- Crypto Intel

- Posts

- Wall Street Went Big on Crypto, But These Tokens Went Bigger

Wall Street Went Big on Crypto, But These Tokens Went Bigger

Bitcoin just hit a new all-time high above $125K, institutions poured a record $6B into crypto, and Morgan Stanley finally told its clients to buy in.

These aren't random headlines—they're signals that big money is reshaping the market right under your feet.

Here's what that means for you, your portfolio, and where the next wave of capital could land.

Jeff Bezos Says This New Breakthrough is Like “Science Fiction”

He called it a “renaissance.” No wonder ~40,000 people backed Amazon partner Miso Robotics. Miso’s kitchen robots fried 4M food baskets for brands like White Castle. In a $1T industry with 144% employee turnover, that’s big. So are Miso’s partnerships with NVIDIA and Uber. Initial units of its newest robot sold out in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Records don't break by accident—they break when conviction returns.

This week's inflows, price action, and Wall Street endorsements show crypto isn't just surviving the macro storm; it's thriving because of it.

If you want to see how deep the shift really goes—and what it could mean for your next move—here's your breakdown.

Markets

Bitcoin Surges to Record High Above $125K After $3.2B in Spot BTC Inflows

Bitcoin broke past $125,000 for the first time ever, marking an 11% weekly gain as investors piled into US-listed spot ETFs.

The funds saw $3.24 billion in net inflows last week—the second-largest total on record, according to SoSoValue.

The rally came as the US government shutdown extended, sparking a rush toward safe-haven assets.

Bitcoin's price briefly topped $125,400 during Asian trading hours before paring gains to around $124,000.

Institutional demand has been relentless, with mid-sized wallets adding exposure while whales continue to provide liquidity.

The inflows show that Bitcoin's narrative as "digital gold" is once again resonating with investors facing macro and political uncertainty.

Analysts see October's historically bullish season aligning with improving sentiment and inflows, setting the stage for continued strength.

For now, Bitcoin's dominance remains unshaken as it reclaims its haven appeal.

Take: Bitcoin's rally above $125K shows the market is looking for stability in chaos.

For you, that means BTC's role as a hedge is no longer theoretical—it's back in play, and staying sidelined could mean missing the next wave of capital rotation.

Crypto ETFs

Crypto Funds Smash Records With $5.95B Inflows Amid Shutdown Concerns

Crypto investment funds just posted their largest inflows ever—$5.95 billion in a single week—according to CoinShares.

Bitcoin led the surge with $3.6 billion, followed by Ether with $1.48 billion and Solana with $706 million.

The record inflows pushed total crypto assets under management above $250 billion for the first time. That's a 35% jump from the previous $4.4 billion inflow record set in mid-July.

Analysts attribute the surge to delayed reactions to the Fed's rate cut, weak US employment data, and growing concerns over government stability.

CoinShares' James Butterfill said investors are repositioning as "concerns around the US government" weigh on traditional markets.

Unlike previous rallies, this one was overwhelmingly Bitcoin-driven, highlighting the shift toward blue-chip crypto exposure.

Ether and Solana also saw record inflows, signaling renewed confidence across the broader market.

Investors ignored bearish instruments, suggesting conviction remains high despite Bitcoin nearing all-time highs.

The momentum indicates that institutional buyers view recent macro turbulence as a buying opportunity, not a warning sign.

Take: Record inflows show institutions are moving from curiosity to conviction.

For you, this proves that even macro uncertainty can become rocket fuel for crypto when capital starts chasing scarcity and yield again.

Trivia: What’s the smallest unit of Bitcoin called? |

Dominate 2025 Now (Sponsored)

How would it feel to double your money by this time next year?

After analyzing thousands of companies, only 5 stocks have emerged with the strongest potential to gain +100% or more in the months ahead.

You can see all five tickers — absolutely free.

Download your copy of the newly released 5 Stocks Set to Double special report today.

While no one can guarantee future performance, previous editions of this report have uncovered gains of +175%, +498%, even +673%. And these new picks could be just as powerful.

This free access ends MIDNIGHT TONIGHT.

[Download your free report now before it’s gone.]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Institutions

Morgan Stanley Recommends' Conservative' Crypto Allocation for Portfolios

Morgan Stanley's Global Investment Committee has officially recommended crypto allocations for the first time.

