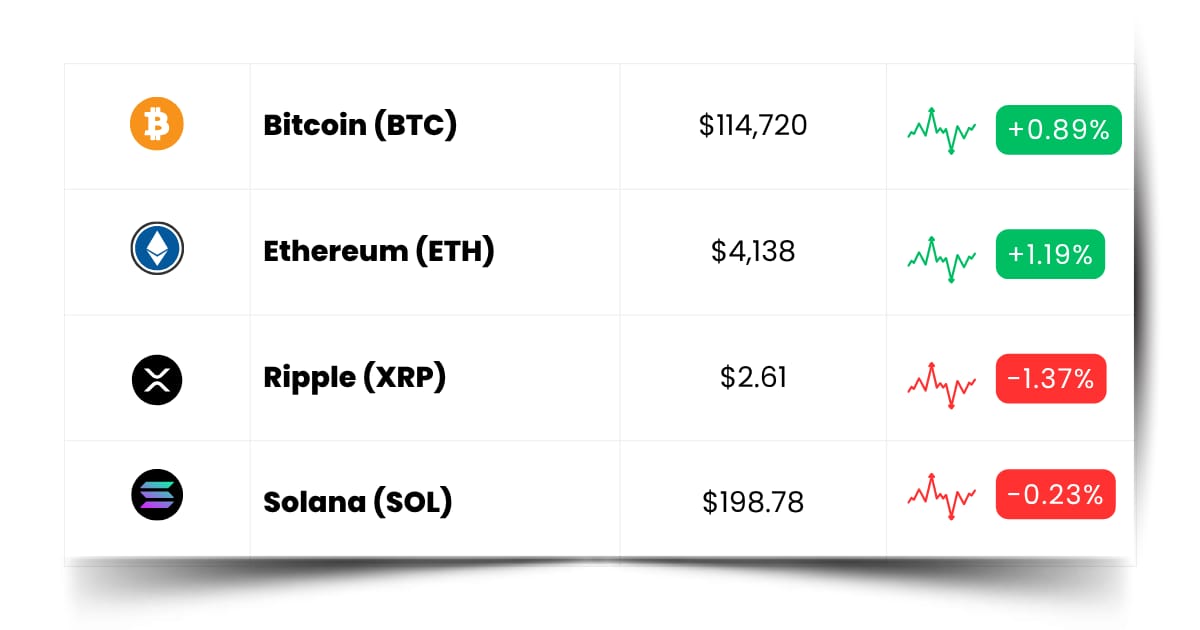

Bitcoin Finds Its Footing as US-China Tariff Truce Cools Market Panic

Bitcoin is breathing again after a record $19 billion liquidation wiped out overleveraged traders earlier this month.

Signs of a temporary ceasefire between the US and China helped steady nerves and lift prices back above $115,000.

Trade Truce Sparks Relief Rally

Reports that Washington and Beijing reached a "preliminary" import tariff deal sent crypto sentiment from "fear" to "neutral" overnight.

Investors are betting that Thursday's meeting between Presidents Trump and Xi could cement a broader agreement.

Trump said he believes both nations will "come away with the deal," a statement that quickly reignited risk appetite.

Bitcoin reclaimed the $114,000 short-term holder cost basis—an important level for avoiding renewed selling pressure.

Fed Cut Fuels Risk Appetite

The rebound also coincides with expectations of a 25-basis-point rate cut at Wednesday's FOMC meeting.

Traders now see a 96.7% probability of easing, according to CME's FedWatch tool, which has poured fresh liquidity into risk assets.

A truce and a rate cut could be the double catalyst Bitcoin needs to rebuild its momentum before November.

Markets will be watching whether the $116,000 zone holds after Thursday's summit.

Take: The tariff pause gives crypto room to breathe again.

If the deal sticks and the Fed delivers a cut, you could see renewed capital rotation into Bitcoin—but keep an eye on $114K support, because any breakdown there could reignite volatility fast.

Stablecoins

Japan Sees Launch of Its First Yen-Backed Stablecoin, JPYC

Japan just joined the global stablecoin race with its first yen-pegged token.

