- Crypto Intel

- Posts

- While Competitors Crashed 40%, This Protocol's TVL Doubled. Is a 172% Hike Next?

While Competitors Crashed 40%, This Protocol's TVL Doubled. Is a 172% Hike Next?

Its TVL surged 107% in a month, powering a new political crypto venture. Analysts see +172% upside.

Imagine owning the infrastructure powering the most talked-about political crypto venture in the world, yet the market hasn't fully realized it yet.

We found a lending protocol that just doubled its assets in a single month—growing 107%—while the rest of its sector barely moved. If you are looking for a DeFi play with a massive political catalyst and a valuation gap that screams opportunity, this +172% setup is for you.

Unexpected Asset (Sponsored)

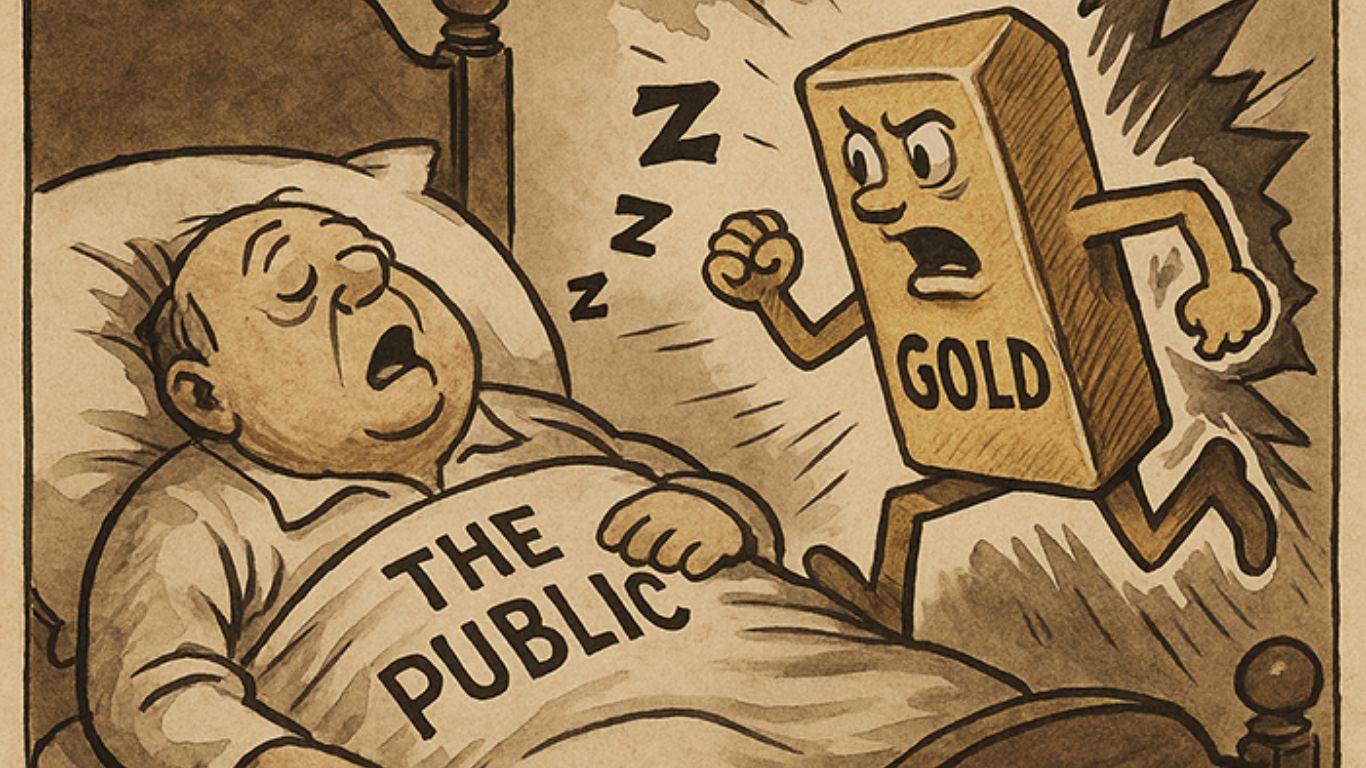

Warren Buffett is holding a record $325 billion in cash — not by choice, but because traditional value has vanished.

With government spending surging and inflation quietly eroding purchasing power, sitting still is no longer neutral.