The report advises up to 4% exposure in high-growth portfolios and 2% for balanced ones, while wealth-preservation portfolios stay at zero.

The bank cited crypto's "outsized total returns" and "declining volatility" but warned of correlations with other assets during market stress.

The move signals a shift in tone from traditional finance toward measured, strategic participation.

Bitwise CEO Hunter Horsley called the announcement "huge," noting that Morgan Stanley guides 16,000 advisors managing over $2 trillion in client assets.

That kind of endorsement could dramatically expand crypto's reach among mainstream investors.

The report arrives as Bitcoin breaks all-time highs and ETF adoption accelerates globally.

Morgan Stanley analysts now describe Bitcoin as a "scarce asset, akin to digital gold," aligning with the narratives that once fueled early adoption.

On-chain data supports the timing—exchange reserves are at six-year lows, limiting supply just as new institutional demand rises.

That's a recipe for potential price support even if volatility returns.

Take: Morgan Stanley's endorsement isn't just about percentages—it's about legitimacy.

For you, this signals that crypto exposure is no longer a fringe idea; it's becoming a financial standard, and missing the allocation window could mean missing institutional upside.

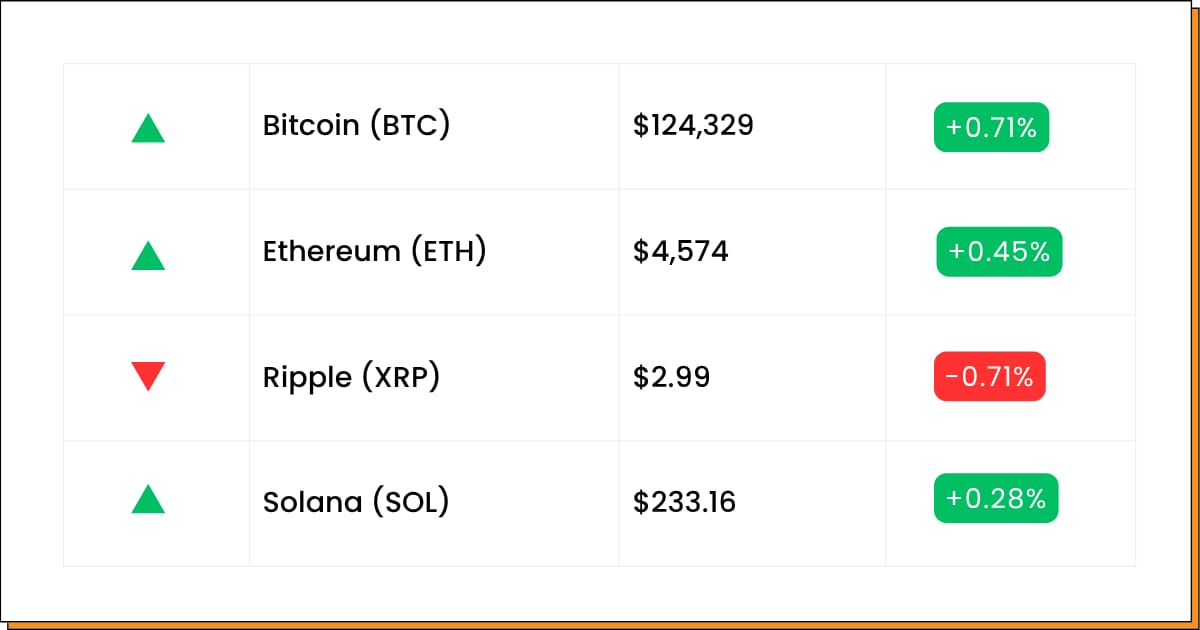

Coin Leaderboard

Crypto Pulse

Bitcoin's breaking records, institutions are piling in, and yet the wildest moves came from the fringes.

LEASH, COAI, and CYPR all ripped triple- and double-digit gains, reminding everyone that even in an institutional bull run, volatility still belongs to the underdogs.

In a week dominated by billion-dollar inflows and Wall Street buy-ins, these breakouts prove the market still rewards speed, instinct, and timing.

Because while the suits scale in slowly, the biggest wins still happen overnight for those who dare to move fast.