Fintech firm JPYC rolled out the new coin, backed 1:1 by bank deposits and government bonds, and paired it with an issuance platform called JPYC EX.

Building Japan's Digital Yen Frontier

JPYC President Noriyoshi Okabe called the launch a "major milestone in Japanese currency history."

The token already has interest from seven firms preparing to integrate it into payments, trading, and settlement services.

Users can deposit yen via bank transfer to receive JPYC to their registered wallet and redeem it seamlessly.

Every transaction follows Japan's strict identity and anti-money-laundering standards under the Act on Prevention of Transfer of Criminal Proceeds.

Japan Eyes Stablecoin Leadership

The company's goal is bold: hit a 10 trillion yen issuance balance within three years and lay the groundwork for "new social infrastructure through stablecoins."

That ambition could soon face competition.

Financial giant Monex Group and Japan's top three banks—MUFG, SMBC, and Mizuho—are also developing their own yen-backed stablecoins.

The Financial Services Agency is even weighing regulatory updates to let banks directly hold crypto like Bitcoin for investment.

Take: Japan's first yen stablecoin isn't just a local play—it's a signal that Asia's financial heavyweights are ready to compete with dollar dominance.

For you, this could mean more stable, fiat-linked on-ramps in crypto and a broader shift toward regulated digital finance in Asia.

Trivia: What term describes removing a token from circulation permanently? |

Next Big Movers (Sponsored)

Not all stocks are created equal.

Some churn out steady returns… others explode.

Our analysts just released a brand-new report featuring 5 stocks with the highest potential to double in the coming year.

What makes them different?

Solid fundamentals that provide staying power

Bullish technicals that suggest a near-term breakout

In the past, this report has uncovered stocks that went on to post extraordinary gains—+175%, +498%, even +673%.

Access is free today, but only until midnight tonight.

[Download your copy instantly before access closes]

This could be your chance to step beyond “average” into extraordinary.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Altcoins

Zcash Surpasses 2021 Peak as Traders Bet on Privacy Revival

Zcash is back in the spotlight after a blistering 30-day rally took it past its 2021 highs.

The privacy coin surged from $54 to roughly $372, fueled by speculation ahead of its November halving and a resurgence in privacy narratives.

Privacy Hype Meets Halving Momentum

Endorsements from Naval Ravikant and ex-Coinbase engineer Mert Mumtaz amplified the buzz.

Traders are also chasing Arthur Hayes's viral $10,000 price call, turning Zcash into one of October's most volatile altcoins.

Grayscale's recent move to offer ZEC exposure to eligible investors added another layer of legitimacy.

Predictions markets like Myriad saw record activity as the coin broke through $369, triggering massive liquidations in short positions.

Speculation or Structural Comeback?

Analysts say Zcash's rally reflects more speculative energy than genuine user growth, with little change in on-chain shielded transactions.

Still, it's benefited from rising distrust in surveillance and renewed attention to data privacy.

The halving on November 18 will cut block rewards from 3.125 to 1.5625 ZEC, reducing supply and potentially adding fuel to volatility.

Traders are watching to see whether this is another hype cycle or the start of a longer-term recovery.

Take: Zcash's surge shows that privacy isn't dead—it's just been waiting for its comeback moment.

If you're trading it, remember that halvings often trigger "sell-the-news" moves, but growing privacy debates could make this narrative stick longer than most expect.

Coin Leaderboard

Crypto Pulse

This week's rebound didn't come quietly—it came roaring back with attitude.

As Bitcoin steadied on tariff truce hopes and Japan's new stablecoin stole headlines, traders hunted for volatility wherever it still lived.

IRIS ripped an unbelievable 875%, MAVIA bounced 82% off its lows, and DIA surged 51% as DeFi and gaming tokens soaked up fresh capital.

It's the kind of rotation that proves momentum never dies—it just changes disguise.

In a market finding balance between policy peace and new innovation, these breakouts show one thing clearly: confidence is creeping back, and traders aren't waiting for permission to make their next move.

