- Crypto Intel

- Posts

- What Bitcoin's Rally Past $120K Didn't Tell You About the Market

What Bitcoin's Rally Past $120K Didn't Tell You About the Market

Bitcoin just broke $120K, Avalanche is pulling Wall Street into a $1B bet, and hackers are switching tactics. These moves aren't just headlines—they tell you where money, power, and risk are shifting in crypto right now.

Here's what matters for your wallet and your next move in the market.

Shockwaves Hit Soon (Sponsored)

When you turn on the TV, the talking heads are all covering the same tired stories…

Rate cuts. Trade disputes. Politics.

But according to one veteran market analyst, these headlines are nothing but noise.

Behind the scenes, he says a rare government-triggered event could quietly reshape the market as soon as October 9th.

He calls it the “Pivot Point.”

And based on historical patterns tied to past events like this, the opportunities have been remarkable — including rapid moves that stunned investors who weren’t prepared.

That’s why his team is going live on Wednesday, October 8th at 2 PM EST for a special emergency briefing.

If you want the details on how this October 9th event could spark a massive shift — and how to prepare before it hits — you’ll want to be in the room.

[Reserve your free spot now for the Pivot Point Briefing]

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Market-Moving News

Big numbers grab attention, but the real signals come from who's buying, who's funding, and who's attacking.

This week shows all three—wallets piling into Bitcoin, institutions lining up behind Avalanche, and hackers proving security is never static.

If you want to stay ahead of where the market's breaking next, here's the rundown.

Markets

Accumulation Trends Strengthen as Bitcoin Breaks $120K

Bitcoin crossed $121,000 this week, marking its highest level since mid-August. The rally coincided with a major shift in wallet behavior from distribution back to accumulation.

Glassnode's Accumulation Trend Score climbed to 0.62, its first sustained level above 0.5 since August. This signals that demand is outweighing supply again across the network.

Wallets holding between 100 and 1,000 BTC flipped from selling to buying in just days.

Smaller holders with 10–100 BTC have also resumed accumulation, while retail buyers under 10 BTC are slowly joining in.

Whales holding more than 10,000 BTC remain heavy sellers, extending a distribution trend that has run since August.

Their exit continues to provide liquidity for other cohorts to absorb.

During US market hours, Bitcoin gained roughly 8% this week. Analysts say this shows renewed bullish sentiment among American investors is driving momentum.

Market participants note the shift to accumulation is reinforcing technical strength. Historically, sustained readings above 0.5 have lined up with durable price advances.

Take: Bitcoin's push above $120K, backed by accumulation across mid-sized wallets and US market hours, shows conviction is returning.

For you, this isn't just price action—it's a reminder that when demand outweighs supply, upside can compound quickly, even without whale support.

Finance

Avalanche Treasury Co. Targets $1B Ecosystem Fund via $675M SPAC Deal

Avalanche Treasury Co. (AVAT) is merging with Mountain Lake Acquisition Corp in a $675 million SPAC deal.

The goal is to build a $1 billion AVAX treasury and list on Nasdaq in early 2026.

The company starts with $460 million in assets, partly from a $200 million discounted token sale.

Investors are offered exposure at roughly 23% below direct token purchases or ETF alternatives.

AVAT is backed by the Avalanche Foundation through an exclusive arrangement.

CEO Bart Smith, a Wall Street veteran, is pitching the venture as more than passive exposure—an active partner in network growth.

The board will feature key names like Aave founder Stani Kulechov and Dragonfly's Haseeb Qureshi. Ava Labs founder Emin Gün Sirer will serve as a strategic advisor.

Institutional investors involved include VanEck, Pantera, Galaxy Digital, and Kraken. FalconX will handle execution, and Monarq will manage assets.

AVAT's strategy centers on direct investments into Avalanche's ecosystem. That includes funding protocol adoption, enterprise use cases, and institutional blockchain launches.

Take: A $1B treasury vehicle tied to Avalanche is a big signal of confidence from institutions.

For you, it shows that serious money is betting not just on tokens—but on Avalanche's long-term role in enterprise blockchain adoption.

Poll: If you got paid in crypto tomorrow, what would you do? |

See Five Now (Sponsored)

Imagine holding a stock before it runs triple digits.