Doge Killer (LEASH) $14.35 (+1,795.36%)

LEASH exploded nearly 1,800% in 24 hours as wild volatility gripped meme tokens, sending traders scrambling for early entries.

ChainOpera AI (COAI) $2.49 (+600.84%)

COAI rocketed more than 600% just days after debuting on Binance Alpha, fueled by surging hype around AI-linked tokens.

Cypher (CYPR) $0.2324 (+74.05%)

CYPR climbed 74% after its KuCoin listing, drawing fresh liquidity and momentum from retail traders chasing the next breakout.

Don’t Miss This (Sponsored)

Most investors are glued to the usual headlines — inflation, interest rates, political chaos.

But while everyone’s distracted, one analyst says a far bigger story is quietly building.

It’s tied to a government-triggered event he calls the “Pivot Point.”

And on October 9th, it could flip the script on the markets in ways few are prepared for.

Looking back at past examples, these kinds of events have preceded explosive market moves — but only for those who were positioned early.

That’s why the Monument Traders Alliance is holding a LIVE Zero Hour Briefing on October 8th at 2 PM EST.

They’ll walk through what the “Pivot Point” means, why it matters now, and what you can do to prepare — free of charge.

Seats are limited, and timing is everything.

[Click here to register for the Pivot Point Briefing]

Future Forward

The next wave of action isn't just on the charts—it's in the calendar.

Conferences are kicking off worldwide, airdrops are dropping fresh tokens into wallets, and new launches are lighting up presale dashboards.

This is where early moves are made and narratives are born—where builders, traders, and investors all collide before the headlines catch up.

Whether you're chasing alpha or just soaking up insights, the next few weeks are packed with opportunities to get ahead of the curve.

Which one will you be watching?

Crypto Conferences:

💎 Porto Tech Hub 2025 (Oct 7, 2025)

💎 Adriatic Web3 and iGaming Awards (Oct 7, 2025)

💎 FITSPA Annual FinTech Conference 2025 (Oct 7, 2025)

Upcoming Airdrops:

🎁 Matchain (MAT) Airdrop (Oct 19, 2025)

Upcoming Token Launches:

🚀 Lern360 (LERN) IDO on Kommunitas (Oct 9, 2025)

🚀 Autify Network (AUTY) IDO on Spores (Oct 10, 2025)

🚀 EarnPark (PARK) Token Sale Tier 3 (Oct 15, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is Galaxy Digital?

Galaxy Digital is a financial services company built for the crypto era, founded by billionaire investor Mike Novogratz.

Think of it as the bridge between Wall Street and Web3—a place where traditional finance meets blockchain innovation.

It runs businesses across trading, asset management, and venture investing, helping institutions, startups, and now individuals access digital assets safely.

Its new retail arm, GalaxyOne, offers high-yield crypto products and stock trading in one platform, aiming to rival big names like Robinhood and Coinbase.

Galaxy also invests in blockchain projects, DeFi protocols, and crypto infrastructure—essentially betting on the backbone of the future financial system.

Behind the scenes, it provides liquidity, research, and custody solutions for some of the biggest players in the industry.

For you, Galaxy matters because it shows how far crypto has come from its outsider days.

When a Wall Street-grade firm goes all-in on digital assets, it's not just validation—it's a sign that the next financial frontier is already being built.

Everything Else

Bitcoin hit a record high against the Japanese yen as Japan's new Prime Minister Takaichi Sanae pledged to revive "Abenomics," sparking hopes for fiscal easing and renewed crypto demand.

Polymarket bettors expect the US government shutdown to last until at least October 15 but end within a month, with some traders linking the political standoff to Bitcoin's recent rally.

Galaxy Digital launched GalaxyOne, a crypto platform for individual investors offering premium yields and stock trading, putting it head-to-head with Robinhood and Coinbase.

Vietnam's digital asset pilot has drawn zero applicants as high capital requirements and bans on stablecoins drive firms toward friendlier markets like Singapore and Hong Kong.

A crypto trader turned $3,000 into nearly $2 million after buying the "4" memecoin minutes before CZ's viral post, showing how fast social media hype can rewrite fortunes in crypto.

The next crypto breakout isn't waiting for permission; it's already loading somewhere off the radar.

Stay curious, stay watching—because the market rewards those who see the shift before it hits the charts.

Best Regards,

— Benjamin Vitaris

Crypto Intel