IRISnet (IRIS) $0.007466 (+875.03%)

IRIS exploded 875.03% in 24 hours as traders piled into the token amid a wave of extreme volatility and renewed speculative interest.

Heroes of Mavia (MAVIA) $0.2489 (+82.70%)

MAVIA bounced hard from its market lows, soaring 82.70%.

DIA (DIA) $0.6796 (+51.77%)

DIA rallied 51.77% in a sharp recovery that pushed the oracle token to new monthly highs, signaling renewed confidence in data-driven DeFi assets.

Time-Sensitive Picks (Sponsored)

Every few weeks, a select number of stocks emerge with the kind of momentum investors look for.

Back-tested by decades of market data, this system has more than doubled the S&P 500’s average annual gain.

The newest report features just seven stocks that meet the highest standards for potential price movement. Fewer than one in twenty even qualify.

Download the report today to see which stocks are positioned for near-term growth.

Click Here to Download the 7 Best Stocks Report — FREE

Future Forward

The next big play isn't hiding in charts—it's tucked between launch dates, airdrops, and TGEs quietly stacking momentum. Liquidity doesn't shout; it sneaks up, then explodes.

The traders winning right now aren't chasing headlines—they're stalking calendars. Start tracking the drops before they trend, because in this market, timing isn't everything—it's the edge.

Crypto Conferences:

💎 ePay Summit 2025 (Oct 28, 2025)

💎 13th Digital Africa Conference and Exhibition (Oct 28, 2025)

💎 Blockchain Life 2025 Dubai (Oct 28, 2025)

Upcoming Airdrops:

🎁 Router Protocol (ROUTE) Airdrop (Oct 28, 2025)

🎁 Monad (MON) Airdrop (Nov 3, 2025)

Upcoming Token Launches:

🚀 BlaBla Protocol (BLA) IDO on Spores (Oct 29, 2025)

🚀 MemeMarket (MFUN) IDO on Polkastarter (Nov 3, 2025)

🚀 Friendly Giant AI (GIANTAI) IDO on Spores (Nov 10, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Mt. Gox?

Mt. Gox was once the world's biggest Bitcoin exchange—handling over 70% of all BTC trades at its peak in 2013.

It collapsed in 2014 after hackers stole around 850,000 Bitcoin, triggering one of crypto's earliest and biggest scandals.

Since then, a court-appointed trustee in Japan has been working to repay creditors through a long and complex "rehabilitation" process.

Many victims have waited over a decade to recover even a portion of their lost funds.

Every few years, the repayment deadline has been delayed as authorities verify claims and coordinate with exchanges to distribute Bitcoin and Bitcoin Cash.

The latest postponement pushes repayments to October 2026.

In simple terms: Mt. Gox is a time capsule from crypto's wild early days—and its slow unwinding still sends ripples through today's markets whenever large BTC movements hit the blockchain.

Everything Else

ClearBank joined Circle's Payments Network to enable near-instant, MiCA-compliant transfers using USDC and EURC, aiming to make cross-border payments faster, cheaper, and fully regulated across Europe.

Mt. Gox postponed its long-awaited Bitcoin repayments to October 2026, citing incomplete creditor procedures and technical delays, keeping roughly $4 billion in BTC locked up for another year.

India's Madras High Court ruled that cryptocurrency can be held in trust, blocking WazirX from redistributing a user's frozen XRP and setting a potential precedent that strengthens user ownership rights.

Tether plans to launch its US-regulated stablecoin, USAT, in December, targeting 100 million American users through new investments in platforms like Rumble and partnerships with Anchorage Digital.

Bitcoin treasury firms are now trading below the value of their BTC holdings as weak sentiment and debt risk weigh on valuations, leaving only Michael Saylor's Strategy still commanding a premium.

Crypto's back in motion—steady, surprising, and full of second chances. This market rewards the ones who move with intent, not impulse.

Whether you're betting on privacy, regulation, or revival, remember this: momentum always finds those who stay ready.

The charts may cool off, but the next breakout's already warming up somewhere else.

Best Regards,

— Benjamin Vitaris

Crypto Intel