That’s what past versions of this report delivered—+175%, +498%, even +673%.¹

Now, we’ve identified the next 5 stocks set to double.

But you only have until midnight to see the names.

[Claim your free copy instantly]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Security

Crypto Hack Losses Fall 37% in Q3, But Million-Dollar Exploits Surge

Crypto hack losses fell to $509 million in Q3, down 37% from Q2. Compared to Q1's $1.7 billion losses, the industry is seeing sharp progress in limiting damage.

CertiK data shows code vulnerability losses dropped from $272 million to $78 million. Phishing losses also fell despite a steady number of incidents.

The decline came even as September set a record for million-dollar hacks.

Sixteen incidents topped $1 million, the highest monthly figure ever recorded.

Hackers focused on mid-sized exploits instead of $100 million mega-hacks.

Exchanges were hit hardest, with $182 million lost in Q3, followed by $86 million from DeFi protocols.

The GMX v1 hack stood out, costing $40 million before the attacker returned funds for a $5 million bounty.

Emerging ecosystems like Hyperliquid also saw new attacks, including rug pulls.

Hacken noted North Korean cyber units remain the top threat, responsible for about half of the funds stolen.

Analysts warned that attackers are evolving from simple phishing into complex operational compromises.

Take: Fewer total losses show security is improving, but the record number of million-dollar hacks is a wake-up call.

For you, it means staying vigilant—especially with exchanges and new chains—is critical as attackers shift tactics.

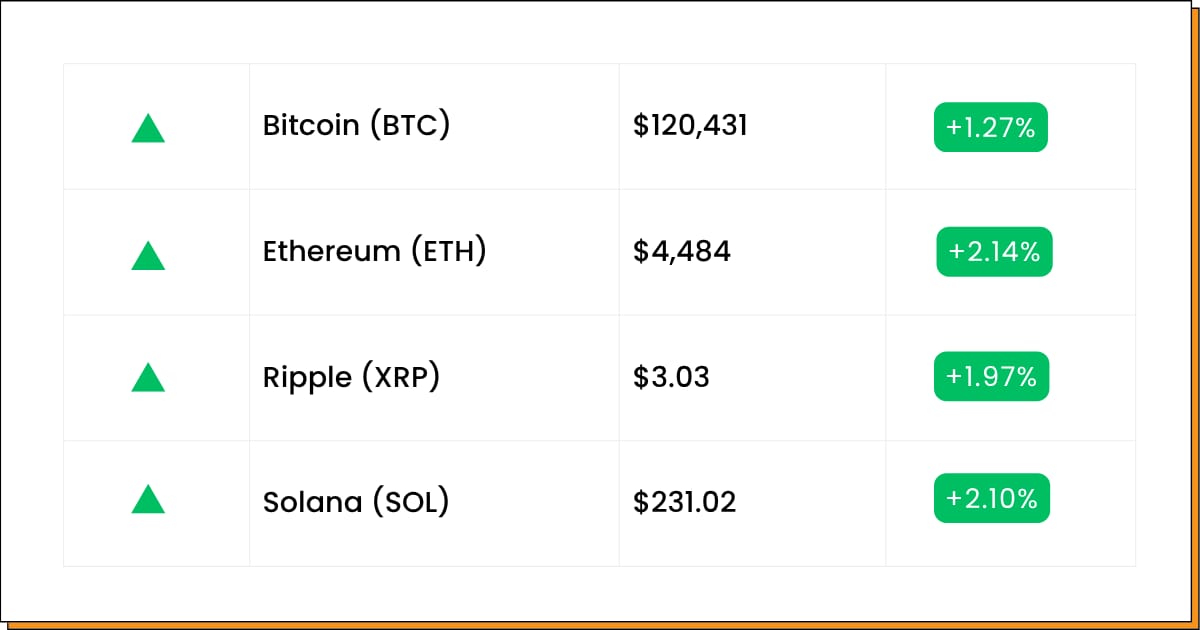

Coin Leaderboard

Crypto Pulse

While Bitcoin ripped past $116K, the SEC cracked open custody rules, and US hiring went into overdrive, a few underdogs stole the spotlight.

