- Crypto Intel

- Posts

- Volatility, ETFs, and Big Moves: Crypto Just Got Interesting Again

Volatility, ETFs, and Big Moves: Crypto Just Got Interesting Again

This week was all about shakeups—both on the charts and in boardrooms.

Bitcoin's wild $113K swing wiped out bulls and bears alike, Hong Kong launched the world's first Solana ETF before the US could blink, and FalconX made a power play by acquiring 21Shares to enter the ETF game.

2025 Profit Catalysts (Sponsored)

The difference between a “good trade” and a wealth-building move?

Timing and precision.

Our analysts just dropped a new report: 5 Stocks Set to Double.

Inside, you’ll find:

Companies with fundamentals built for staying power

Technical setups flashing breakout signals

Analyst insights you won’t find anywhere else

Past reports uncovered winners that soared +175%, +498%, even +673%.¹

This free edition expires at midnight.

[Get your copy before the window closes]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News — What It Means for You

Volatility's back, but so is opportunity. Between record liquidations, fresh ETF approvals, and billion-dollar deals, crypto's next setup is forming right under your feet.

These stories aren't just headlines—they're signals.

They show where liquidity is flowing, how institutions are positioning, and what kind of edge you can carve out before the next breakout hits.

Markets

Crypto Bulls and Bears Lose $300M Each as Bitcoin Dumps After Brief $113K Rally

Bitcoin's late-week breakout above $113K didn't last long.

Within hours, the market reversed sharply, liquidating over $657 million in leveraged positions split nearly evenly between longs and shorts.

Volatility Tightens Its Grip

BTC's price swung between $107K and $113K in just 24 hours, leaving both sides of the market battered. Data from CoinGlass showed $355 million in long positions and $301 million in shorts wiped out across major exchanges.

Bitcoin led the carnage with $340 million in liquidations, followed by Ethereum at $200 million. Solana, XRP, and Dogecoin each saw tens of millions more flushed as the broader market dropped 2.5%.

Sentiment Stays Fragile

Kraken's derivatives head Alexia Theodorou noted that positioning is stabilizing, but sentiment remains fragile.

Futures activity hit record levels, but traders are still hesitant to take strong directional bets.

Analysts at FxPro said Bitcoin's failed breakout confirmed a short-term downtrend, with the $108K level now acting as key support near the 200-day moving average.

Altcoins mirrored the weakness, while memecoins saw sharper corrections amid thinning liquidity.

Take: This tug-of-war between bulls and bears shows just how shaky confidence remains.

For now, expect choppy action—until either macro clarity or ETF inflows restore enough conviction for Bitcoin to find its next real floor.

ETFs

Hong Kong Approves First Spot Solana ETF Ahead of the US

Hong Kong just gave Solana a huge credibility boost. The city's securities regulator approved the first Solana spot ETF—beating the US once again to the punch.

A Regional Power Move

The new ChinaAMC Solana ETF will list on the Hong Kong Stock Exchange with both RMB and USD counters. Each unit will include 100 shares, with a roughly $100 minimum entry.

OSL Exchange will handle trading, while OSL Digital Securities acts as sub-custodian. Annual expenses are capped at 1.99%, putting it in line with other Asian crypto ETFs.

Asia Pulls Ahead

Hong Kong already leads with Bitcoin and Ethereum spot ETFs, and Solana's addition cements its first-mover advantage in Asia.

Canada, Brazil, and Kazakhstan also launched Solana ETFs earlier this year, leaving the US lagging behind.

Bitwise CIO Matt Hougan said Solana could become Wall Street's go-to blockchain for stablecoins and tokenized assets.

He argued that its speed and throughput make it ideal for financial applications that traditional investors can actually understand.

Take: This move isn't just another ETF headline—it's a statement.

While US regulators hesitate, Asia's capital markets are building the rails for real institutional exposure, and Solana might just become the network they all meet on.

Trivia: What year did Bitcoin first trade above $1? |

Regulation Breakthrough (Sponsored)

After years of uncertainty, crypto just got its biggest breakthrough.

Congress passed nationwide legislation—and the market surged past $4 trillion almost immediately.

Here’s what that means:

✓ Institutions now have a greenlight.

✓ Banks are preparing customer-facing crypto services.

✓ Wall Street is finally free to scale in.

Most investors still haven’t caught on.

Our free book, Crypto Revolution, breaks down what this means for you—and how to get positioned before the next adoption wave.