That’s why attention is shifting toward a sector most investors have ignored for years.

Certain gold producers are generating real cash flow, trading at steep discounts, and benefiting from renewed domestic mining support.

One major miner stands out as exceptionally well-run, deeply undervalued, and positioned for the next phase of capital rotation.

The full breakdown — including four smaller miners — is available now.

Never Miss a Game-Changing Crypto Play Again!

We now send our daily picks via text, too, so you’ll get the same powerful content right on your phone.

Crypto Name

Dolomite (DOLO) is a next-generation money market that does way more than just lending and borrowing; it allows your idle assets to work multiple jobs at once through virtual liquidity.

While the broader lending sector has been stagnant, Dolomite is on a tear, recently selected to power World Liberty Financial, the DeFi project backed by Donald Trump's family.

The token is currently trading around $0.0546, up 32% in the last 30 days.

That might sound like a decent gain, but it is nothing compared to the explosion happening on-chain, where the Total Value Locked (TVL) is growing three times faster than the price.

Trivia: What does “paper hands” describe? |

Tokenomics, Strategic Positioning, and Use CasesText Here

DOLO isn't just a generic reward token; it is the key to a capital-efficient machine that lets you keep your voting rights and staking rewards even while using your coins as collateral.

You can lock it for veDOLO to gain governance power, or earn oDOLO for providing liquidity, creating a cycle that aligns your wallet with the protocol's health.

The biggest strategic win here is the integration with World Liberty Financial; despite the different branding, the underlying engine is 100% Dolomite.

They are also expanding to Bitcoin via the Spiderchain Layer 2, positioning themselves to capture liquidity from the two biggest ecosystems in crypto.

Action: Keep a close watch on the World Liberty Markets platform. |

Accelerated Gains (Sponsored)

$1,000 in just seven stocks in 2004 could have turned into a million-dollar portfolio today…

Back then… one financial expert begged people to look at Nvidia -- when it was trading at just $1.10!

Now… he’s urging you to look at a new group of seven stocks…

Check this Out (The NEXT Magnificent Seven)

Financial Outlook and Market Position

Let's look at the scoreboard. DOLO is currently ranked #1,016 overall and sits at #14 among lending tokens, with a tiny market cap of roughly $25 million.

Here is the wild discrepancy: while the DOLO price moved up 32% recently, the actual money managed by the protocol (TVL) more than doubled, surging 107.6% to reach roughly $229 million.

It is rare to see a business grow its assets so aggressively while its valuation lags behind.

The competition is getting crushed in comparison; Euler dropped 36.1%, and FOLKS plunged 41.9%, while Dolomite is sprinting ahead.

This massive divergence suggests that the market is severely underestimating the value of the protocol's recent partnerships and asset growth.

Action: Monitor the ratio between the protocol's TVL ($229M) and its market cap ($25M). |

Bear Case

We have to keep it real about the risks. DOLO is down about 85% from its all-time high, and as a micro-cap token, it is prone to violent price swings that can shake out the faint of heart.

There is also the "key person" risk associated with its admin controls; while they are moving toward a DAO, the protocol is currently managed by a multisig wallet.

If the Trump-linked World Liberty Financial project faces regulatory headwinds or public backlash, Dolomite could get caught in the crossfire.

Action: You should treat this as a high-volatility play. |

Asset Rotation (Sponsored)

Political transitions historically increase uncertainty—and this cycle is no exception.

Tariff expansion is reviving crash-risk conversations across Wall Street.

Asset protection strategies are gaining attention as volatility accelerates.

Ignoring structural risk has consequences during regime shifts.

Awareness precedes action.

No guarantees are implied.

This content is not a recommendation to buy or sell.

Download the FREE Presidential Transition Guide now.

Outlook and Investment Thesis

Dolomite is building the money legos for the next era of DeFi, allowing for complex strategies like looping and delta-neutral farming that other platforms can't handle.

The stark contrast between a 107% explosion in monthly TVL and a market cap that hasn't caught up offers a textbook setup for a repricing event.

With the tailwind of a major political partnership and expansion into the Bitcoin ecosystem, the token has serious momentum.

Analysts are forecasting a potential climb to $0.1491. Hitting that target would deliver a massive +172.46% return by October 2026.

Action: If you want to bet on the convergence of politics and DeFi, this is the infrastructure play to own. |

That's all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Benjamin Vitaris

Crypto Intel