SQD, ZEC, and CLEAR ripped huge double-digit gains—proof that even as the big narratives dominate, smaller plays can flip the script in 24 hours.

When regulation shifts and institutions circle, the market's wildest action often hides in the corners.

Spot these runs early, and you're not just keeping up—you're running the board before anyone else notices.

Giggle Fund (GIGGLE) $84.87 (+189.67%)

GIGGLE ripped nearly 190% after landing a fresh listing on Binance Alpha, fueling a wave of momentum trades.

DeAgentAI (AIA) $1.83 (+178.21%)

AIA soared 178% as its contract trading volume shot past XRP's, cracking the global top-five leaderboard.

4 (4) $0.1543 (+167.30%)

The newly launched token 4 exploded 167% in its debut run, turning heads with one of the day's fastest climbs.

Final Quarter Map (Sponsored)

The final quarter of 2025 will create two groups of people: those who watched their portfolios stagnate (or worse), and those who capitalized on the coming volatility.

Which group will you be in?

Our new report reveals 7 stocks positioned to thrive in the chaos, with specific entry and exit price targets for each.

This is your blueprint to potentially turn market uncertainty into your biggest advantage of the year.

The market's final big move of 2025 is coming.

By the time it's obvious, it will be too late.

Don't get left behind.

Get Your FREE Q4 Stocks Advantage Report Now!

Future Forward

This week wasn't just about Bitcoin breaking $120K or Avalanche lining up Wall Street money—it was also about the wild cards. GIGGLE, AIA, and 4 went vertical with triple-digit runs, showing that the market's loudest signals aren't always where the biggest wins hide.

Crypto Conferences:

💎 The Amsterdam Cryptocurrency Conference 2025 (Oct 4, 2025)

💎 India Blockchain Tour Goa Node (Oct 5, 2025)

💎 Finxtex Trilogy Qatar 2025 (Oct 5, 2025)

Upcoming Airdrops:

🎁 APEX (APEX) Airdrop (Oct 6, 2025)

🎁 Matchain (MAT) Airdrop (Oct 19, 2025)

Upcoming Token Launches:

🚀 Lern360 (LERN) IDO on Kommunitas (Oct 9, 2025)

🚀 Autify Network (AUTY) IDO on Spores (Oct 10, 2025)

🚀 EarnPark (PARK) Token Sale Tier 3 (Oct 15, 2025)

Which event are you most excited for? Let us know!

Crypto Know-How: What Is NEAR?

NEAR is a layer-1 blockchain built to make crypto apps faster, cheaper, and easier to use.

Think of it like Ethereum's cousin—same smart contracts, but designed to handle bigger crowds without slowing down.

Instead of cramming all transactions onto one chain, NEAR uses "sharding," which breaks the workload into smaller chunks.

That makes it possible to run thousands of transactions at once, keeping fees low and speeds high.

Developers like NEAR because it's friendly to build on—apps can run across multiple chains, and even Web2-style logins (like email or social accounts) are supported.

For users, it feels less like coding in the dark and more like clicking around a familiar app.

For you, NEAR is worth watching because it's aiming to power the next wave of mainstream Web3 adoption.

If blockchains are highways, NEAR is building wider lanes so traffic can flow without jams.

Everything Else

BNB broke above $1,100, sending PancakeSwap's CAKE up 30% and newer tokens like ASTER higher, while memes like FLOKI and CAT lagged behind utility plays.

New York lawmakers introduced a bill to tax Bitcoin miners on electricity usage, aiming to fund energy relief programs for low-income households.

Michael Saylor's Strategy Inc. hit a record $77.4B in Bitcoin holdings, giving it a stash bigger than major banks and even the GDP of some nations.

Nomura-owned Laser Digital is preparing to apply for a crypto trading license in Japan, opening the door to new institutional services.

Near Foundation is building AI "digital twins" to vote in DAO governance, aiming to fix low participation with models that learn user preferences.

The stories moving crypto today are really just clues about tomorrow. If you can read between the lines, you're not reacting to the market—you're already two steps ahead of it.

Best Regards,

— Benjamin Vitaris

Crypto Intel