You’ll also receive $788 in free bonus resources when you claim your copy.

[Claim Your Free Copy Now]

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Acquisitions

FalconX to Acquire 21Shares, Expanding Into Crypto ETFs

FalconX is about to make a major leap. The digital asset prime broker reportedly agreed to acquire Swiss-based 21Shares, one of Europe's largest crypto ETF issuers.

Bridging Trading and Products

The deal—first reported by the Wall Street Journal—lets FalconX move beyond liquidity and market-making into direct ETF issuance.

It's a strategic expansion into one of crypto's fastest-growing institutional arenas.

21Shares, headquartered in Zurich, already offers over 50 exchange-traded products across Europe.

The firm pioneered regulated access to Bitcoin and Ethereum long before the US caught up.

Institutional Access Meets Liquidity Power

By merging FalconX's deep liquidity infrastructure with 21Shares' ETF pipeline, the combined firm could reshape how institutions access crypto markets.

It's the kind of integration traditional finance players love—efficient, compliant, and global.

Terms of the deal weren't disclosed, but both companies are expected to maintain their branding under a shared institutional umbrella.

That suggests this is less a buyout and more a power merge.

Take: FalconX stepping into ETF issuance is a sign of where institutional crypto is heading—toward full-service platforms that connect liquidity, custody, and regulated products.

For investors, it means easier, safer access to the next wave of digital asset exposure.

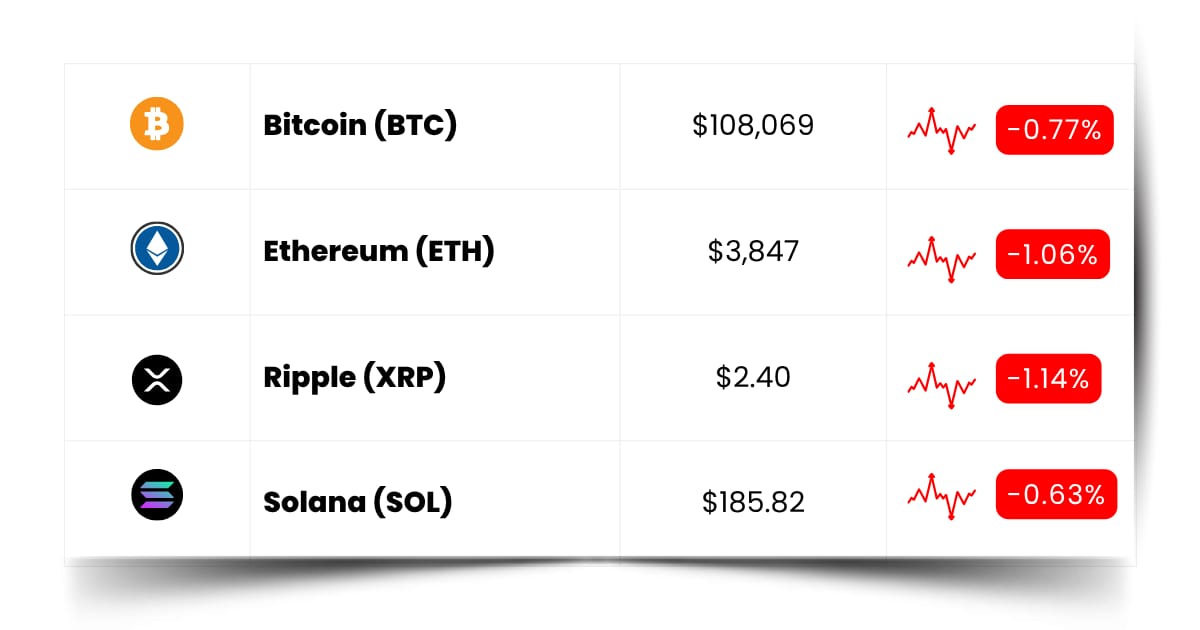

Coin Leaderboard

Crypto Pulse

The market may be shaky, but traders aren't standing still.

As Bitcoin's whiplash moves flushed leverage from both sides, altcoins with real catalysts stepped into the spotlight—turning volatility into opportunity.

EVAA ripped nearly 71% after revealing plans to go full DAO, 0x0 roared back with a 52% rebound fueled by AI token momentum, and BLUAI jumped 36% on its Binance Alpha debut.

While the majors caught their breath, these tokens reminded everyone that conviction still pays when the story's strong enough.

Momentum never disappears—it just migrates. And this week, it's clearly found a new home in projects built around community, AI, and fresh listings.

EVAA Protocol (EVAA) $7.98 (+70.96%)

EVAA soared 70.96% to top today's Crypto Pulse leaderboard after announcing its transition into a decentralized autonomous organization (DAO).

0x0.ai (0x0) $0.01438 (+51.99%)

0x0 rebounded sharply with a 51.99% gain in the past 24 hours.

Bluwhale (BLUAI) $0.02882 (+36.12%)

BLUAI climbed 36.12% after its October 21 debut on Binance Alpha, riding a fresh wave of attention toward new AI listings.

Surge Potential Ahead (Sponsored)

Some stocks take months or years to move. Others? They can move in weeks.

That’s why we’ve just released a FREE report: 7 Best Stocks for the Next 30 Days.

Less than 5% of all publicly traded companies meet the strict criteria to make this list.

These are hand-selected from thousands of candidates — the very best positioned for potential short-term upside.

If you’re looking for fresh ideas to fuel your next trade, this is the list to start with.

[Download your FREE copy now] before you place your next trade.

Timing is everything in the market.

Don’t wait until these moves are yesterday’s news.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Future Forward

The next breakout isn't hiding in your charts—it's hiding in your calendar.

Real momentum starts before the candles move, in the quiet build-up to token launches, airdrops, and TGEs that light up liquidity once they hit.

The traders who win big aren't the ones chasing green candles—they're the ones who circle dates, track narratives, and stay two steps ahead.

If you want an edge, plan like a pro and act before the crowd even knows what's coming.

Crypto Conferences:

💎 Wall Street Blockchain Alliance Crypto and Blockchain Summit 2025 (Oct 23, 2025)

💎 Scandinavian and Nordic Gaming Show 2025 (Oct 23, 2025)

💎 dAGI Summit 2025 (Oct 24, 2025)

Upcoming Airdrops:

🎁 DFDV Staked SOL (DFDVSOL) Airdrop (Oct 23, 2025)

🎁 Commune AI (COMAI) Airdrop (Oct 24, 2025)

🎁 Monad (MON) Airdrop (Nov 3, 2025)

Upcoming Token Launches:

🚀 MWX (MWXT) IDO on Spores (Oct 23, 2025)

🚀 Meteora (MET) TGE and Distribution (Oct 23, 2025)

🚀 Seedli Capital (SEEDLI) IDO on IXIRPAD (Oct 25, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Jupiter?

Jupiter is one of the biggest DeFi platforms on Solana, built to make crypto trading faster, cheaper, and smarter.

It acts as a liquidity hub—connecting dozens of decentralized exchanges (DEXs) so you always get the best possible price on every trade.

Think of it as Solana's version of Google Flights, but for tokens instead of airline tickets.

You enter what you want to swap, and Jupiter automatically finds the most efficient route across multiple liquidity pools—saving you time, fees, and headaches.

Beyond simple swaps, Jupiter powers features like perpetual trading, limit orders, and even prediction markets, all within the Solana ecosystem.

Its low fees and lightning-fast execution have made it a go-to for both retail traders and on-chain power users.

In plain English: Jupiter makes DeFi on Solana feel less like code and more like finance.

It's the invisible engine behind countless trades—and a reminder that great UX isn't just about design, it's about making complex tech feel effortless.

Everything Else

Solana-based Jupiter launched a Kalshi-powered prediction market for the Formula One Mexico Grand Prix, letting users bet on race outcomes with capped limits to maintain market stability and transparency.

The Kadena Foundation announced it will shut down due to unsustainable market conditions, leaving the blockchain to operate solely through miners and community developers as KDA plunged over 55%.

US Senator Cynthia Lummis urged regulators to finalize the open banking rule, warning that major banks are blocking crypto access and calling it essential for connecting Americans' bank accounts to digital asset platforms.

A major AWS outage knocked several crypto exchanges and infrastructure providers offline—including Coinbase, Infura, and Base—exposing how centralized cloud dependence still undermines blockchain decentralization.

Tether said its USDT stablecoin now reaches 500 million users—around 6.25% of the world's population—calling it one of the biggest financial inclusion milestones in history as adoption surges in emerging markets.

Every cycle has its noise, but clarity belongs to those who read between the lines.

The smartest traders don't react—they anticipate. So stay curious, stay contrarian, and keep your finger on the pulse of what's next, not what's trending.

Best Regards,

— Benjamin Vitaris

Crypto Intel